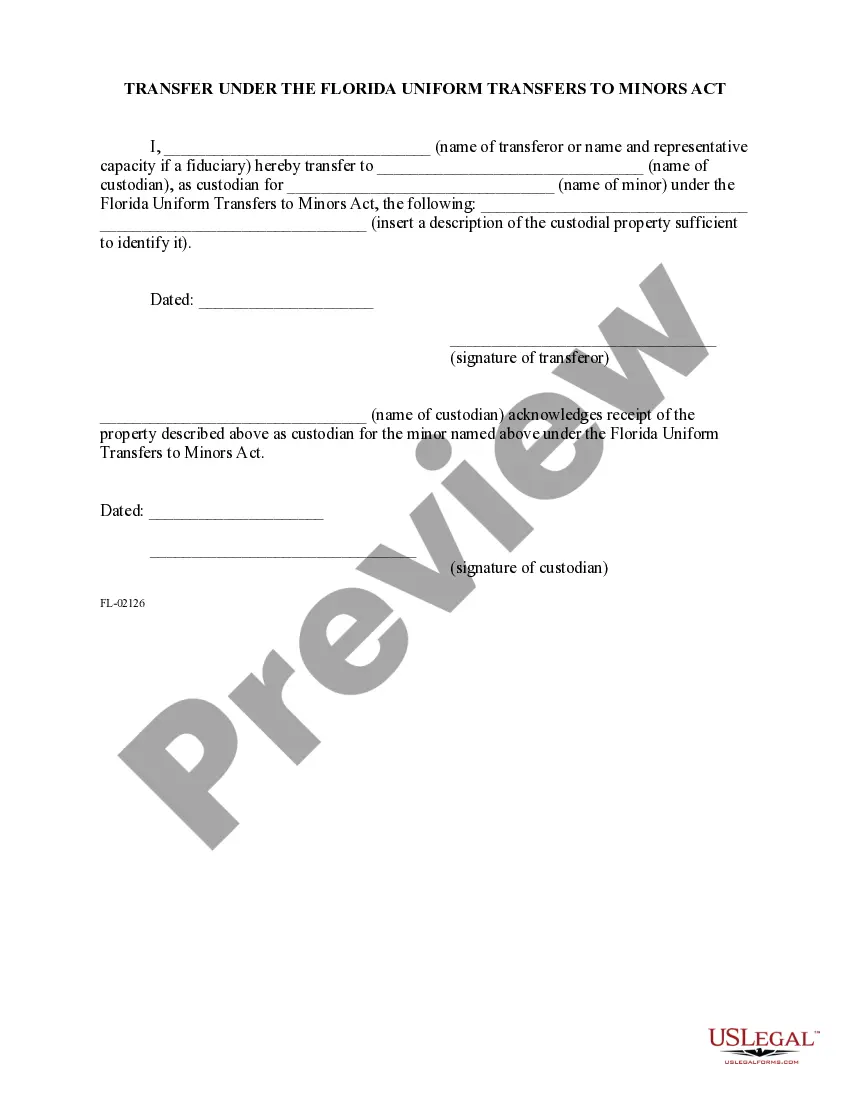

Transfer Under The Florida Uniform Transfers to Minors Act

Definition and meaning

The Transfer Under The Florida Uniform Transfers to Minors Act is a legal process that allows a minor to receive gifts or property through a custodian until they reach the age of majority. This Act simplifies the process of transferring assets to minors, ensuring that the property is managed by a trusted adult until the minor is old enough to handle it independently.

How to complete a form

Completing the Transfer Under The Florida Uniform Transfers to Minors Act form involves several steps:

- Identify the parties: Write your name as the transferor and the name of the custodian.

- Specify the minor: Clearly state the name of the minor who will benefit from the transfer.

- Describe the property: Include a detailed description of the asset you are transferring.

- Sign and date: Ensure that both the transferor and custodian sign and date the form to validate the transfer.

Who should use this form

This form is ideal for individuals who wish to gift assets, such as cash, stocks, or real estate, to a minor. It's particularly useful for parents, relatives, or guardians who want to ensure that the transferred assets are managed responsibly until the minor reaches adulthood.

Key components of the form

The key components of the Transfer Under The Florida Uniform Transfers to Minors Act form include:

- Name of the transferor: The individual or entity transferring the property.

- Name of the custodian: The person responsible for managing the property.

- Name of the minor: The recipient of the transferred assets.

- Property description: Detailed information about the items or assets being transferred.

State-specific requirements

In Florida, the transfer must comply with the Uniform Transfers to Minors Act (UTMA). It's important to note that only designated custodians under this Act can manage the assets. Ensure that the form meets all state regulations to prevent legal issues in the future.

Common mistakes to avoid when using this form

To ensure a smooth transfer process, avoid these common mistakes:

- Not providing enough detail in the property description.

- Failing to sign and date the form properly.

- Choosing an unsuitable custodian.

- Not understanding the responsibilities of the custodian.

Form popularity

FAQ

Yes, you can close your child's UTMA account, but there are specific regulations to follow under the Transfer Under The Florida Uniform Transfers to Minors Act. Generally, you must ensure that the funds are properly distributed to the child when they reach the age of 21, or you can choose to manage the account until that time. Closing the account involves administrative steps and may require understanding the tax implications. If you have questions about how to handle this process, consider using a platform like uslegalforms to guide you through the necessary paperwork.

The purpose of the Uniform Transfers to Minors Act is to provide a simple way for adults to transfer assets to minors while ensuring that funds are managed by a responsible custodian. By using the Transfer Under The Florida Uniform Transfers to Minors Act, you can protect your child’s financial interests until they reach a suitable age. This act enables parents to save for education or other future needs without creating complex trusts. Essentially, it balances oversight with the child's future financial independence.

When a child turns 21, they gain full ownership of the UTMA account under the Transfer Under The Florida Uniform Transfers to Minors Act. At this point, the child can withdraw funds and make independent financial decisions regarding the account. It's a significant transition that emphasizes the need for early financial education. As a parent or guardian, you may want to prepare your child for this responsibility to help them manage their newfound financial freedom.

One drawback of the UTMA is that once the child turns 21, they have unrestricted access to the account. While this autonomy empowers young adults, it can also lead to impulsive spending that may not align with long-term financial goals. Moreover, there is no provision for additional guidance or oversight once control is transferred. This aspect of the Transfer Under The Florida Uniform Transfers to Minors Act highlights the importance of planning and understanding your options.

In Florida, the UTMA age is 21. This means that once a child reaches 21 years of age, they can take full control of the funds in their Transfer Under The Florida Uniform Transfers to Minors Act account. The account ensures that a custodian manages the funds until the child reaches maturity. It's essential to understand the implications of this age limit as you plan for your child's financial future.

Yes, UTMA accounts can be transferred under certain conditions, but the process varies based on specific rules of the Florida Uniform Transfers to Minors Act. Typically, these accounts must remain in the name of the minor until they reach the age of majority. If you need assistance navigating the complexities of transferring an UTMA account, consider using platforms like US Legal Forms, which provide resources and guidance tailored to your needs.

To transfer an UTMA account to a child, you need to follow specific steps outlined by the Florida Uniform Transfers to Minors Act. First, you should contact the financial institution holding the account for their requirements. Next, provide necessary documentation, such as the child's identification and the original UTMA account details. Ensuring the transfer complies with local laws will help you effectively make the transfer under the Florida Uniform Transfers to Minors Act.

One significant disadvantage of an UTMA account is that it becomes irrevocable once established, meaning that the funds cannot be reclaimed by the custodian. Additionally, once the beneficiary turns 21, they gain full control over the account, which can lead to concerns about their ability to manage the assets wisely. Tax implications may also arise, as the funds are considered part of the minor’s assets. For thorough guidance on managing UTMA accounts, uslegalforms can provide valuable resources.

The Uniform Transfers to Minors Act, or UTMA, in Florida allows adults to transfer assets to minors without the need for a formal trust. This legislation provides a way for minors to hold property until they reach adulthood, typically 21 years of age. By utilizing this act, you ensure that the assets are used for the minor's benefit while managing them responsibly. For more information, refer to resources provided by uslegalforms to navigate the legal aspects easily.

Transferring an UTMA account involves notifying the financial institution where the account is held. You must provide necessary documentation that proves the relationship to the beneficiary and compliance with the Florida Uniform Transfers to Minors Act. Additionally, you may need to fill out a form to officially initiate the transfer. For smoother handling of this process, you can utilize uslegalforms, which offers templates and support.