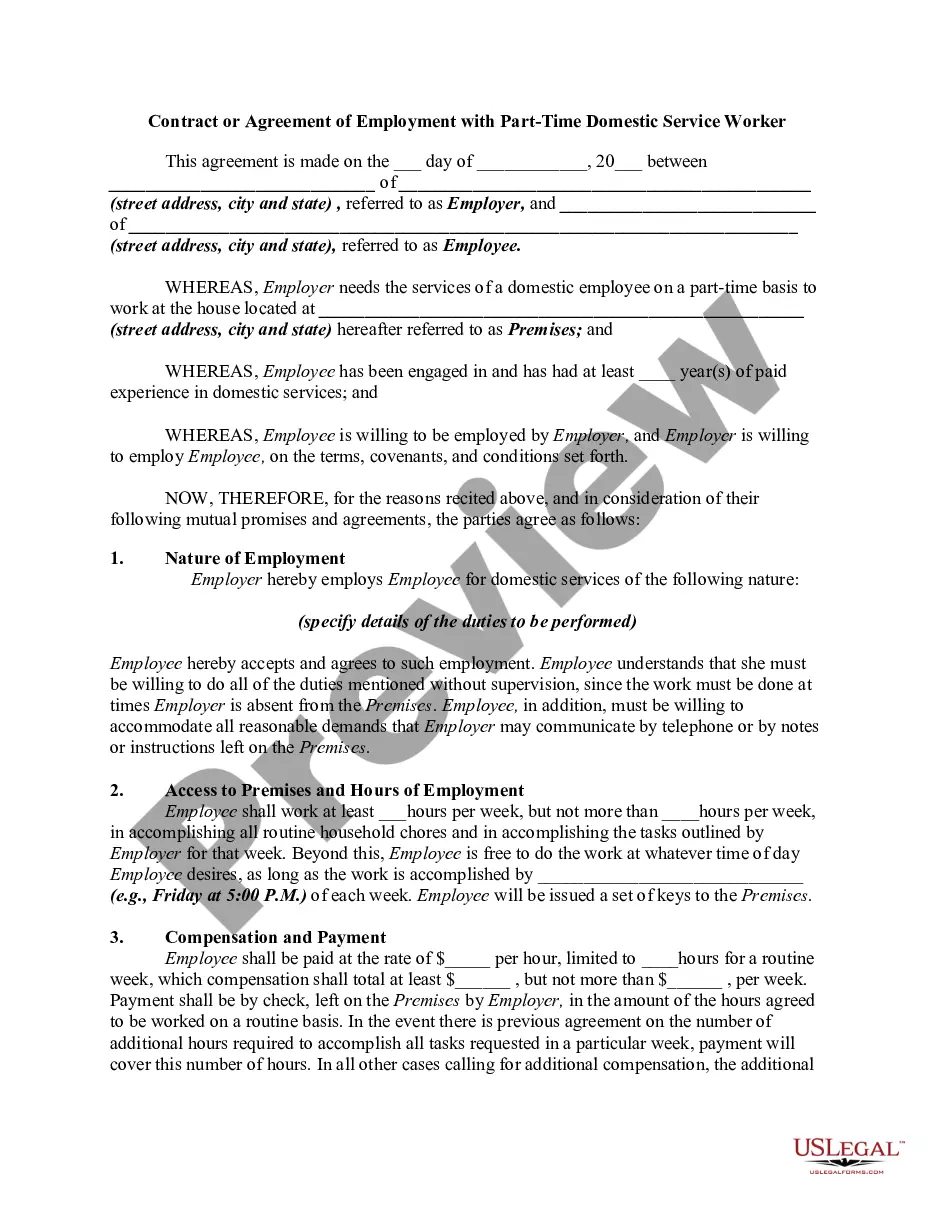

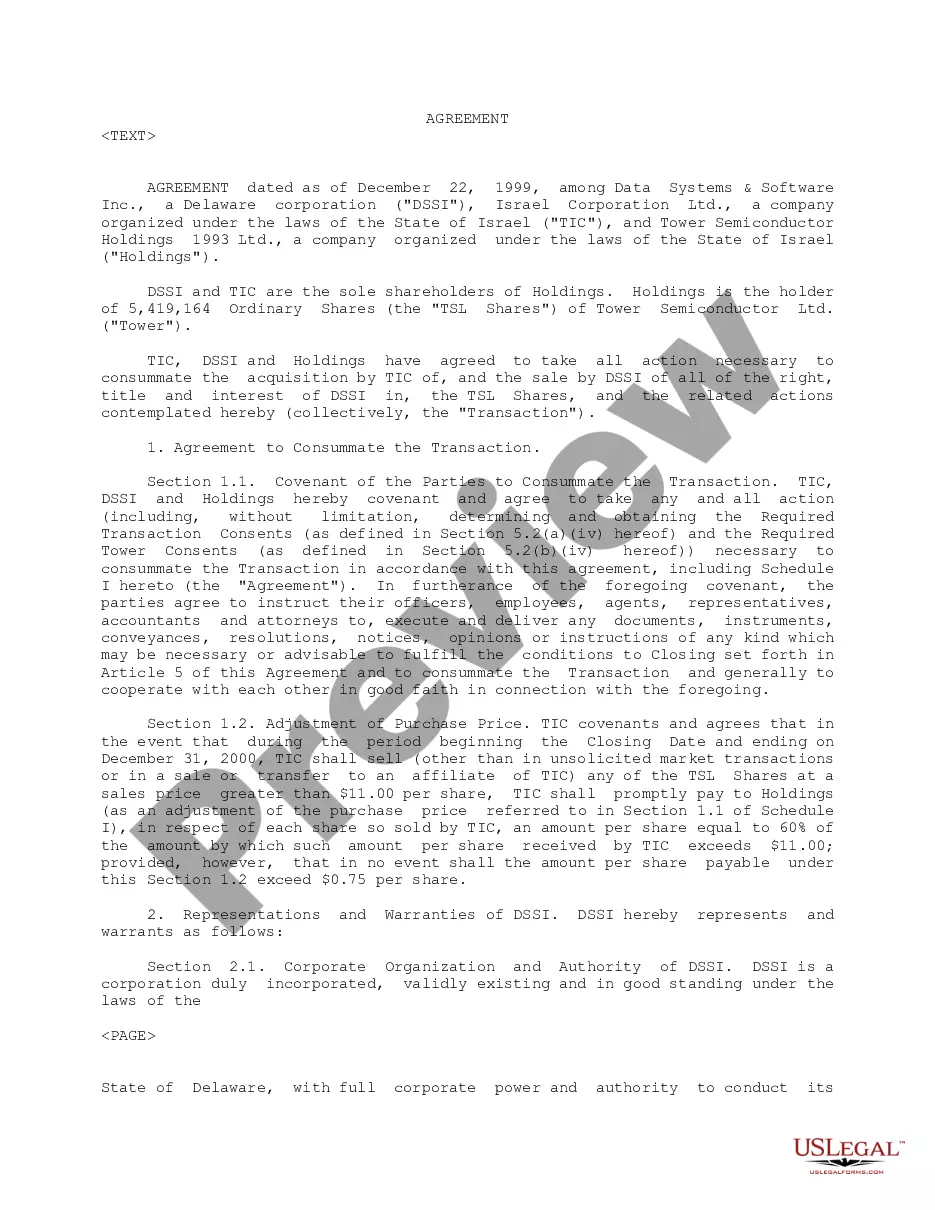

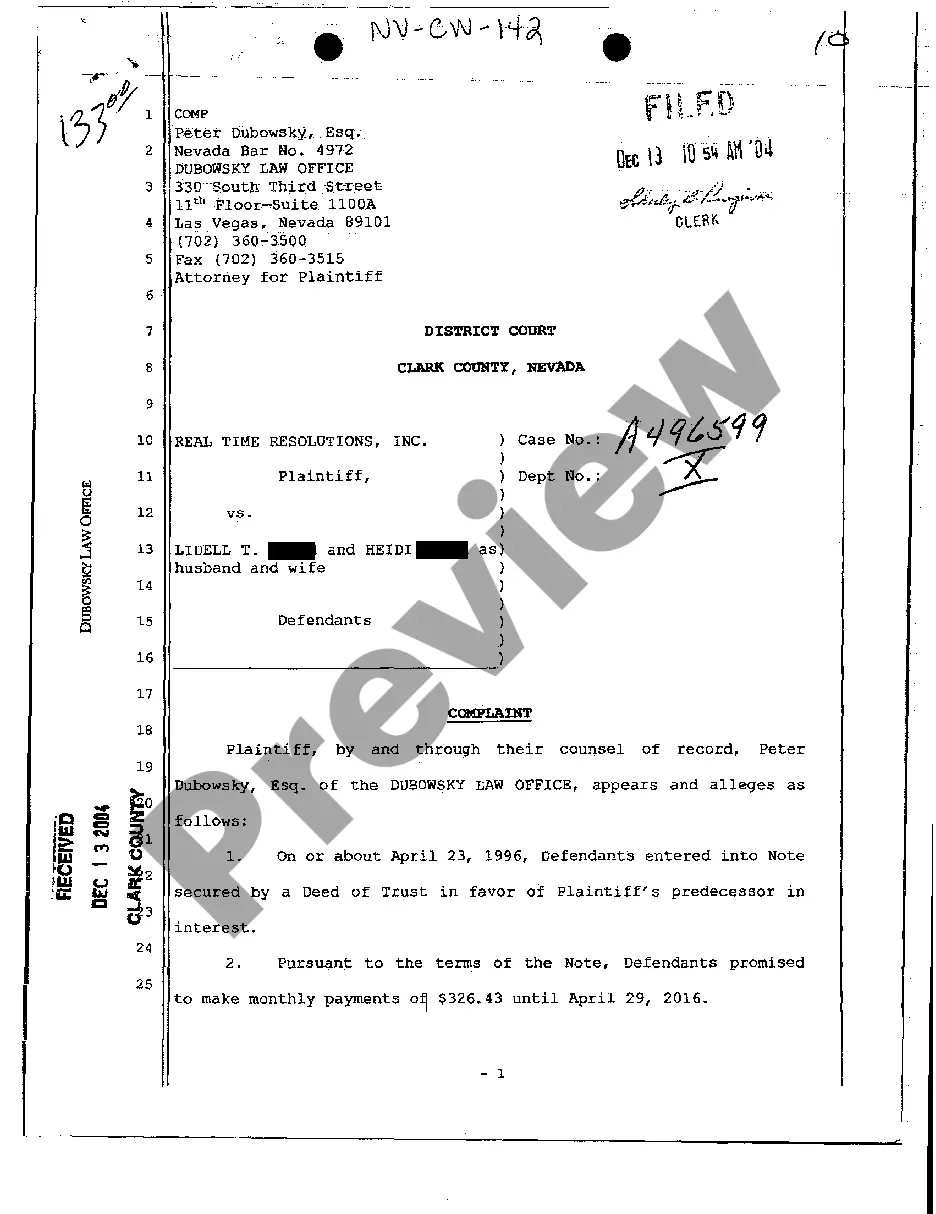

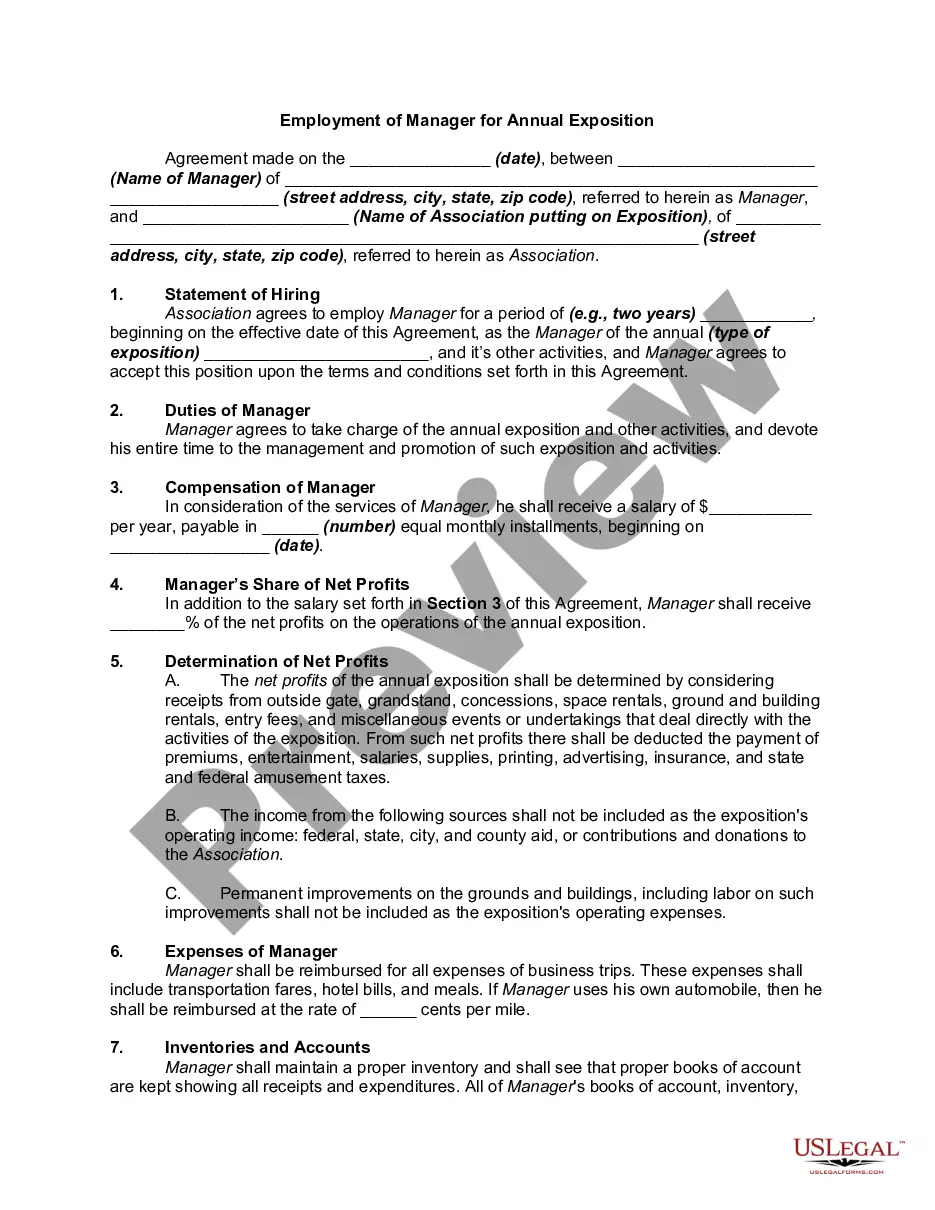

A Conversion of Reserved Overriding Royalty Interest to Working Interest form. The assignee shall be entitled to recover, out of the total proceeds derived from the sale of oil and gas produced from each well drilled and completed as a well capable of producing oil or gas in paying quantities on the Land, the total cost of drilling, completing, and equipping such well together with the cost of operating such well until the time of such recovery.

Delaware Conversion of Reserved Overriding Royalty Interest to Working Interest

Description

How to fill out Conversion Of Reserved Overriding Royalty Interest To Working Interest?

US Legal Forms - among the biggest libraries of lawful kinds in the States - provides a wide range of lawful file layouts you may download or print. Utilizing the website, you can find 1000s of kinds for business and individual reasons, categorized by classes, suggests, or keywords and phrases.You will discover the newest versions of kinds such as the Delaware Conversion of Reserved Overriding Royalty Interest to Working Interest within minutes.

If you already have a monthly subscription, log in and download Delaware Conversion of Reserved Overriding Royalty Interest to Working Interest through the US Legal Forms library. The Download button can look on every form you see. You get access to all in the past acquired kinds inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms the first time, listed here are simple instructions to obtain began:

- Ensure you have selected the right form for your personal town/region. Click the Preview button to analyze the form`s information. Read the form description to ensure that you have chosen the proper form.

- When the form doesn`t fit your requirements, use the Search discipline on top of the display to get the one which does.

- Should you be pleased with the form, affirm your option by clicking the Acquire now button. Then, pick the pricing program you favor and offer your references to register to have an bank account.

- Process the purchase. Make use of credit card or PayPal bank account to complete the purchase.

- Find the formatting and download the form on your own system.

- Make changes. Fill out, edit and print and sign the acquired Delaware Conversion of Reserved Overriding Royalty Interest to Working Interest.

Each design you included with your money does not have an expiry time and it is yours forever. So, if you would like download or print yet another version, just check out the My Forms area and then click in the form you will need.

Get access to the Delaware Conversion of Reserved Overriding Royalty Interest to Working Interest with US Legal Forms, the most extensive library of lawful file layouts. Use 1000s of professional and express-distinct layouts that satisfy your organization or individual demands and requirements.

Form popularity

FAQ

Once the lease ends, the lessee can obtain a new lease from the mineral owner without any overriding royalty obligation. To prevent this scenario, the ?anti-washout provision? was created. This provision is designed to ensure that the overriding royalty interest remains intact if the lease is extended.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

Blanchard Interests or Blanchard Royalties refer to the way that royalty owners were to be paid by the various Working Interest owners in a well when each working interest owner entered into a separate gas sale contract for their proportionate share of gas produced and sold.

Finally, overriding royalty. An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

If the lessee decides to extract the minerals, the lessor then receives royalty payments; otherwise, the lease expires with no further payments. The royalty payment may range from 12.5?25 percent. The landowner can also sell options on the right to buy mineral rights and profit even if the options are not exercised.