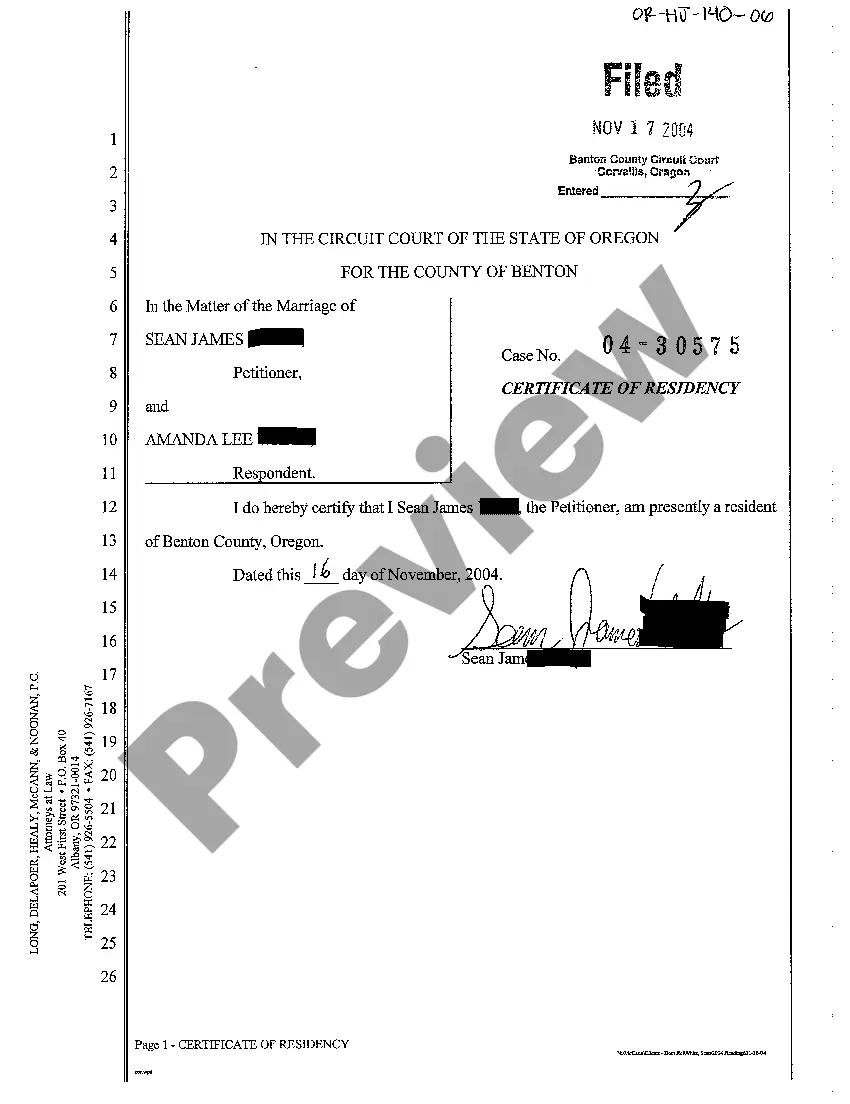

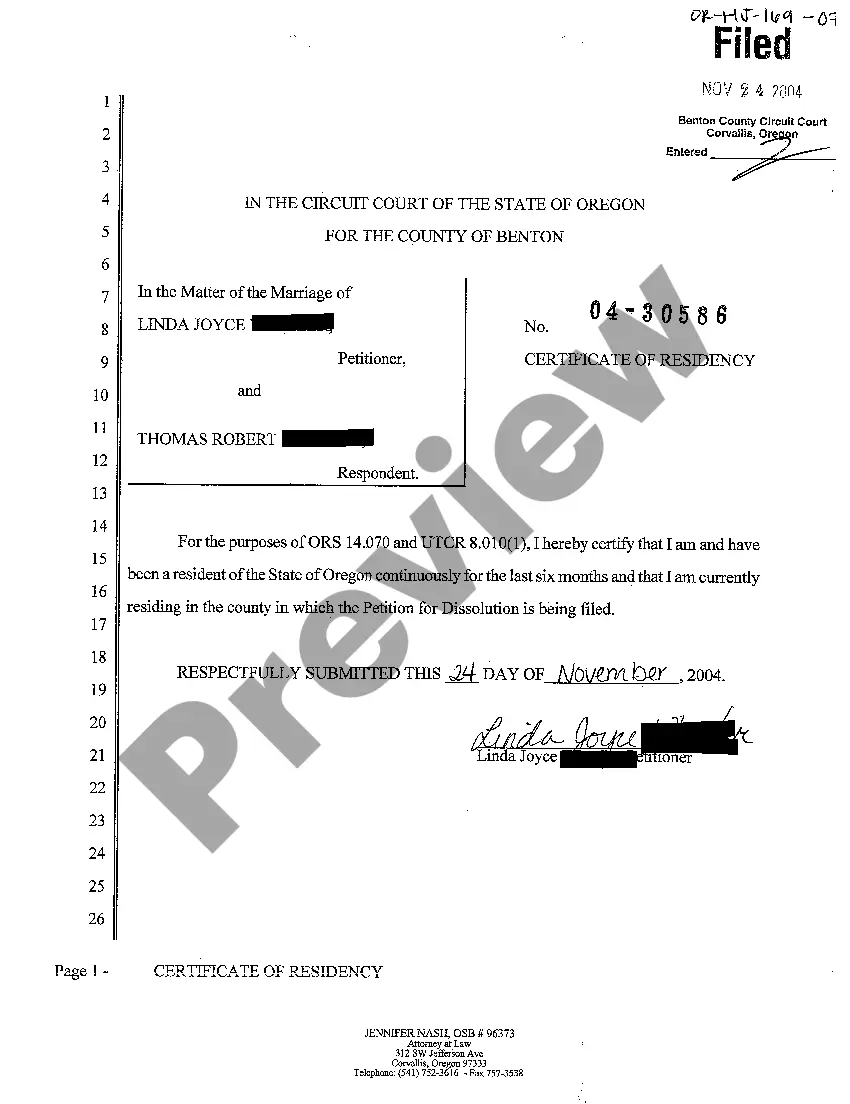

Oregon Affidavit regarding Residency

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

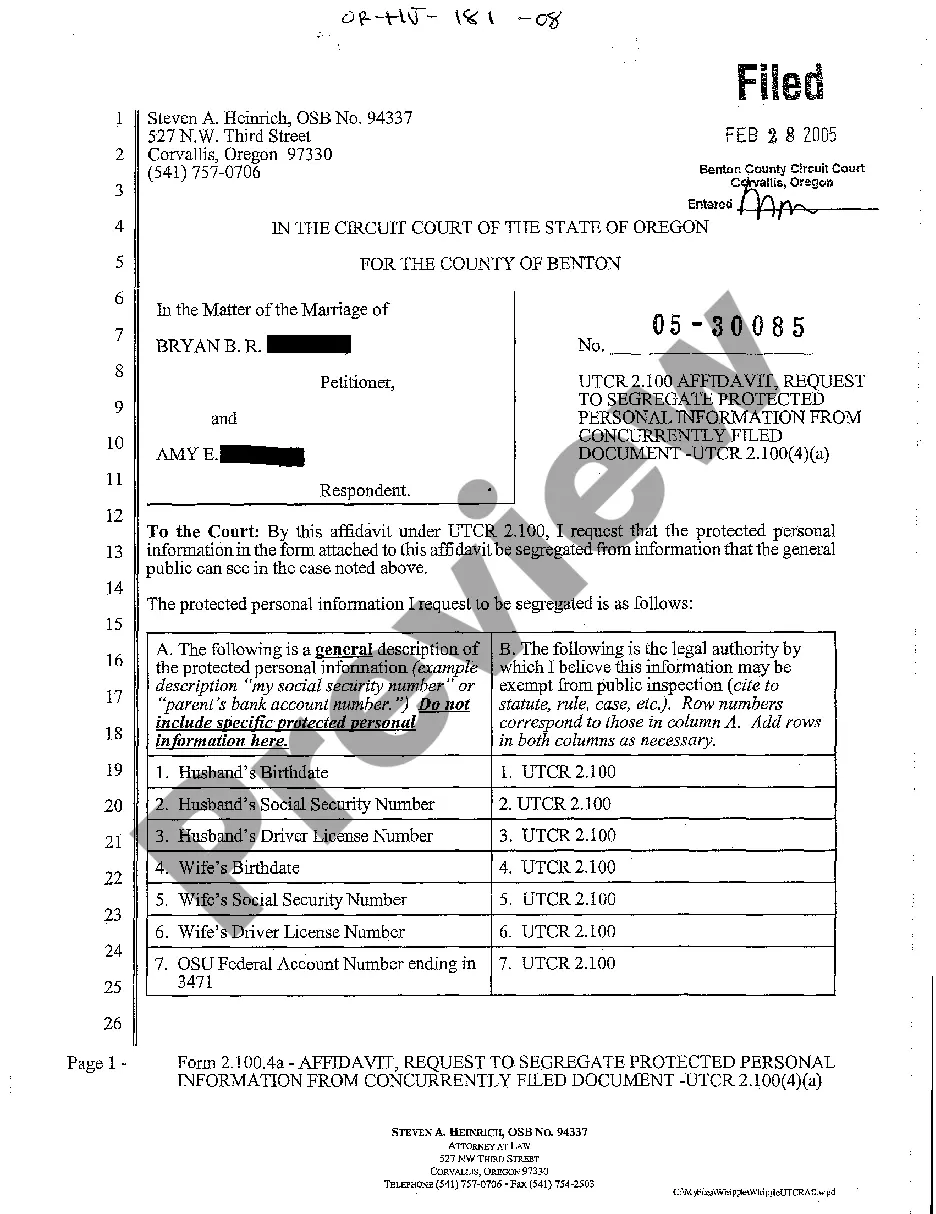

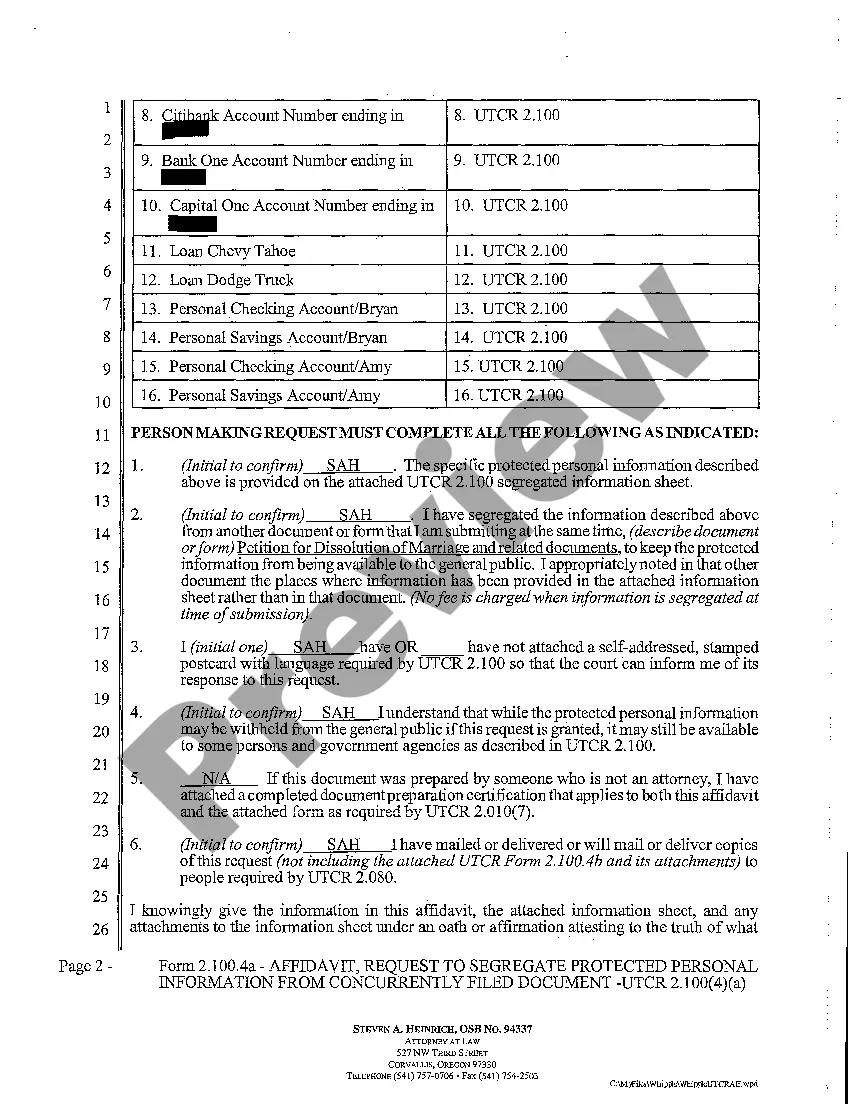

How to fill out Oregon Affidavit Regarding Residency?

The work with papers isn't the most straightforward task, especially for those who almost never work with legal papers. That's why we recommend utilizing accurate Oregon Affidavit regarding Residency samples made by professional lawyers. It allows you to stay away from difficulties when in court or handling official organizations. Find the samples you want on our site for top-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the template page. After accessing the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Follow this short step-by-step help guide to get the Oregon Affidavit regarding Residency:

- Ensure that file you found is eligible for use in the state it is required in.

- Confirm the document. Make use of the Preview option or read its description (if available).

- Buy Now if this file is what you need or utilize the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these straightforward steps, it is possible to fill out the sample in your favorite editor. Double-check filled in details and consider asking a legal professional to review your Oregon Affidavit regarding Residency for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

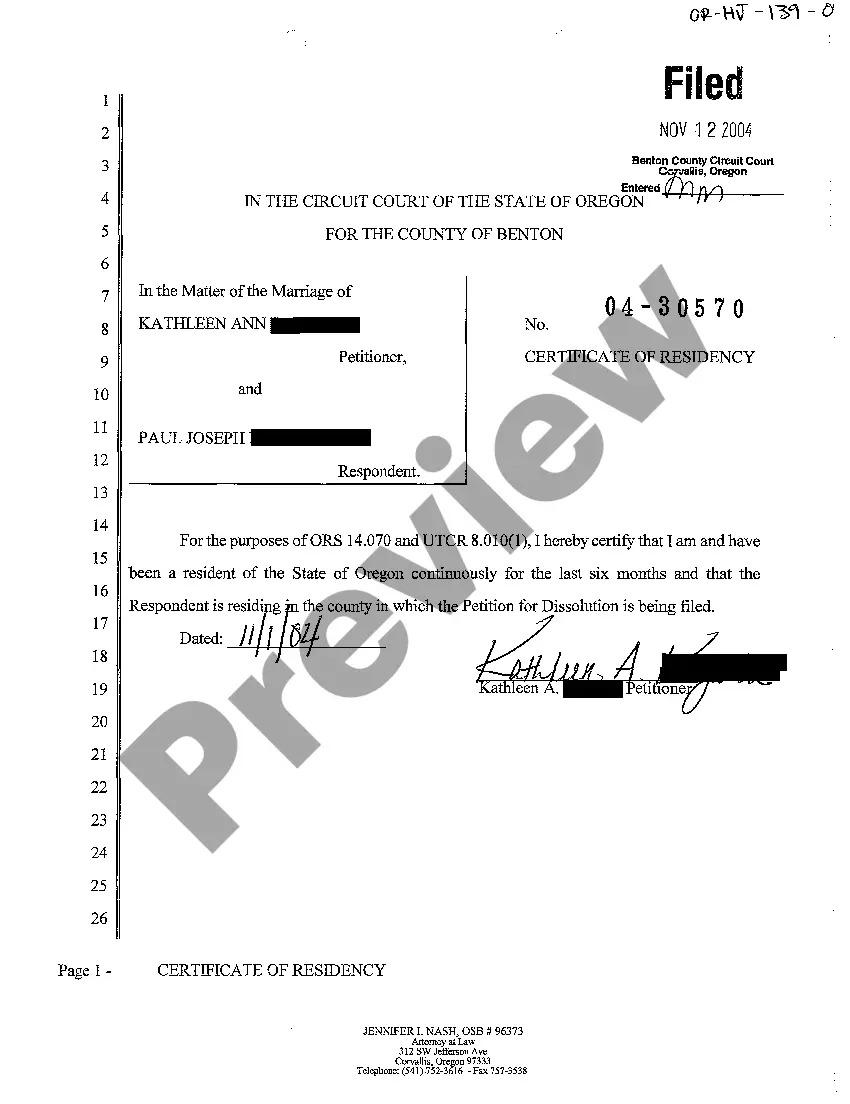

Typically, you're considered a resident of the state you consider to be your permanent home. Residency requirements vary from state to state. You can check your state's department of revenue website for more information to confirm your residency status.

Generally, you're a resident of a state if you don't intend to be there temporarily. It's where home iswhere you come back to after being away on vacation, business trip, or school. Think of it as your permanent home (for now), but don't confuse "permanent" with "forever." Nothing is forever.

Typical factors states use to determine residency. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are present" in the state for 183 days or more (one-half of the tax year).

Government-issued photo ID.Residential lease/property deed.Utility bill.Letter from the government/court (marriage license, divorce, government aid)Bank statement.Driver's license/learner's permit.Car registration.Notarized affidavit of residency.

Bank Statements. Document description: Preprinted account statements from your bank. Court Letters. Government Documents. Income Tax Statements. Lease Agreements. Notarized Affidavit of Residency. School Records. Vehicle Registration.

If you reside in Oregon, and need to provide proof that you are a resident of or domiciled in Oregon, a true copy of your Oregon permanent or part-year income tax return filed with the Oregon Department of Revenue for the previous tax year is acceptable proof with this form.

Government-issued photo ID. Residential lease/property deed. Utility bill. Letter from the government/court (marriage license, divorce, government aid) Bank statement. Driver's license/learner's permit. Car registration. Notarized affidavit of residency.

Examples of acceptable documents to prove California residency are: rental or lease agreements with the signature of the owner/landlord and the tenant/resident, deeds or titles to residential real property, mortgage bills, home utility bills (including cellular phone), and medical or employee documents.

To qualify as an Oregon resident (for tuition purposes), one must live in Oregon for 12 consecutive months while taking eight credits or fewer per term while demonstrating that they are in the state for a primary purpose other than education (such as working, volunteering, or other purposes).