Delaware Division Order

Description

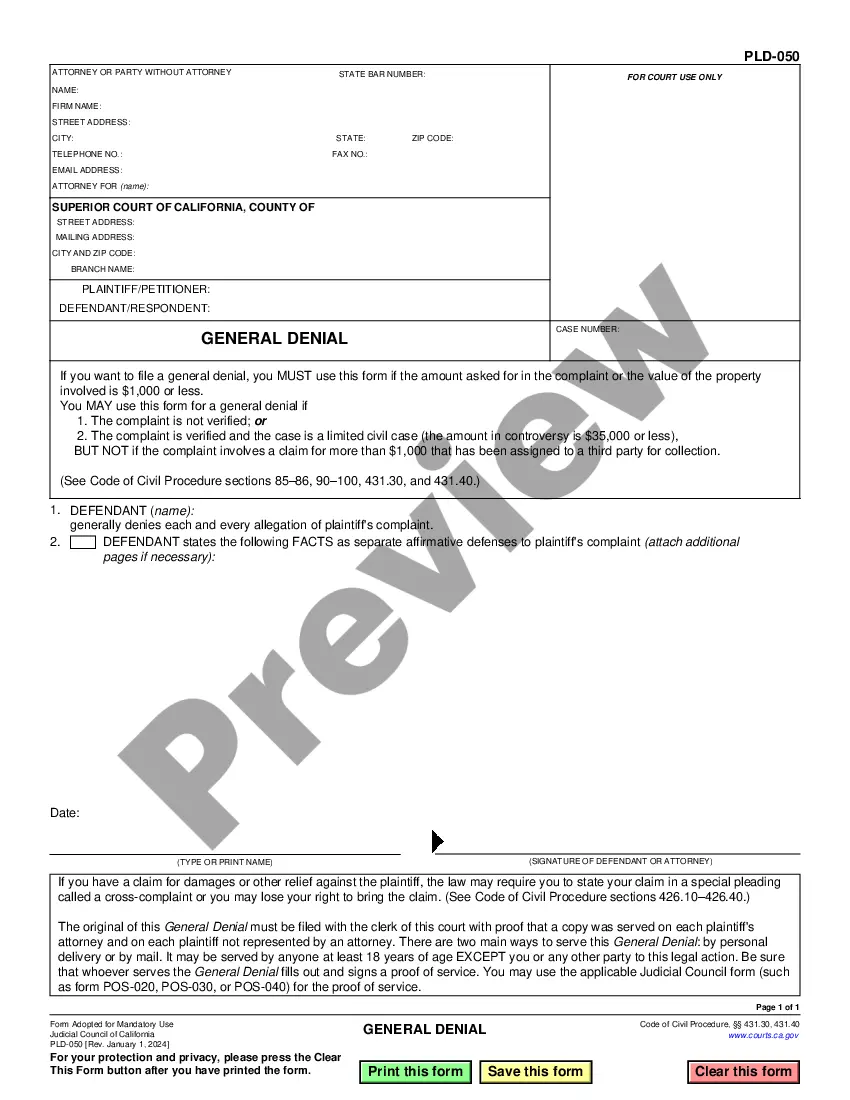

How to fill out Division Order?

Are you currently inside a position in which you need to have documents for either organization or specific purposes virtually every day time? There are tons of legal record templates available online, but getting ones you can rely on isn`t easy. US Legal Forms offers a large number of develop templates, just like the Delaware Division Order, which are written to satisfy federal and state demands.

If you are presently informed about US Legal Forms site and possess an account, merely log in. Next, you may download the Delaware Division Order template.

Should you not come with an account and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you will need and make sure it is for your proper town/area.

- Take advantage of the Preview option to check the shape.

- Browse the explanation to actually have selected the right develop.

- In case the develop isn`t what you are trying to find, utilize the Look for field to discover the develop that meets your requirements and demands.

- If you discover the proper develop, click Acquire now.

- Opt for the pricing plan you need, fill in the desired details to make your bank account, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free file format and download your duplicate.

Locate all the record templates you have purchased in the My Forms menu. You can aquire a additional duplicate of Delaware Division Order at any time, if necessary. Just go through the required develop to download or print the record template.

Use US Legal Forms, the most substantial assortment of legal forms, to save some time and stay away from mistakes. The assistance offers expertly produced legal record templates which can be used for an array of purposes. Produce an account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The EIN is issued by the Internal Revenue Service (IRS). You can find your state file number in the upper left or upper right hand side of your certificate of incorporation or certification of formation.

The Delaware state file number is the number that the state of Delaware issues to each new company at the time of formation. It is formatted with seven numbers; for example, 1234567. Each new Delaware company will be one digit higher than the company before it.

To find your Delaware Tax File number, you will need to look it up on the State's Entity Search web site: . This site will open in a new window. After you have found your Tax File number, close the window and enter the number in the FranTax login page.

If you do not legally and officially cancel your LLC or dissolve your corporation, your company will continue to be held responsible for the annual Delaware Franchise Tax Fee as well as your annual Registered Agent Fee until either the Registered Agent resigns or until the State of Delaware voids the company.

LP/LLC/GP Tax Penalty for non-payment or late payment is $200.00. Interest accrues on the tax and penalty at the rate of 1.5% per month.

If you have questions concerning franchise tax please contact the Franchise Tax Department at 302-739-3073 and select option 3.

If you wish to order a copy of an annual report, please call 302-739-3073 for more information. NOTE: Alternative entities (Limited Liability Companies, Limited Partnerships, and General Partnerships) do not currently file annual reports. Annual reports are required for domestic and foreign corporations only.

In addition to the general fishing license, all anglers (resident and non-resident) age 16 or older must obtain a free Delaware Fisherman Information Network (FIN) number each year before fishing in tidal or non-tidal waters of Delaware. This includes those anglers exempt from obtaining a general fishing license.