Delaware Quitclaim Deed for Mineral / Royalty Interest

Description

How to fill out Quitclaim Deed For Mineral / Royalty Interest?

Choosing the best authorized record design might be a have a problem. Of course, there are plenty of templates available on the Internet, but how will you find the authorized form you require? Make use of the US Legal Forms internet site. The service gives 1000s of templates, like the Delaware Quitclaim Deed for Mineral / Royalty Interest, which you can use for enterprise and personal demands. All the forms are checked out by professionals and fulfill state and federal demands.

When you are already authorized, log in for your profile and then click the Down load switch to obtain the Delaware Quitclaim Deed for Mineral / Royalty Interest. Make use of profile to look throughout the authorized forms you have bought earlier. Go to the My Forms tab of your respective profile and acquire another version from the record you require.

When you are a whole new end user of US Legal Forms, allow me to share basic recommendations that you should adhere to:

- Initially, be sure you have selected the appropriate form for your area/area. It is possible to look through the shape while using Review switch and look at the shape outline to ensure this is basically the best for you.

- In the event the form fails to fulfill your needs, make use of the Seach industry to find the proper form.

- Once you are sure that the shape would work, click the Buy now switch to obtain the form.

- Pick the rates prepare you would like and enter the needed information and facts. Build your profile and purchase the transaction using your PayPal profile or credit card.

- Opt for the document formatting and acquire the authorized record design for your product.

- Complete, revise and printing and indication the obtained Delaware Quitclaim Deed for Mineral / Royalty Interest.

US Legal Forms is definitely the most significant collection of authorized forms in which you can find numerous record templates. Make use of the company to acquire professionally-made documents that adhere to status demands.

Form popularity

FAQ

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

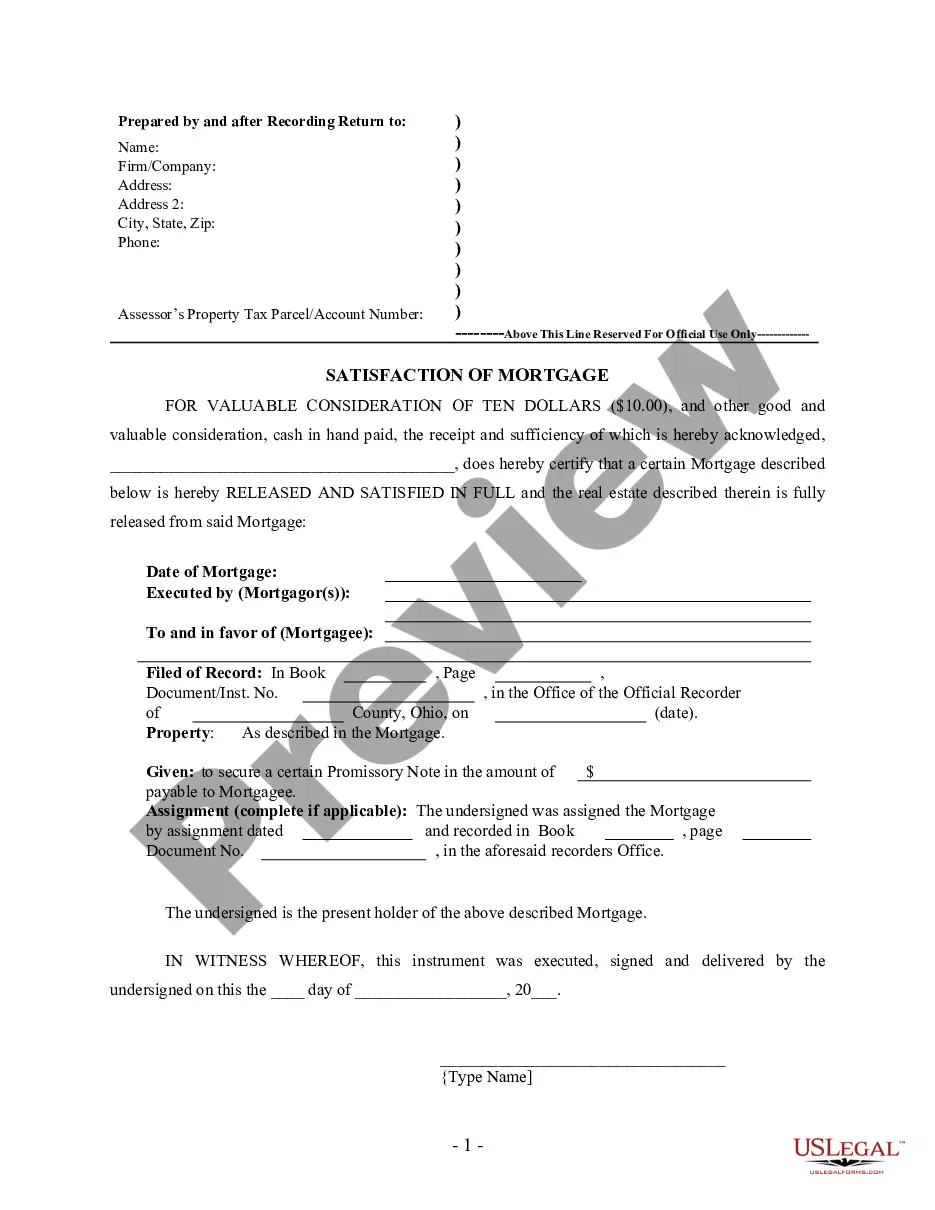

In order for a deed to be valid and enforceable, it must be in writing; describe with specificity the property conveyed; specify the names of the grantor and grantee; be signed; be sealed; be acknowledged; and be delivered.

The Process of Transferring Property Identify the recipient or donee. Discuss the terms and conditions of the transfer with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Laws & Requirements Recording Requirements: Delaware Code Title 9, Chapter 96: Delaware has three districts to record quitclaim deeds, and fees vary by county: Fees in Kent County start at $36.00/document, $10.00/page, and $5.00/tax parcel number. Fees in New Castle County are $13.00/page and $3.00/parcel description.

The fees involved in filing a quitclaim deed depend on the type of real estate being transferred. Filing a deed for a farm or residential property typically costs $125 and $250 for other types of property. There may be additional fees involved when filing your forms.

In addition, a properly executed quit claim deed requires specific information, including the name and address of both the grantor and grantee; the grantee's vesting choice (how to hold title to the property); a complete legal description of the property to be conveyed; the county tax assessment parcel ID (if available ...

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

You would sign quitclaim deed as the grantor in front of notary and then file in the county deed records. There is a small recording fee you pay the clerk in the real property records. Forms: return it to you after recording.