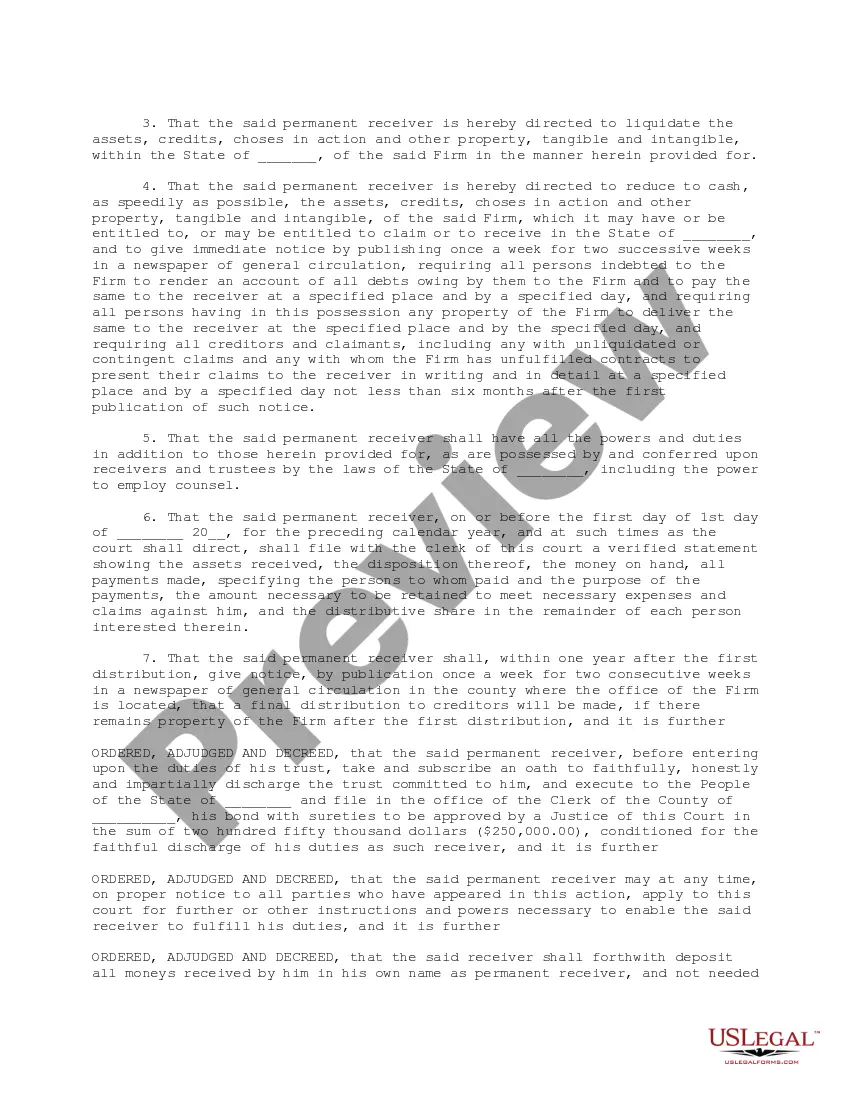

This is an order for the appointment of a receiver. In an instance where the appointment of a receiver is necessary, this decision and order directs the receiver to reduce to cash any and all asssets where possible, and to file with the clerk a list of all assets and their disposition.

Delaware Appointment of a Receiver

Description

How to fill out Appointment Of A Receiver?

You are able to invest hours on the Internet looking for the lawful papers format that suits the federal and state demands you want. US Legal Forms gives 1000s of lawful forms which can be examined by professionals. It is simple to download or produce the Delaware Appointment of a Receiver from the support.

If you currently have a US Legal Forms accounts, you may log in and click the Obtain switch. Afterward, you may comprehensive, edit, produce, or sign the Delaware Appointment of a Receiver. Each and every lawful papers format you buy is the one you have eternally. To obtain yet another duplicate of the bought form, check out the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms website for the first time, keep to the simple instructions listed below:

- Very first, make sure that you have chosen the right papers format for that county/area of your liking. Browse the form outline to make sure you have picked the proper form. If available, take advantage of the Preview switch to search through the papers format also.

- If you wish to get yet another version from the form, take advantage of the Look for field to discover the format that meets your needs and demands.

- After you have discovered the format you would like, just click Get now to continue.

- Select the costs program you would like, key in your references, and register for an account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal accounts to cover the lawful form.

- Select the format from the papers and download it to your gadget.

- Make alterations to your papers if needed. You are able to comprehensive, edit and sign and produce Delaware Appointment of a Receiver.

Obtain and produce 1000s of papers themes using the US Legal Forms web site, that offers the largest selection of lawful forms. Use skilled and state-certain themes to tackle your business or personal needs.

Form popularity

FAQ

The receiver is a neutral, legally-appointed professional who is entrusted to manage a company's operations, finances, and property in the event that they default on their loan payments. The main goals of receivership are to: Repay debts to creditors. Negotiate with creditors to secure lower interest rates.

§ 211. Meetings of stockholders. (a) (1) Meetings of stockholders may be held at such place, either within or without this State as may be designated by or in the manner provided in the certificate of incorporation or bylaws, or if not so designated, as determined by the board of directors.

§ 280. Notice to claimants; filing of claims. f. The aggregate amount, on an annual basis, of all distributions made by the corporation to its stockholders for each of the 3 years prior to the date the corporation dissolved.

Understanding Receivership: Receivership, also known as administrative receivership, is a legally sanctioned procedure where an entity, typically a lender like a bank, appoints a receiver. The primary role of this receiver is to ?receive? and liquidate the company's assets, if necessary, to repay the lender. What is Receivership? | Company Rescue companyrescue.co.uk ? guides-knowledge companyrescue.co.uk ? guides-knowledge

(a) The corporation shall prepare, at least 10 days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting; provided, however, if the record date for determining the stockholders entitled to vote is less than 10 days before the meeting date, the list shall reflect the ...

Section 226 - Appointment of custodian or receiver of corporation on deadlock or for other cause (a) The Court of Chancery, upon application of any stockholder, may appoint 1 or more persons to be custodians, and, if the corporation is insolvent, to be receivers, of and for any corporation when: (1) At any meeting held ...

Insolvency. (a) A debtor is insolvent if the sum of the debtor's debts is greater than all of the debtor's assets, at a fair valuation. (b) A debtor who is generally not paying debts as they become due is presumed to be insolvent.

Whenever a corporation shall be insolvent, the Court of Chancery, on the application of any creditor or stockholder thereof, may, at any time, appoint 1 or more persons to be receivers of and for the corporation, to take charge of its assets, estate, effects, business and affairs, and to collect the outstanding debts, ...

A receiver is a person appointed as custodian of a person or entity's property, finances, general assets, or business operations. Receivers can be appointed by courts, government regulators, or private entities. Receivers seek to realize and secure assets and manage affairs to pay debts. Receiver: Definition, Legal Role, and Responsibilities Investopedia ? terms ? receiver Investopedia ? terms ? receiver

A receiver is a person appointed by a court, government regulator, or private entity to manage debt consolidation for a company. When a receiver is appointed, a company is said to be "in receivership." Receivership is an alternative to bankruptcy.