Delaware Self-Employed Travel Agent Employment Contract

Description

How to fill out Self-Employed Travel Agent Employment Contract?

Are you presently in a position that requires you to have documentation for either corporate or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of document templates, such as the Delaware Self-Employed Travel Agent Employment Contract, which are crafted to comply with state and federal regulations.

Once you find the correct document, click on Buy now.

Select the pricing plan you wish, provide the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Delaware Self-Employed Travel Agent Employment Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the document you need and ensure it is for the correct area/county.

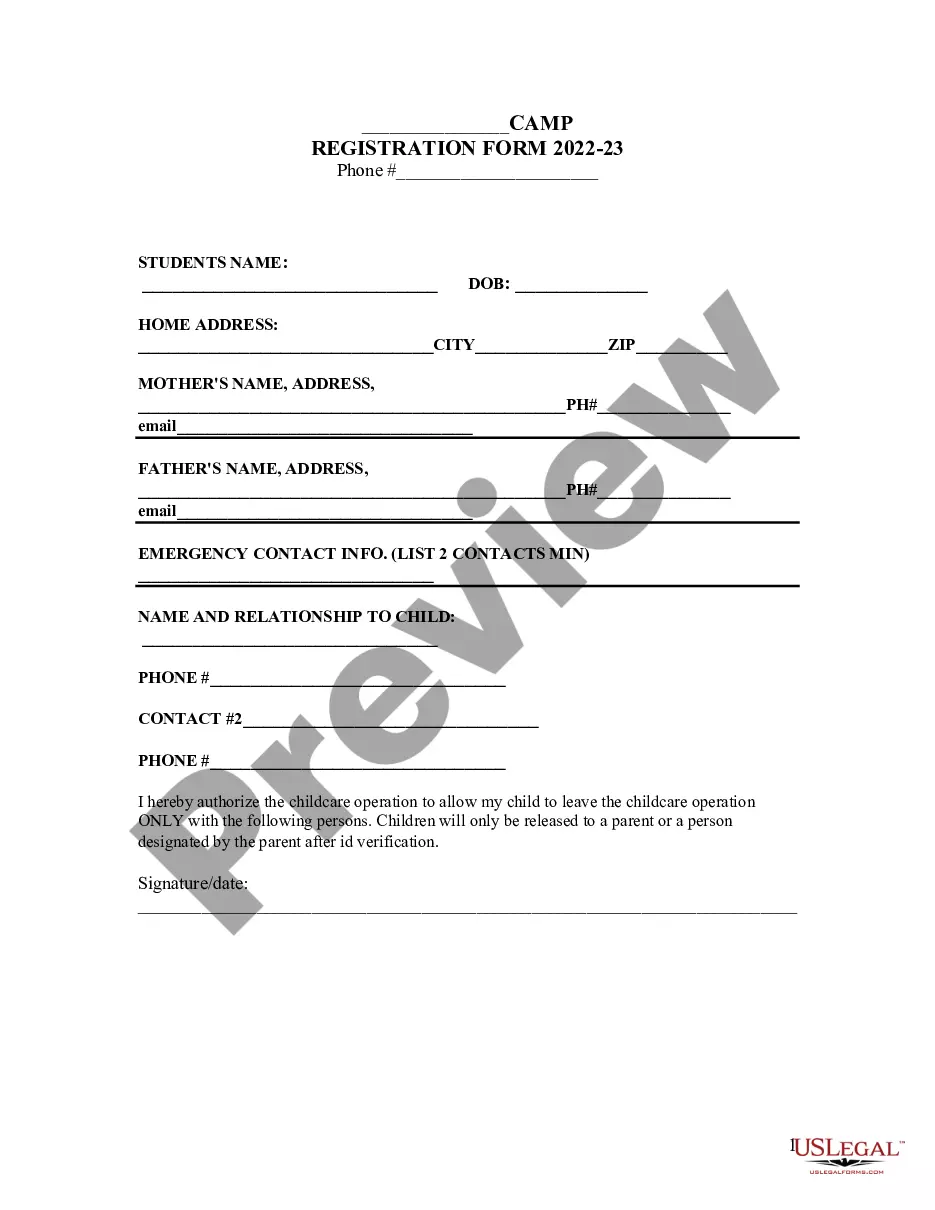

- Use the Preview button to examine the form.

- Review the description to confirm that you have selected the right document.

- If the document is not what you are looking for, utilize the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

While Delaware law does not mandate that LLCs have an operating agreement, it is highly advisable for your business. A well-drafted operating agreement can clarify the roles and responsibilities of members, helping to prevent disputes. Moreover, if you are a self-employed travel agent operating through an LLC, having this document can strengthen your business structure and enhance your credibility. Consider using the US Legal Forms platform to create a tailored operating agreement that fits your Delaware self-employed travel agent business.

You can conveniently download a Delaware Self-Employed Travel Agent Employment Contract from the US Legal Forms platform. This site offers a wide range of legal documents tailored to meet your needs. Simply search for the specific contract you require, and you will find a user-friendly option for easy download. With this resource, you can ensure that your employment contract meets all necessary legal standards.

To write a self-employed contract, begin by outlining the services you will provide and the terms of compensation. It's crucial to detail the duration of the contract and any specific conditions or expectations. Using the Delaware Self-Employed Travel Agent Employment Contract from uslegalforms can ensure that you cover all essential aspects and create a professional agreement.

When writing a contract for a 1099 employee, focus on the nature of the work, payment structure, and the independence of the contractor. Clearly state that the individual is not an employee but a self-employed contractor. The Delaware Self-Employed Travel Agent Employment Contract template from uslegalforms can help you create an effective agreement that meets these requirements.

Filling out an employment agreement form requires careful attention to detail. Start by entering the names of both parties, followed by the job title and responsibilities. Make sure to include payment details and any specific terms that apply to your Delaware Self-Employed Travel Agent Employment Contract. Using predefined forms from uslegalforms can guide you in providing accurate information.

Writing a simple employment contract involves defining the roles, responsibilities, and expectations of both parties. Be clear about the duration of the contract and the payment terms. For a more effective approach, consider using the Delaware Self-Employed Travel Agent Employment Contract template from uslegalforms, which simplifies the process and ensures all necessary elements are included.

To write a self-employment contract, start by outlining the scope of work, payment terms, and duration of the agreement. Include specific details relevant to your role as a travel agent, such as commission structures and client responsibilities. Utilizing a structured template, such as the Delaware Self-Employed Travel Agent Employment Contract available on uslegalforms, can make this process easier.

Yes, you can write your own legally binding contract, including a Delaware Self-Employed Travel Agent Employment Contract. However, it's essential to ensure that your contract meets all legal requirements and clearly outlines the terms of the agreement. Using templates from reputable sources, like uslegalforms, can help you include necessary clauses and protect your interests.

To qualify as an independent contractor under the Delaware Self-Employed Travel Agent Employment Contract, you must meet specific criteria set by the IRS and state regulations. Typically, this includes demonstrating control over your work schedule, retaining the right to accept or reject assignments, and being responsible for your expenses. Additionally, you should maintain your own business identity, which can include having a separate business bank account. By establishing these elements, you can position yourself as an independent contractor, gaining the flexibility and autonomy that come with this role.

The purpose of an employment contract is to define the relationship between an employer and an employee, clearly outlining roles, responsibilities, and expectations. For self-employed travel agents, this contract serves to protect both parties by specifying terms such as compensation and termination conditions. A well-crafted Delaware Self-Employed Travel Agent Employment Contract can help you avoid disputes and ensure a smooth working relationship.