Wyoming Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease

Description

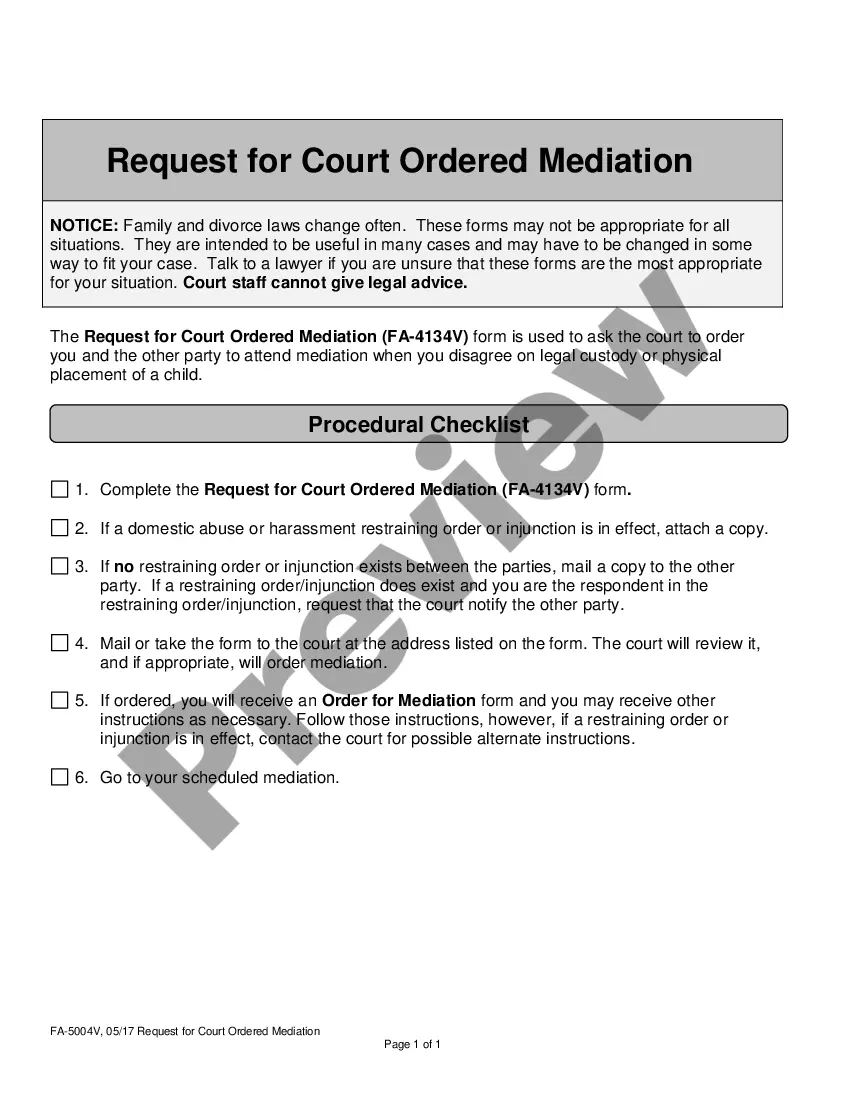

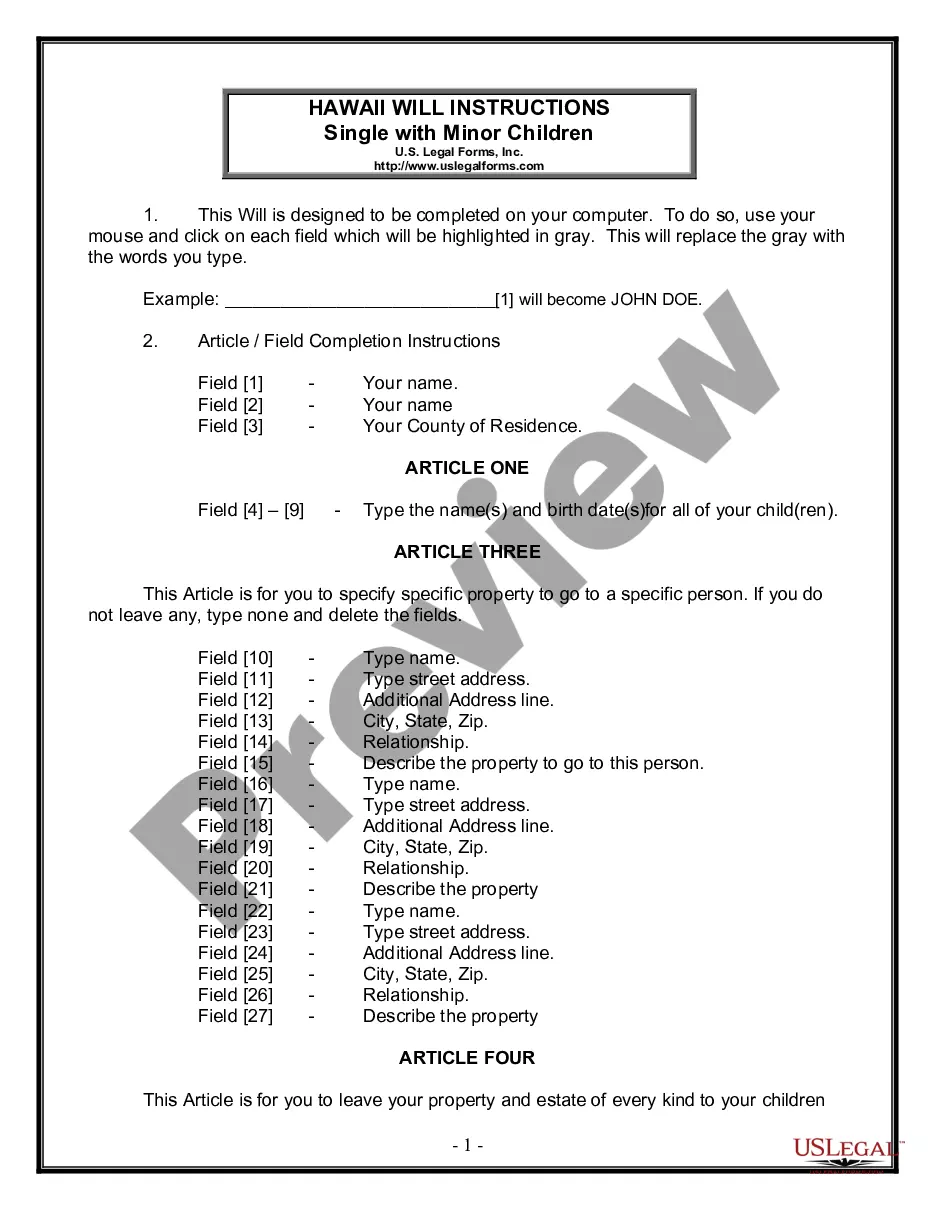

How to fill out Conveyance Of Right To Make Free Use Of Gas Provided For In An Oil And Gas Lease?

Are you currently in the place where you need to have paperwork for both organization or individual uses just about every working day? There are tons of lawful file layouts accessible on the Internet, but finding ones you can depend on is not easy. US Legal Forms offers a large number of develop layouts, like the Wyoming Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease, which are created to meet federal and state specifications.

Should you be currently acquainted with US Legal Forms internet site and get your account, basically log in. Next, you are able to down load the Wyoming Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease template.

Should you not have an bank account and want to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is to the appropriate town/state.

- Utilize the Preview button to analyze the shape.

- See the explanation to actually have chosen the correct develop.

- In the event the develop is not what you`re looking for, take advantage of the Search discipline to find the develop that suits you and specifications.

- Whenever you obtain the appropriate develop, click Purchase now.

- Opt for the costs plan you would like, fill in the desired details to produce your money, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a hassle-free document file format and down load your backup.

Discover each of the file layouts you may have purchased in the My Forms menus. You can obtain a additional backup of Wyoming Conveyance of Right to Make Free Use of Gas Provided For in An Oil and Gas Lease whenever, if needed. Just go through the necessary develop to down load or produce the file template.

Use US Legal Forms, the most substantial collection of lawful types, to save time and stay away from errors. The assistance offers skillfully created lawful file layouts that can be used for a variety of uses. Produce your account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

The period of time in the life of an oil & gas lease that begins after the expiration of the primary term. Production, operations, continuous drilling, or shut-in royalty payments are most often used to extend an oil & gas lease into its secondary term.

The primary term is the initial period during which a well may be drilled. If a successful well is drilled within the primary term, the lease will extend for as long as the well remains productive. If a well is not drilled within the primary term, the lease will usually expire.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

An ?unless? clause provides that the lease terminates unless the lessee has either made the required payments or commenced drilling operations. Lessees can therefore be terminated from the lease by failure to pay the proper amount, by the due date, in the proper form, to the proper party.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.