Delaware Recovery Services Contract - Self-Employed

Description

How to fill out Recovery Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal templates that you can download or print.

By using the website, you can access thousands of documents for business and personal use, organized by type, state, or keywords. You can quickly find the latest versions of forms like the Delaware Recovery Services Contract - Self-Employed.

If you already have an account, Log In and retrieve the Delaware Recovery Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously obtained forms from the My documents section of your account.

Proceed with the purchase. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded Delaware Recovery Services Contract - Self-Employed. Each template you added to your account does not have an expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Delaware Recovery Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/county.

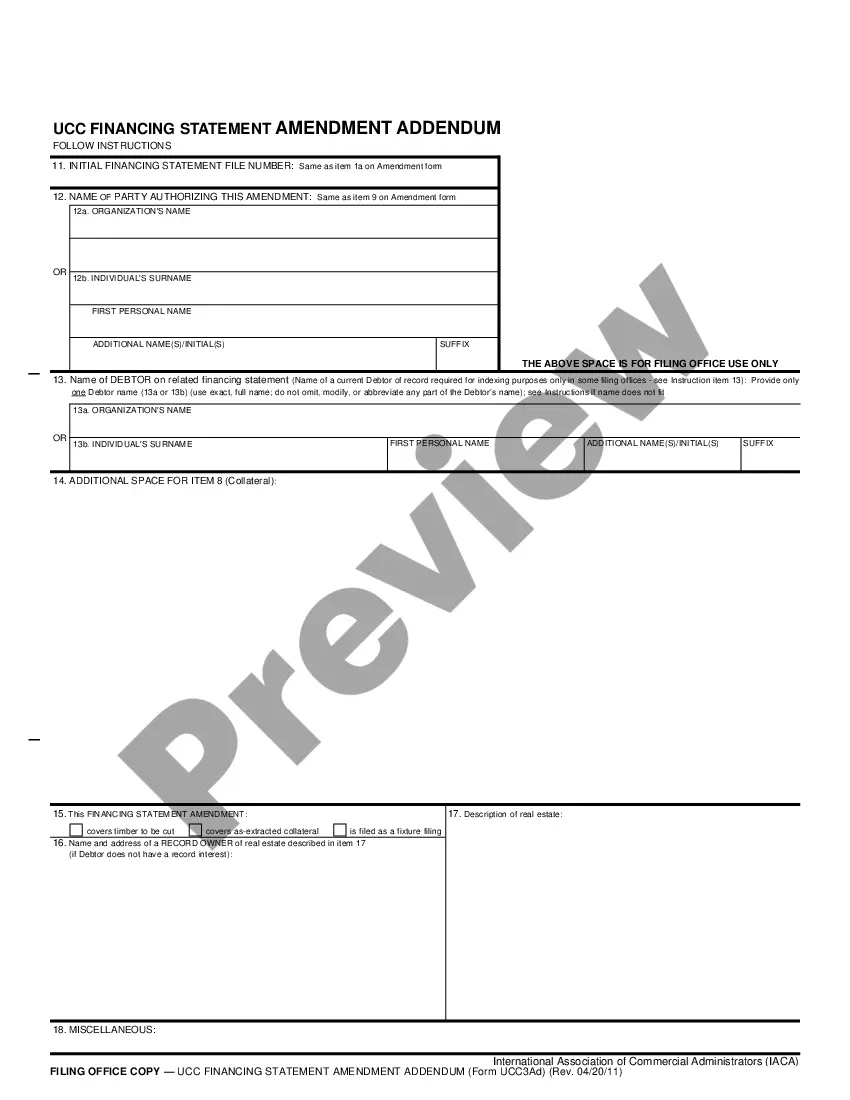

- Click the Preview button to review the form's content.

- Check the form details to confirm you have selected the correct document.

- If the form does not meet your requirements, use the Search bar at the top of the page to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

To speak to a live person at Delaware Unemployment, you can call their dedicated helpline during business hours. You may need to navigate automated menus, but pressing the appropriate options will lead you to a representative. Engaging with services through the Delaware Recovery Services Contract - Self-Employed can simplify your experience and potentially provide additional resources.

The wage base for unemployment in Delaware may be updated periodically, reflecting changes in the state’s economic conditions. Employers need to know the wage base to calculate their unemployment tax obligations accurately. For those engaging with the Delaware Recovery Services Contract - Self-Employed, maintaining awareness of these figures is essential to stay compliant.

Predictions for the unemployment rate in Delaware for 2025 depend on economic trends and workforce dynamics. Economic forecasts consider various factors, including job growth and market demands. Staying informed about these trends can benefit self-employed individuals, particularly when utilizing the Delaware Recovery Services Contract - Self-Employed for planning.

The State Unemployment Insurance (SUI) rate for new employers in Delaware varies, but it typically starts at a base rate. This rate is subject to adjustments based on the employer's experience with claims. If you are entering the workforce as a self-employed individual or new employer, understanding how the Delaware Recovery Services Contract - Self-Employed works can help streamline your financial planning.

The hardship program in Delaware offers assistance to individuals facing financial difficulties. This program provides resources such as financial aid and counseling services to help residents regain stability. For self-employed individuals, understanding the Delaware Recovery Services Contract - Self-Employed can be beneficial, as it may help you access support while ensuring your contractual obligations are met.

The Delaware Employee Rights Act is legislation designed to protect the rights of workers in the state. It covers various aspects, including wage protection, anti-discrimination measures, and the right to a safe workplace. If you are self-employed, being aware of the Delaware Recovery Services Contract - Self-Employed and the Employee Rights Act will help you navigate your rights and responsibilities effectively.

A Delaware employment contract is a legally binding agreement between an employer and an employee, outlining the terms of employment. This contract typically includes details such as job responsibilities, compensation, and duration of employment. For self-employed individuals, understanding the Delaware Recovery Services Contract - Self-Employed can clarify your rights and obligations under this agreement.

Yes, you can strike in Delaware; however, it is subject to certain regulations and conditions. Employees have the right to strike for various reasons, including unfair labor practices. The Delaware Recovery Services Contract - Self-Employed offers resources and guidance for those navigating their rights during such actions. Always consider seeking legal advice to understand your specific situation.

The Delaware business tax loophole refers to the state’s favorable tax structure, which allows some businesses to significantly reduce their tax liabilities. This includes no sales tax and minimal corporate tax rates for certain entities. For individuals operating in the realm of Delaware Recovery Services Contract - Self-Employed, understanding this loophole can provide valuable financial insights. Consulting uslegalforms can help you navigate these aspects for optimal tax planning.

Yes, you must renew your LLC every year in Delaware by filing the annual report and paying the associated fees. This renewal keeps your business active and legally compliant. If you are operating in the scope of a Delaware Recovery Services Contract - Self-Employed, staying on top of renewals is essential. Use platforms like uslegalforms to manage your renewals effectively.