Delaware Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by category, state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Delaware Door Contractor Agreement - Self-Employed.

Every legal document template you purchase is your property forever. You will have access to every form you downloaded from your account. Select the My documents section and choose a form to print or download again. Compete and obtain, and print the Delaware Door Contractor Agreement - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Delaware Door Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to find the Delaware Door Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the appropriate form for your city/state.

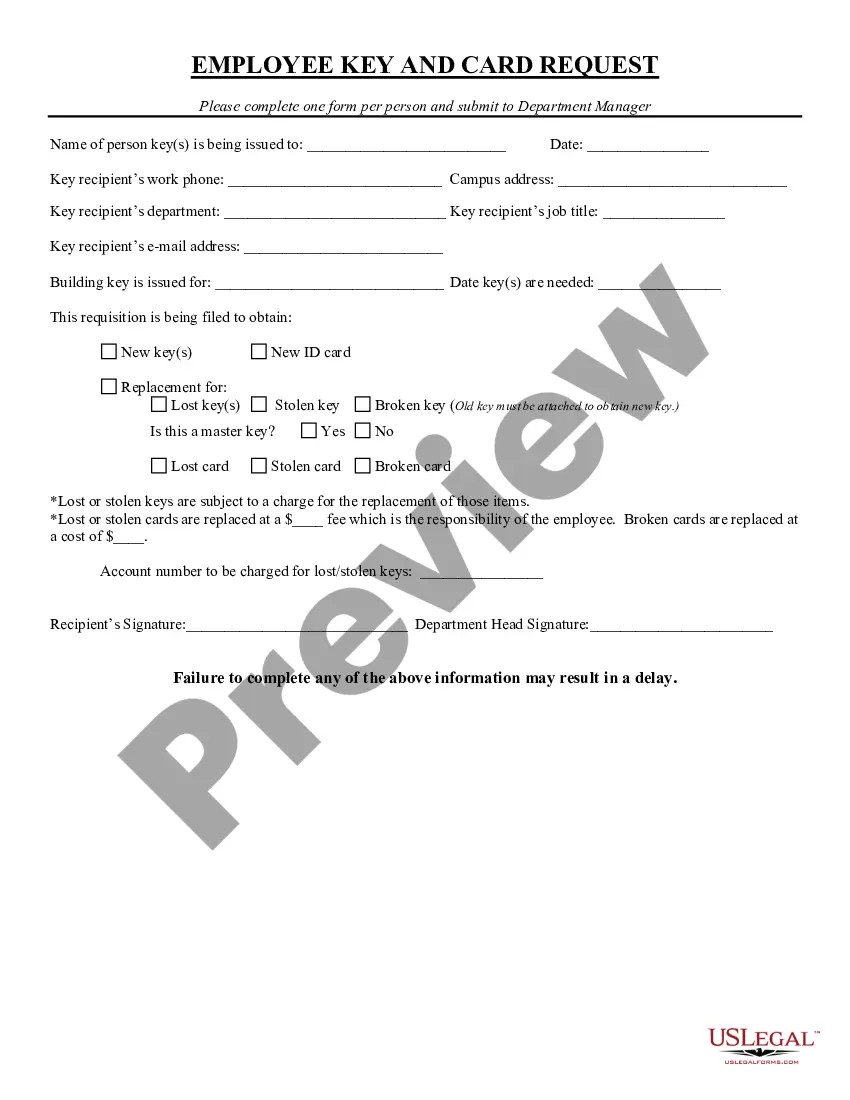

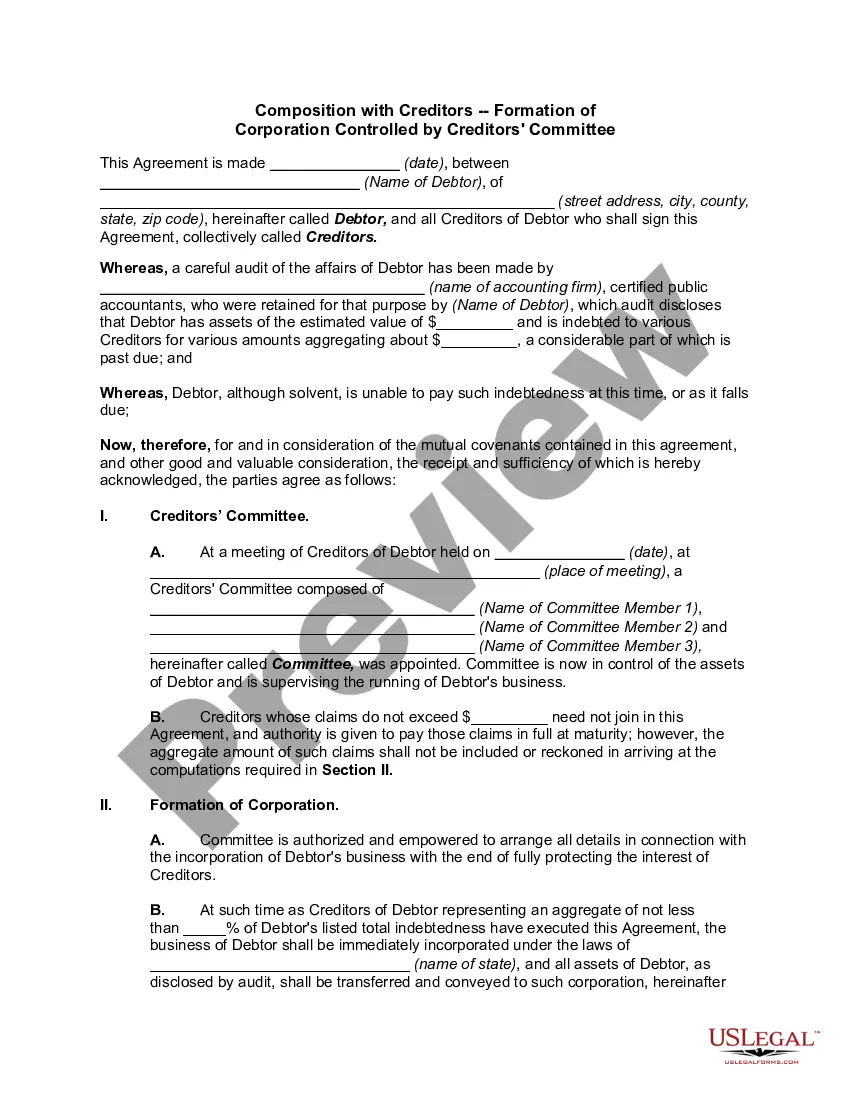

- Step 2. Use the Review feature to examine the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To fill out an independent contractor form, start by entering your personal information, including your name and contact details. Next, specify the services you will provide, along with payment terms and deadlines. Ensure that you review all terms before signing. Opting for the Delaware Door Contractor Agreement - Self-Employed from US Legal Forms can streamline this process and ensure you include important legal clauses.

Writing an independent contractor agreement involves specifying essential details about your project. Consider including the parties' names, the services provided, payment structure, and duration of the agreement. It is vital to clarify any terms regarding confidentiality and dispute resolution. Using a comprehensive resource like the Delaware Door Contractor Agreement - Self-Employed from US Legal Forms can provide valuable insights.

Yes, independent contractors in Delaware often need a business license to operate legally. It helps ensure compliance with state regulations and can impact your ability to secure work. Requirements can vary based on your location and the type of work you perform. It's advisable to consult the Delaware Division of Revenue or consider the Delaware Door Contractor Agreement - Self-Employed for guidance.

Filling out an independent contractor agreement is crucial for a clear understanding between you and your client. Start by including your full name and address, then add the client's information. Specify the scope of work, payment terms, and deadlines. Using a template like the Delaware Door Contractor Agreement - Self-Employed from US Legal Forms can simplify this process.

An operating agreement is not required for a Delaware LLC, but it is a smart decision to create one. This document can prevent conflicts among members and establish clear operational processes. For those involved in crafting a Delaware Door Contractor Agreement - Self-Employed, having an operating agreement can foster professionalism and structure in your business dealings, ensuring that all parties are aligned.

When writing an independent contractor agreement, be clear about the scope of work, payment terms, and duration of the contract. Include a section that outlines the relationship between the contractor and your business to avoid misclassification. If you're creating a Delaware Door Contractor Agreement - Self-Employed, you can find templates on platforms like uslegalforms, which assist you in ensuring all vital elements are included and legally sound.

Delaware does not legally require LLCs to have an operating agreement, but it is highly advisable. An operating agreement helps clarify the management structure and operational procedures of your business. For those drafting a Delaware Door Contractor Agreement - Self-Employed, this document can enhance the professionalism and clarity of your agreement. It may also safeguard your interests should disputes arise.

Many states recommend or require an operating agreement for LLCs, including Arizona and New York. An operating agreement outlines the rights and responsibilities of members, helping to avoid misunderstandings. If you’re engaging in a Delaware Door Contractor Agreement - Self-Employed, having a clear agreement is crucial. It ensures compliance with state laws and protects your business.

An independent contractor must earn at least $600 in a calendar year from a business to receive a 1099 form. This threshold applies under the regulations surrounding the Delaware Door Contractor Agreement - Self-Employed. It is essential to maintain accurate records of your earnings to ensure you meet these requirements. If you believe you may exceed this limit, consider consulting a financial advisor for accurate planning.

Writing a self-employed contract involves several critical steps. First, specify the nature of the work, detailing services to be provided under the Delaware Door Contractor Agreement - Self-Employed. Next, outline payment terms, including rates and deadlines. Finally, ensure you include clauses on confidentiality and termination to protect both parties.