Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

If you need to compile, obtain, or generate authentic document templates, utilize US Legal Forms, the premier collection of authentic forms available online.

Employ the site's user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types, states, or keywords.

Step 5. Complete the transaction. You can use your Мisa or Ьank card, or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal document and download it to your device.

- Utilize US Legal Forms to locate the Delaware Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to acquire the Delaware Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP.

- You can also access forms you previously obtained in the My documents tab of your account.

- For first-time users of US Legal Forms, please follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the contents of the form. Remember to check the outline.

- Step 3. If the form does not meet your satisfaction, use the Search area at the top of the screen to discover other forms in the legal document template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and input your details to register for an account.

Form popularity

FAQ

As of 2025, the availability of HAMP may vary based on federal regulations and housing policy changes. It’s crucial to stay informed about updates regarding this program to understand your options. You can reach out via the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP to obtain the latest information and ensure you don’t miss potential assistance tailored to your situation.

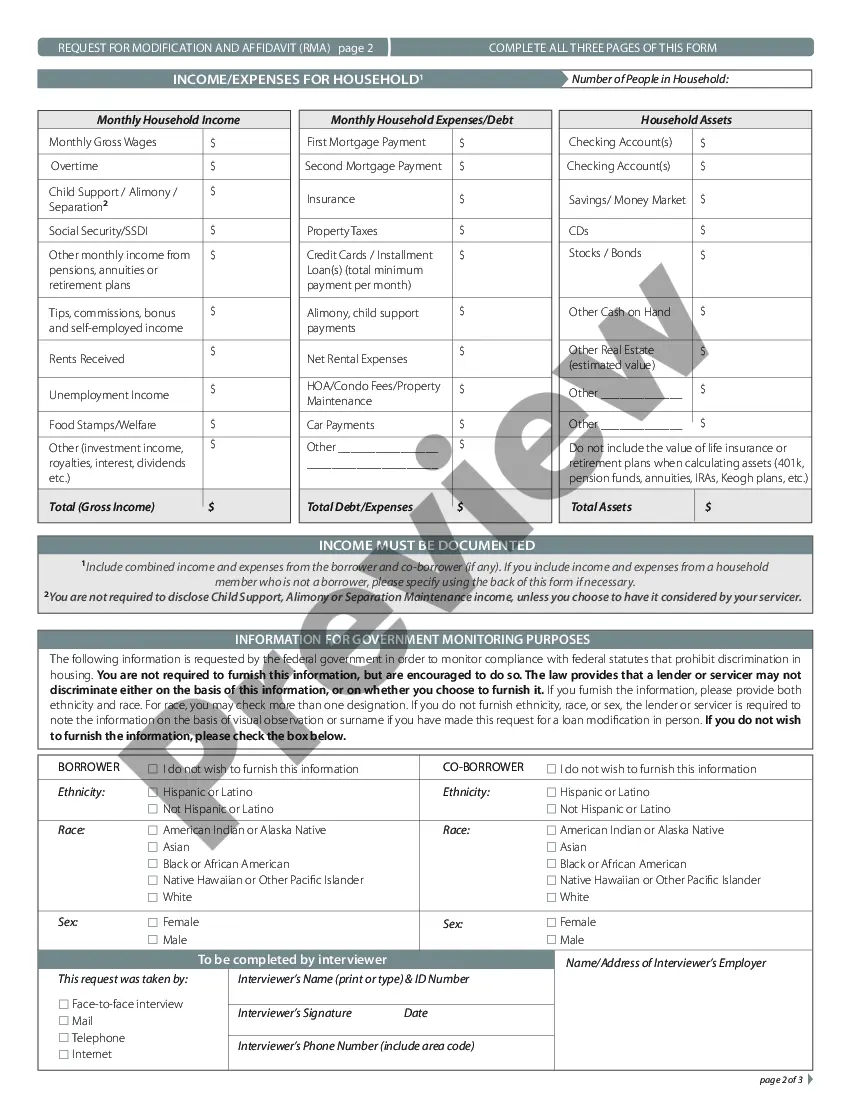

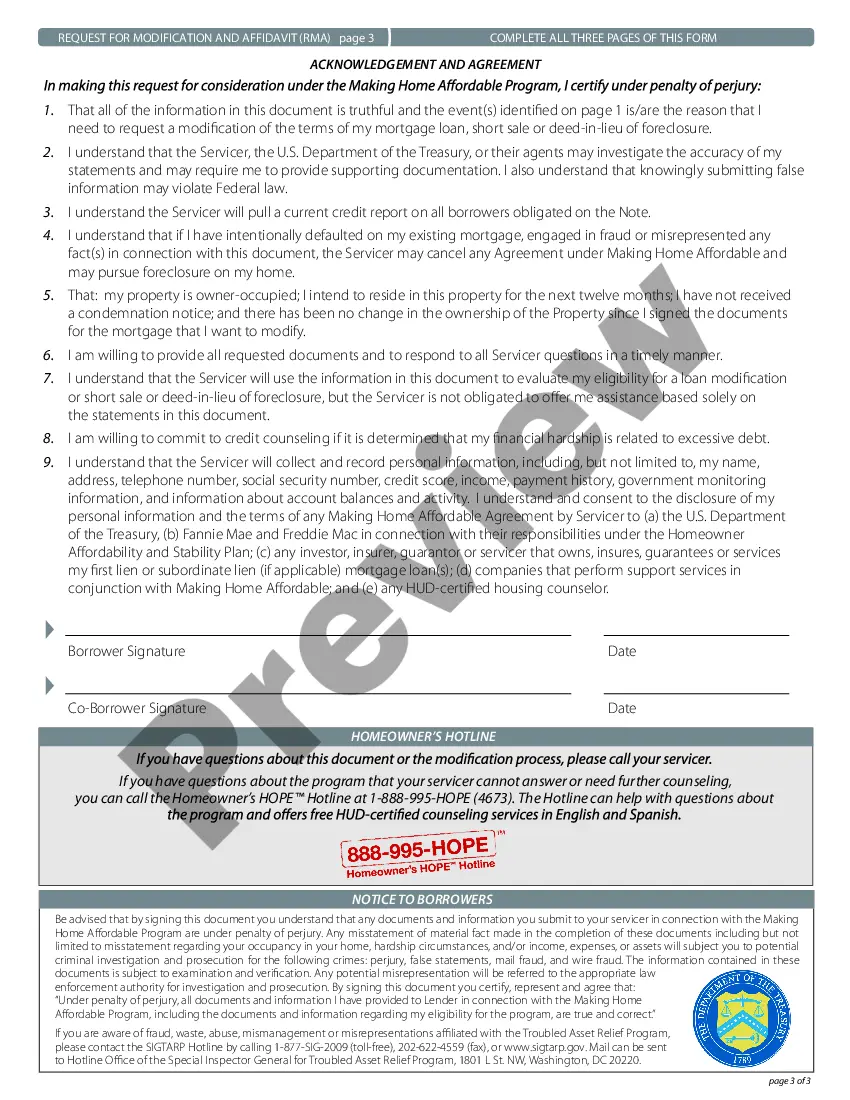

A HAMP loan modification refers to the specific changes made to your mortgage loan under the Home Affordable Modification Program. This can include lowering your interest rate, extending the loan term, or even offering a temporary forbearance. Utilizing a Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can help you find relief from burdensome loan terms and make your mortgage payments more manageable.

To apply for a loan modification, start by contacting your lender to discuss your financial challenges. You will need to provide documentation that outlines your current situation, including income and expenses. Once you gather necessary information, you can submit a Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which will guide you through the application process and help ensure you meet all the requirements.

HAMP stands for the Home Affordable Modification Program, a federal initiative aimed at helping homeowners with financial difficulties. It provides options for lowering monthly mortgage payments and making them more affordable through various modifications. Understanding HAMP is crucial if you are considering a Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP to stabilize your financial situation.

A HAMP modification is a program designed to assist homeowners in adjusting their mortgage payments to avoid foreclosure. Specifically, it enables borrowers facing economic hardship to modify their loan terms under the Home Affordable Modification Program HAMP. By meeting certain criteria, you can potentially lower your monthly mortgage payments and make your debt more manageable through a Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

The timeline for loan modification approval can vary, but it generally takes anywhere from a few weeks to a few months. After you submit your request, the lender will review your financial documents and may need additional information, which can prolong the process. Staying in regular contact with your lender can help ensure a smoother approval journey. Keep in mind, the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP often accelerates this timeline.

The process for a loan modification generally involves applying directly to your lender and providing necessary documentation about your financial situation. Once you apply, the lender will assess your situation and evaluate the options available to you. This can include lowering your interest rate or extending your loan term. Utilizing the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can facilitate and clarify this process.

Eligibility for loan modification varies based on several factors, including the type of loan and the specific conditions set by your lender. Generally, borrowers who are experiencing financial hardship due to circumstances like job loss or medical emergencies may qualify. Additionally, if you have a loan backed by the HAMP program, you would likely meet the necessary requirements. Consulting resources like the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can provide clarity on your eligibility.

To request a mature modification on your loan, start by contacting your lender to understand their specific requirements. Typically, you will need to submit documentation showing your current financial status, along with any forms your lender requires. It is beneficial to reference the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP during this interaction. With a clear understanding of the process, you can manage your request effectively.

The loan modification process begins with gathering your financial documents and submitting a formal request to your lender. After this, your lender will review your request, assessing your financial situation and the value of your property. Keep in mind that you may need to provide additional documents, depending on your lender's requirements. Using the Delaware Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can help streamline this process.