Delaware Term Sheet for Potential Investment in a Company

Description

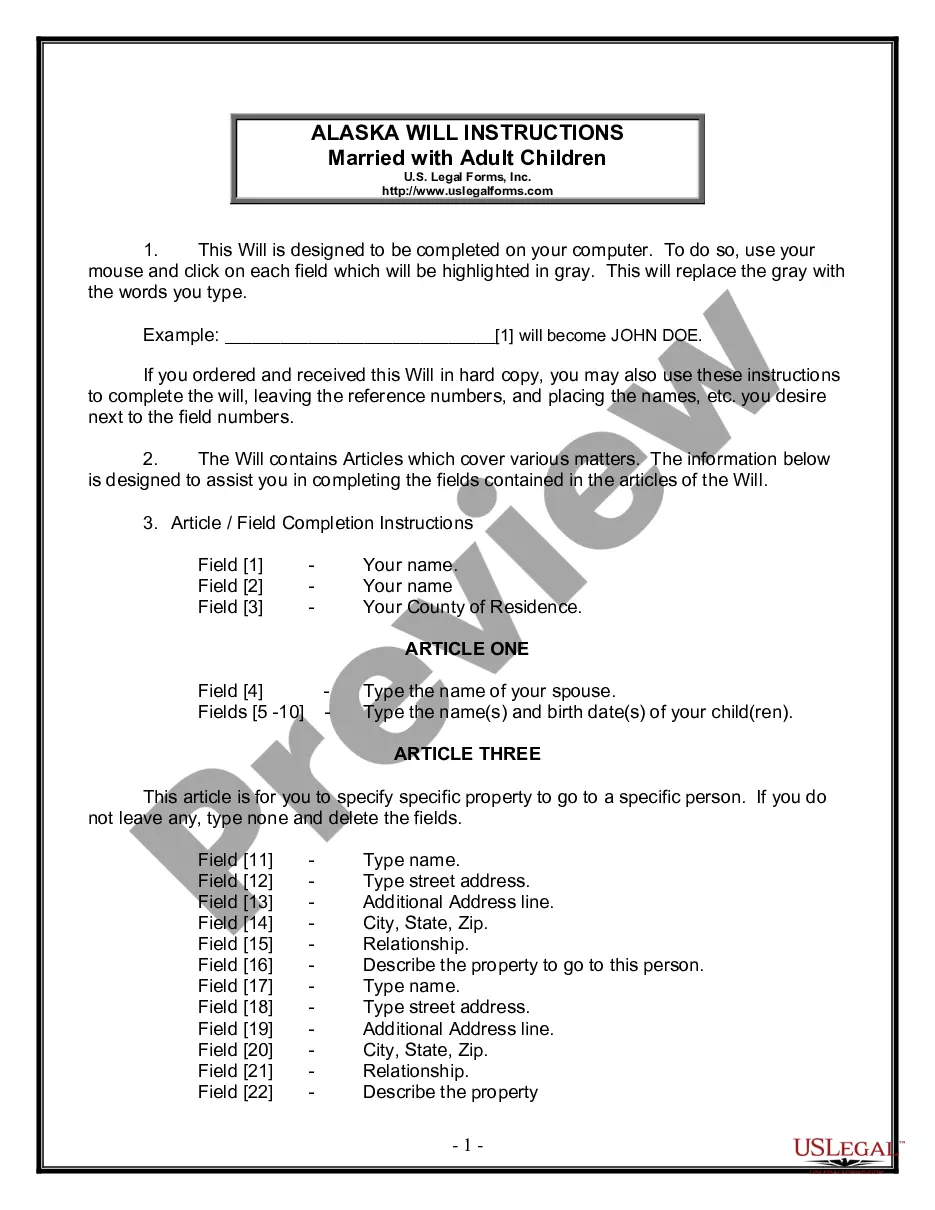

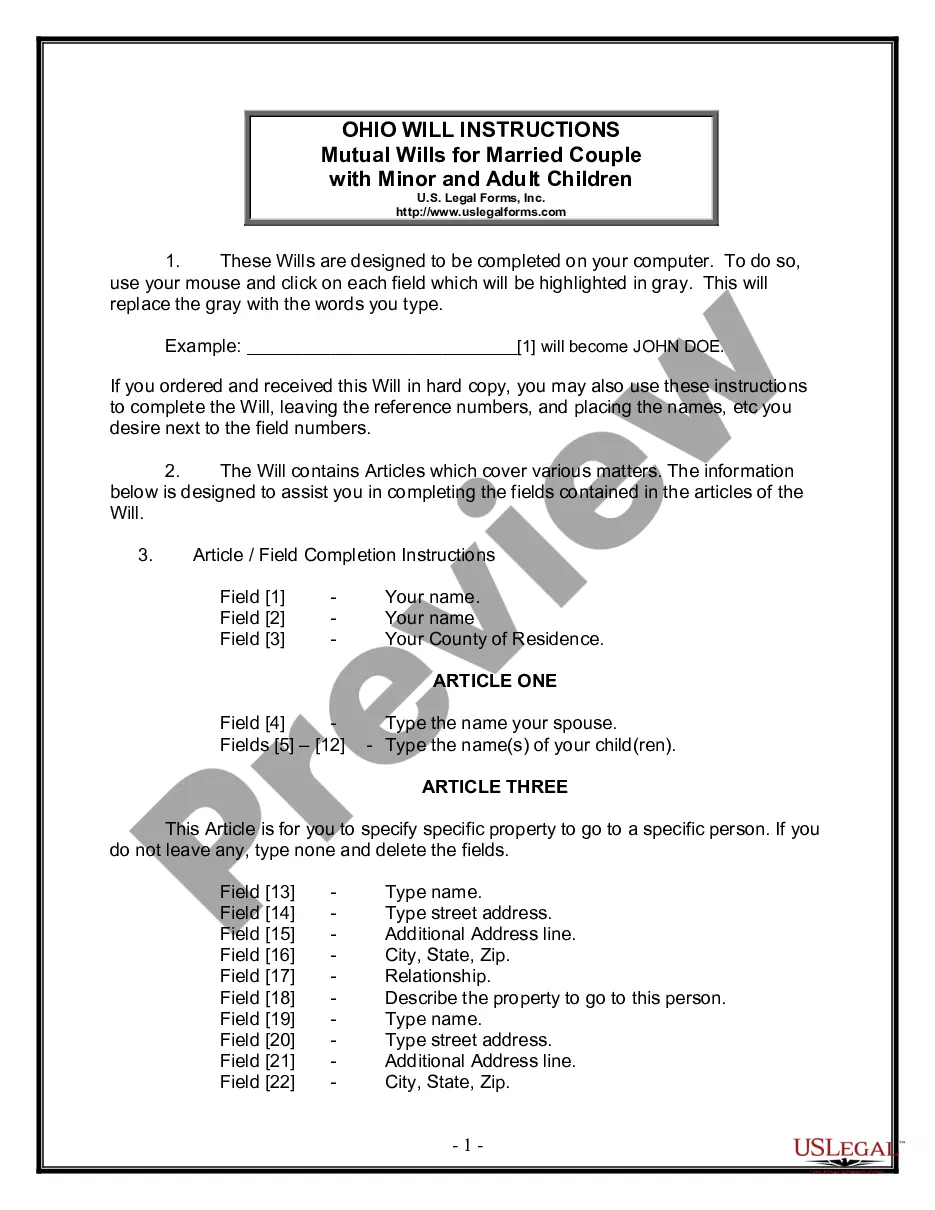

How to fill out Term Sheet For Potential Investment In A Company?

Are you presently inside a position that you need papers for both enterprise or individual reasons nearly every day? There are a lot of legal papers web templates available on the Internet, but getting versions you can rely isn`t simple. US Legal Forms provides a large number of kind web templates, just like the Delaware Term Sheet for Potential Investment in a Company, which can be composed to fulfill federal and state needs.

Should you be presently knowledgeable about US Legal Forms website and possess an account, just log in. Afterward, you may acquire the Delaware Term Sheet for Potential Investment in a Company design.

Unless you have an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and make sure it is for your correct area/state.

- Use the Preview option to examine the form.

- See the information to actually have selected the appropriate kind.

- When the kind isn`t what you are seeking, use the Search industry to discover the kind that suits you and needs.

- Once you get the correct kind, click on Buy now.

- Pick the costs program you would like, fill out the specified information to generate your bank account, and buy the transaction using your PayPal or charge card.

- Decide on a practical data file format and acquire your duplicate.

Locate all of the papers web templates you may have purchased in the My Forms food list. You can get a extra duplicate of Delaware Term Sheet for Potential Investment in a Company any time, if possible. Just select the necessary kind to acquire or print the papers design.

Use US Legal Forms, by far the most considerable variety of legal forms, to conserve time as well as prevent errors. The service provides professionally made legal papers web templates which can be used for an array of reasons. Produce an account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

What is a Term Sheet? A term sheet can be defined as a non-binding agreement that sets out the basic conditions for making an investment. It serves as a template for developing more detailed documents that are legally binding.

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

The main point of difference is that, generally, a Term Sheet is not intended to be legally binding while Shareholders Agreements are legally binding. You often use a Term Sheet to quickly agree on the key commercial terms and then use that as a basis to draft up a more formal Shareholders Agreement.

A Term Sheet sets the initial tone, outlining crucial terms and conditions. A Letter of Intent breathes life into intentions, providing a preliminary agreement framework. Finally, a Purchase Agreement seals the deal with legally binding precision. Prepare to delve into a comprehensive exploration of these documents.