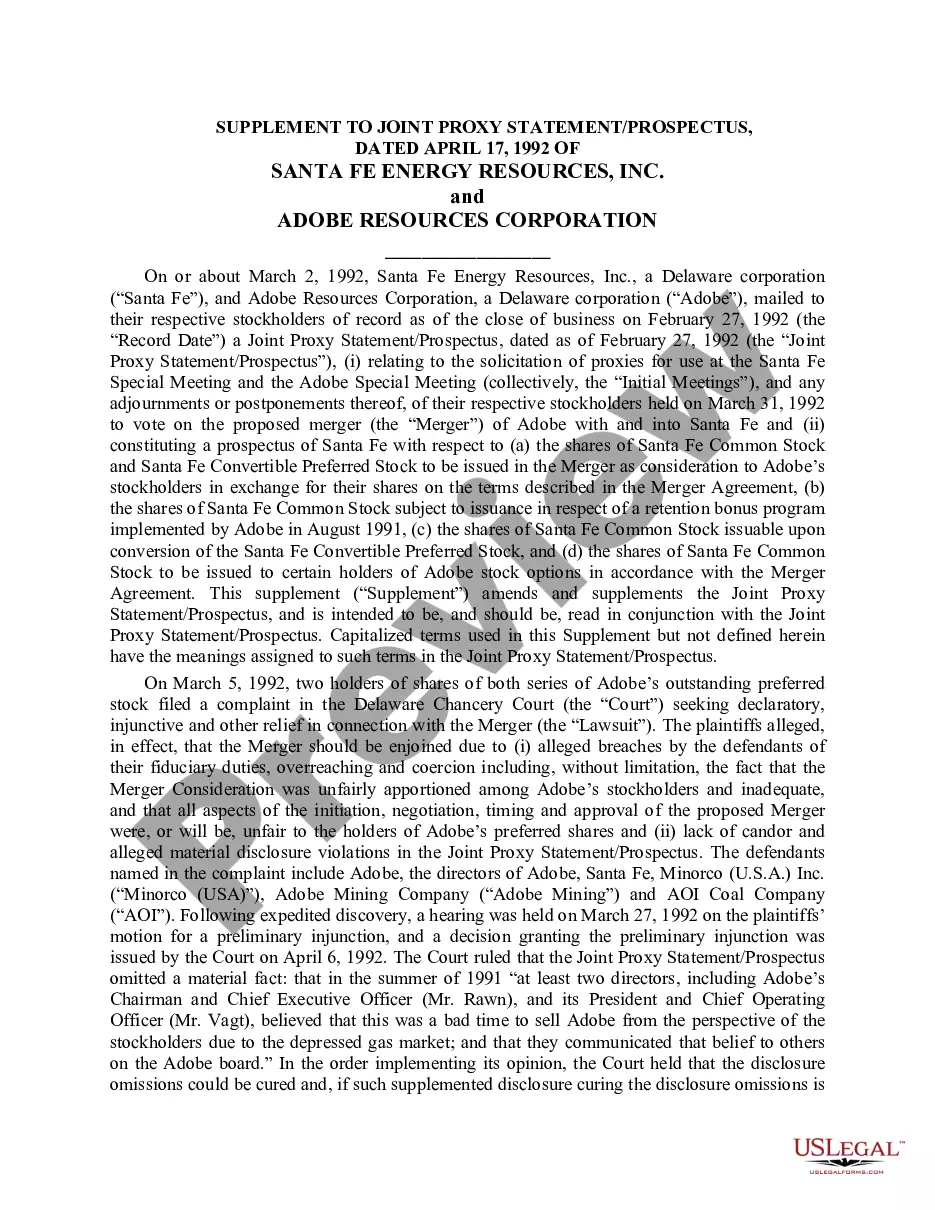

Delaware Term Sheet - Six Month Promissory Note

Description

How to fill out Term Sheet - Six Month Promissory Note?

Have you been within a situation where you need paperwork for either organization or specific reasons just about every day? There are tons of legal papers templates available on the net, but locating types you can rely isn`t straightforward. US Legal Forms gives a large number of form templates, much like the Delaware Term Sheet - Six Month Promissory Note, which can be published to fulfill federal and state specifications.

In case you are previously knowledgeable about US Legal Forms site and have a merchant account, simply log in. Afterward, you can down load the Delaware Term Sheet - Six Month Promissory Note format.

If you do not have an profile and want to start using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is for that right area/area.

- Use the Preview option to analyze the form.

- Read the explanation to ensure that you have selected the appropriate form.

- In the event the form isn`t what you`re searching for, take advantage of the Research area to discover the form that fits your needs and specifications.

- Whenever you discover the right form, just click Purchase now.

- Select the rates plan you want, submit the specified information and facts to make your bank account, and pay money for your order with your PayPal or credit card.

- Decide on a practical paper formatting and down load your copy.

Locate every one of the papers templates you possess purchased in the My Forms food selection. You can aquire a additional copy of Delaware Term Sheet - Six Month Promissory Note whenever, if possible. Just click the required form to down load or printing the papers format.

Use US Legal Forms, the most considerable selection of legal kinds, in order to save efforts and avoid errors. The services gives skillfully manufactured legal papers templates that can be used for an array of reasons. Produce a merchant account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

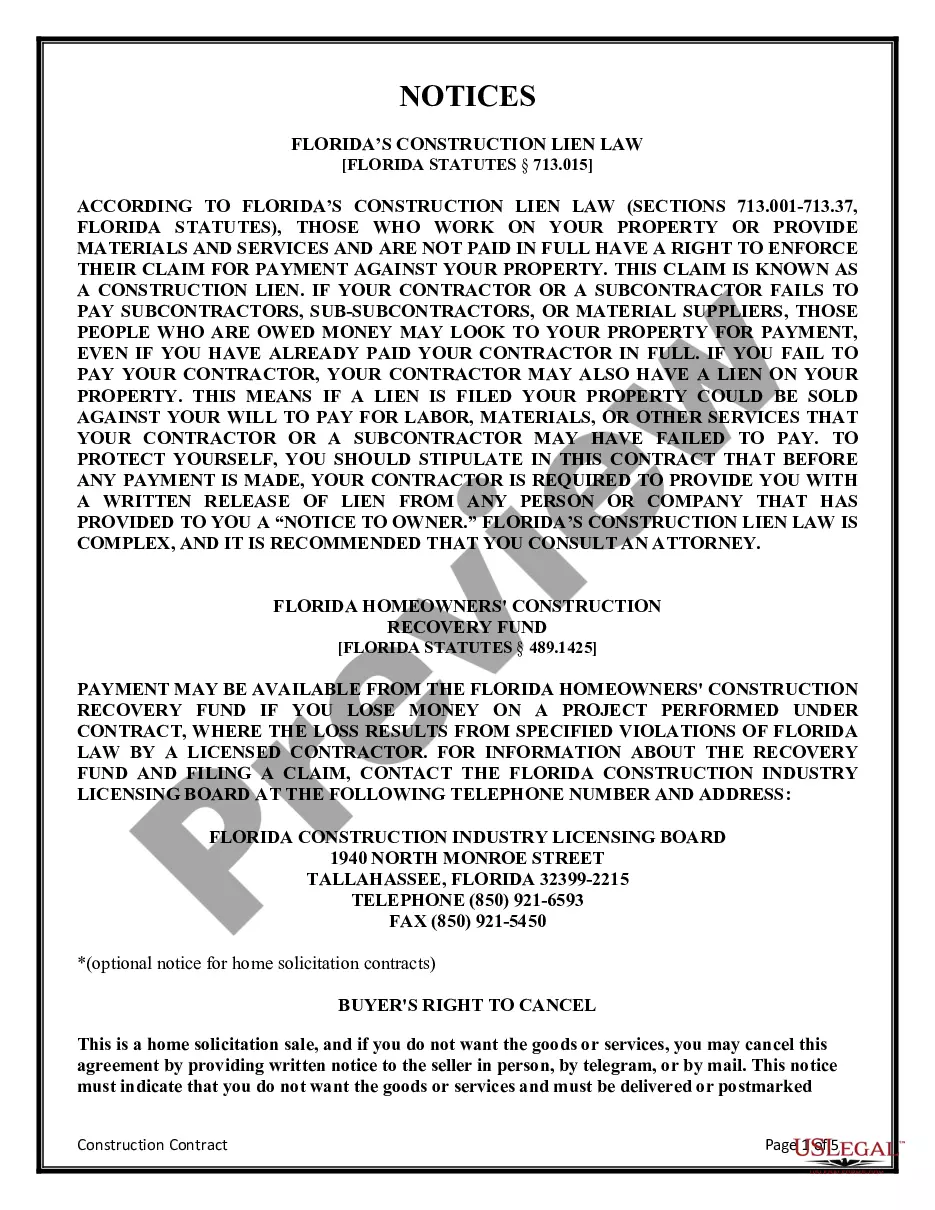

In most cases, the note should be recorded with the local county clerk or recorder's office. Does recording a promissory note affect the terms of the loan? Recording a promissory note generally does not affect the terms of the loan, as the terms are already agreed upon by the parties involved.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

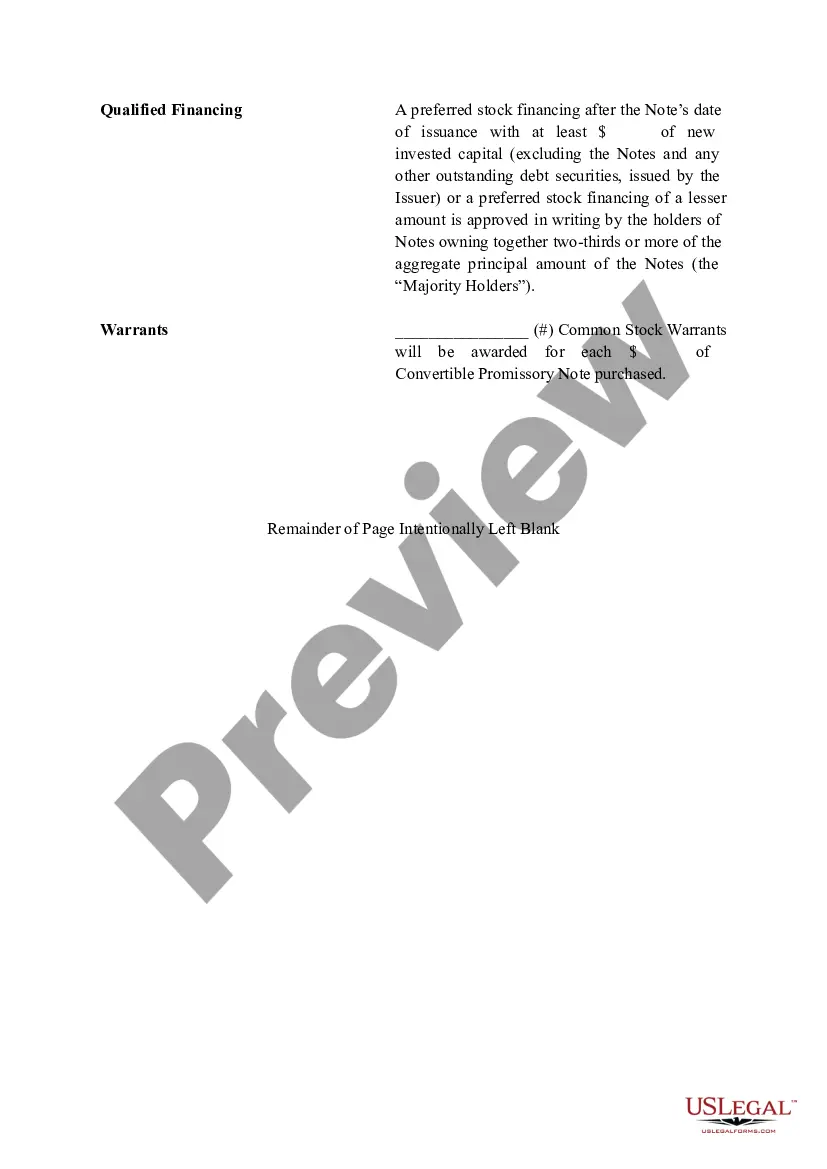

Detailed Information ? The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Summary. A note receivable is also known as a promissory note. When the note is due within less than a year, it is considered a current asset on the balance sheet of the company the note is owed to. If its due date is more than a year in the future, it is considered a non-current asset.

When the borrower signs the promissory note, the lender records the written promise in a Notes Receivable account, which appears under Assets on the lender's balance sheet. At the same time, the borrower records the obligation in a liabilities account such as Notes Payable, Bank Loans Payable, or something similar.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.