Delaware Incentive and Nonqualified Share Option Plan

Description

How to fill out Incentive And Nonqualified Share Option Plan?

US Legal Forms - one of several biggest libraries of authorized varieties in America - offers an array of authorized papers templates it is possible to obtain or produce. Using the site, you will get 1000s of varieties for enterprise and individual purposes, sorted by groups, suggests, or search phrases.You can get the most recent types of varieties like the Delaware Incentive and Nonqualified Share Option Plan in seconds.

If you currently have a subscription, log in and obtain Delaware Incentive and Nonqualified Share Option Plan through the US Legal Forms local library. The Acquire key will show up on each develop you look at. You get access to all formerly acquired varieties within the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, allow me to share easy guidelines to obtain started out:

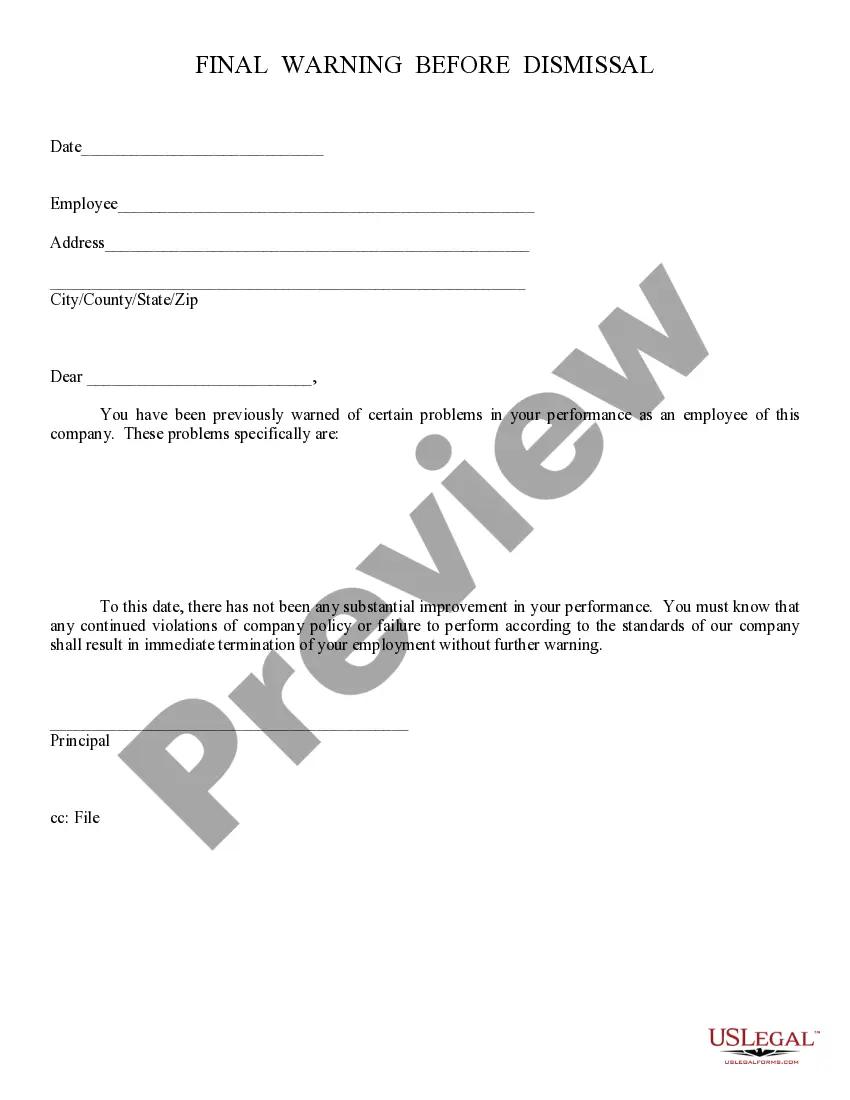

- Make sure you have selected the right develop for your town/region. Click on the Preview key to analyze the form`s information. Browse the develop description to actually have selected the proper develop.

- In case the develop does not match your specifications, take advantage of the Research discipline at the top of the display to discover the one who does.

- If you are happy with the form, confirm your decision by clicking the Get now key. Then, select the prices plan you want and supply your references to sign up to have an profile.

- Process the transaction. Make use of your charge card or PayPal profile to complete the transaction.

- Pick the file format and obtain the form on your system.

- Make alterations. Fill up, change and produce and indication the acquired Delaware Incentive and Nonqualified Share Option Plan.

Each design you included with your money does not have an expiration date and is also yours eternally. So, in order to obtain or produce an additional duplicate, just proceed to the My Forms area and click on about the develop you want.

Obtain access to the Delaware Incentive and Nonqualified Share Option Plan with US Legal Forms, probably the most comprehensive local library of authorized papers templates. Use 1000s of specialist and condition-specific templates that satisfy your organization or individual requires and specifications.

Form popularity

FAQ

In practice, there's no material difference between ISOs and NQOs. However, ISOs may have the advantage in situations where employees should reasonably exercise and hold (for instance, the company goes public). The tax regulations for option grants and exercises are very complicated and can change at any time.

Unlike NQSOs, ISOs cannot be transferred to others (e.g. upon divorce or by gifting).

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment. The favorable tax treatment is the main advantage of ISOs for employees, and this includes long-term capital gains and no recognition of income when they exercise their options.

For example, RSU and NQSO have different rules about when they are taxed (RSUs at vesting, no choice) (NQSOs at exercise, choice of timing). It's also reasonable to assume that when offered the choice, you may get ?more? NQSOs than you would RSUs. And finally, RSUs do not cost anything to purchase, whereas NQSOs do.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

A major difference is that the NSO tax is withheld at the point of exercise whereas the potential AMT on ISOs isn't due until you file taxes next April. You won't know if you are even subject to AMT until after your taxes have been calculated.

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.