Delaware Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Are you presently inside a situation in which you will need documents for possibly organization or individual reasons almost every day? There are tons of lawful papers templates accessible on the Internet, but getting ones you can trust is not straightforward. US Legal Forms provides 1000s of type templates, like the Delaware Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, that happen to be created to meet federal and state specifications.

When you are presently informed about US Legal Forms internet site and have your account, simply log in. Afterward, it is possible to obtain the Delaware Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock design.

Unless you come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for your right city/region.

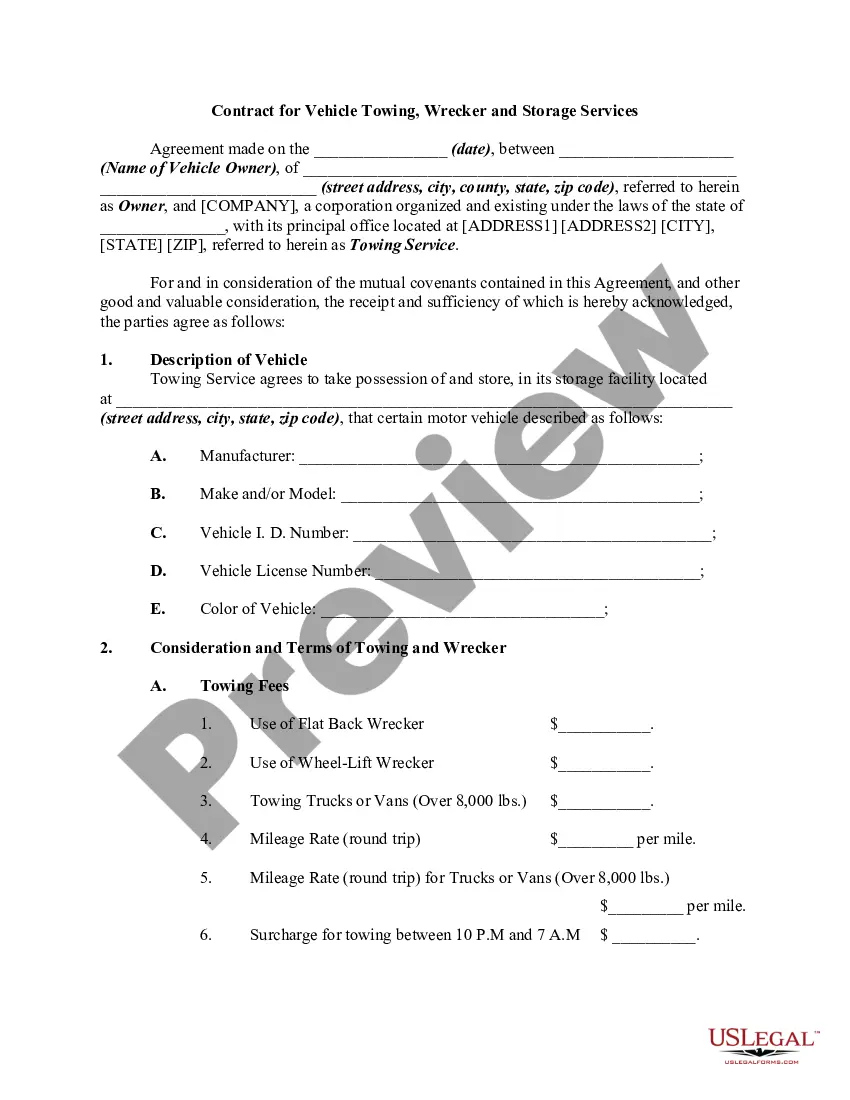

- Make use of the Preview switch to check the form.

- Read the outline to ensure that you have selected the proper type.

- In the event the type is not what you are trying to find, take advantage of the Lookup area to discover the type that suits you and specifications.

- If you get the right type, just click Purchase now.

- Select the pricing strategy you desire, complete the desired information and facts to produce your bank account, and purchase your order using your PayPal or credit card.

- Pick a convenient file formatting and obtain your copy.

Find all of the papers templates you possess bought in the My Forms menu. You can obtain a further copy of Delaware Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock at any time, if possible. Just click on the needed type to obtain or produce the papers design.

Use US Legal Forms, one of the most considerable collection of lawful types, to conserve time as well as steer clear of errors. The service provides expertly produced lawful papers templates which can be used for a selection of reasons. Make your account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

(a) A corporation may, whenever desired, integrate into a single instrument all of the provisions of its certificate of incorporation which are then in effect and operative as a result of there having theretofore been filed with the Secretary of State 1 or more certificates or other instruments pursuant to any of the ...

Section 242 of the DGCL governs the procedures by which a corporation may amend its certificate of corporation, or charter, and generally requires approval by (a) the board of directors and (b) holders of a majority in voting power of the outstanding stock entitled to vote thereon and by the holders of a majority in ...

Every holder of stock represented by certificates shall be entitled to have a certificate signed by, or in the name of, the corporation by any 2 authorized officers of the corporation representing the number of shares registered in certificate form. Any or all the signatures on the certificate may be a facsimile.

Section 232 - Delivery of notice; notice by electronic transmission (a) Without limiting the manner by which notice otherwise may be given effectively to stockholders, any notice to stockholders given by the corporation under any provision of this chapter, the certificate of incorporation, or the bylaws may be given in ...

To make amendments to your Delaware Stock Corporation, you submit the completed State of Delaware Certificate of Amendment of Certificate of Incorporation form to the Department of State by mail, fax or in person, along with the filing fee and the Filing Cover Memo. Non-stock corporations use a separate amendment form.

The constituent corporations may merge into a single surviving corporation, which may be any 1 of the constituent corporations, or they may consolidate into a new resulting corporation formed by the consolidation, which may be a corporation of the jurisdiction of organization of any 1 of the constituent corporations, ...

The Delaware General Corporation Law (Title 8, Chapter 1 of the Delaware Code) is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. The statute was adopted in 1899. Since then, Delaware has become the most prevalent jurisdiction in United States corporate law.

Corporations § 155. Fractions of shares. A corporation may, but shall not be required to, issue fractions of a share.