Delaware Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

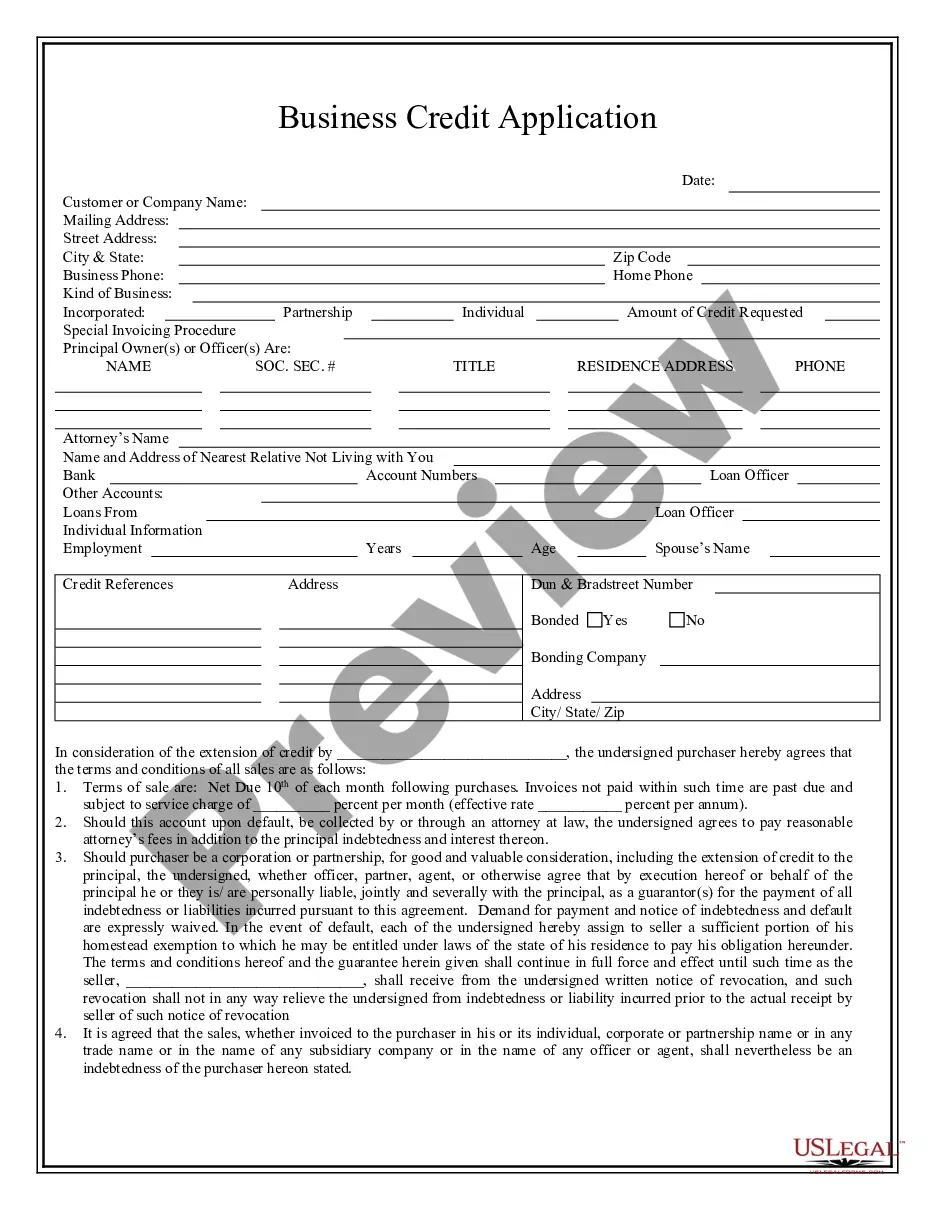

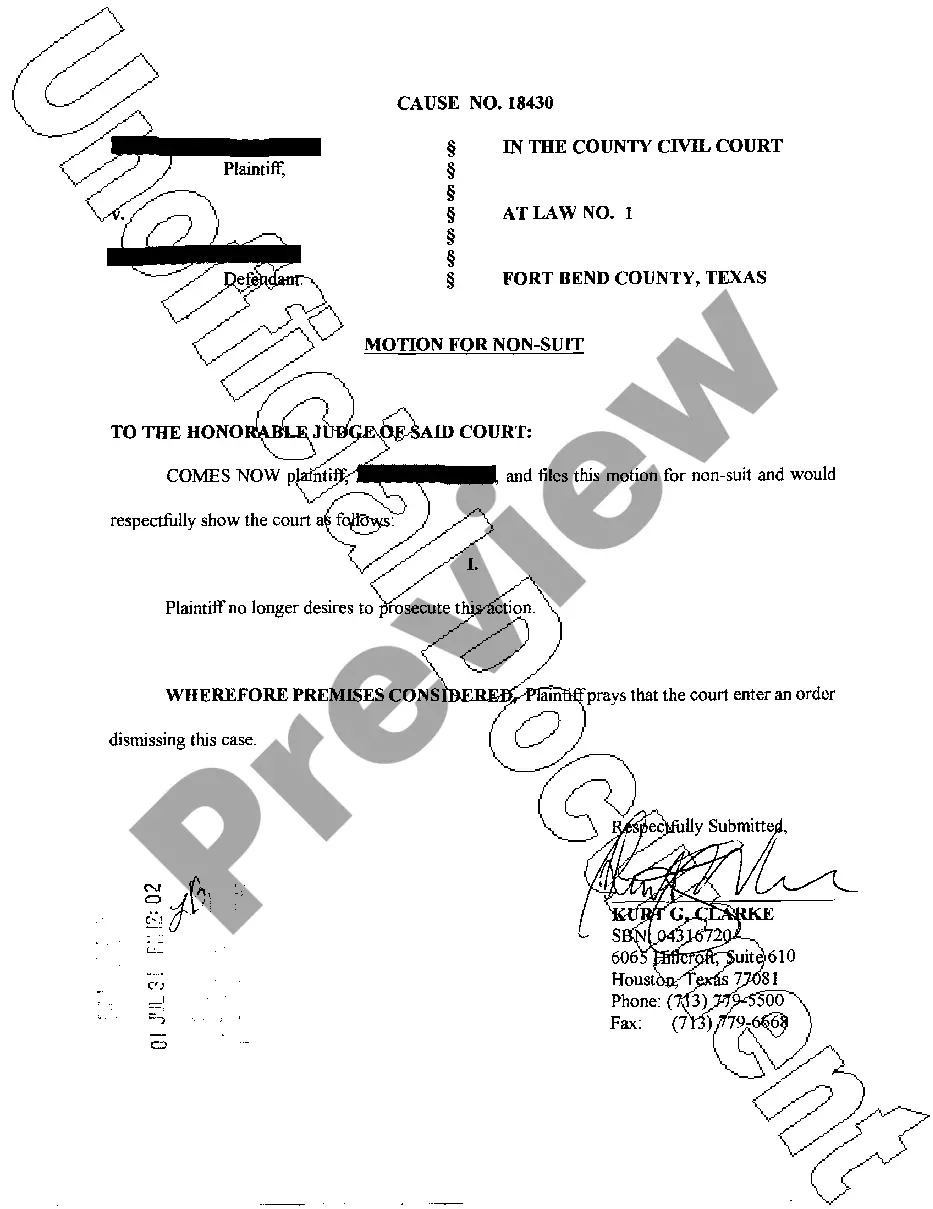

How to fill out Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

US Legal Forms - among the greatest libraries of legitimate kinds in the United States - gives a wide array of legitimate file templates you can obtain or print. Utilizing the internet site, you can find a huge number of kinds for organization and specific purposes, categorized by categories, suggests, or key phrases.You will discover the most up-to-date versions of kinds just like the Delaware Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees in seconds.

If you already possess a registration, log in and obtain Delaware Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees through the US Legal Forms library. The Download button will appear on each and every form you see. You gain access to all earlier saved kinds from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, allow me to share straightforward instructions to obtain started:

- Ensure you have picked the proper form for the area/region. Click on the Preview button to check the form`s information. Read the form information to actually have chosen the right form.

- If the form doesn`t suit your requirements, use the Research industry on top of the monitor to obtain the one who does.

- If you are pleased with the form, validate your option by simply clicking the Get now button. Then, opt for the pricing program you want and offer your accreditations to register to have an accounts.

- Method the deal. Make use of your Visa or Mastercard or PayPal accounts to finish the deal.

- Find the formatting and obtain the form on your product.

- Make changes. Fill out, edit and print and indication the saved Delaware Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

Each format you included in your bank account does not have an expiry time and it is yours eternally. So, if you wish to obtain or print one more backup, just check out the My Forms section and click in the form you require.

Obtain access to the Delaware Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees with US Legal Forms, the most extensive library of legitimate file templates. Use a huge number of specialist and express-distinct templates that meet your small business or specific requires and requirements.

Form popularity

FAQ

A key employee is an employee with major ownership and/or decision-making role in the business. Key employees are usually highly compensated either monetarily or with benefits, or both. Key employees may also receive special benefits as an incentive both to join the company and to stay with the company.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts*, and Water Management Districts* [established under ...

Stock Options. Stock options are a popular way to provide additional compensation for key employees, and you can tie these options to the business's success. ... Incentive and Deferred Compensation. ... Arranging Equity Participation. ... Supplemental Executive Retirement Plans. ... Golden Parachutes & Golden Parachute Tax.

A salary deferral is a plan or arrangement made between an employee and an employer. Under such an arrangement, an employee postpones receiving salary and wages to a later year. The amount postponed is called "deferred amount."

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.

Types of Deferred Compensation Salary Reduction Arrangements: Employees on a deferred compensation plan may choose to defer a portion of their salary until a future year. For example, an employee that earns $80,000 per year may choose to defer $30,000 of their salary and only receive $50,000 for the current year.