Delaware Expense Limitation Agreement

Description

How to fill out Expense Limitation Agreement?

If you wish to total, download, or printing authorized file templates, use US Legal Forms, the biggest assortment of authorized kinds, which can be found on-line. Utilize the site`s simple and convenient search to get the files you want. Various templates for company and personal reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to get the Delaware Expense Limitation Agreement in a handful of clicks.

When you are currently a US Legal Forms customer, log in to your profile and then click the Down load button to get the Delaware Expense Limitation Agreement. You can also gain access to kinds you formerly downloaded in the My Forms tab of your own profile.

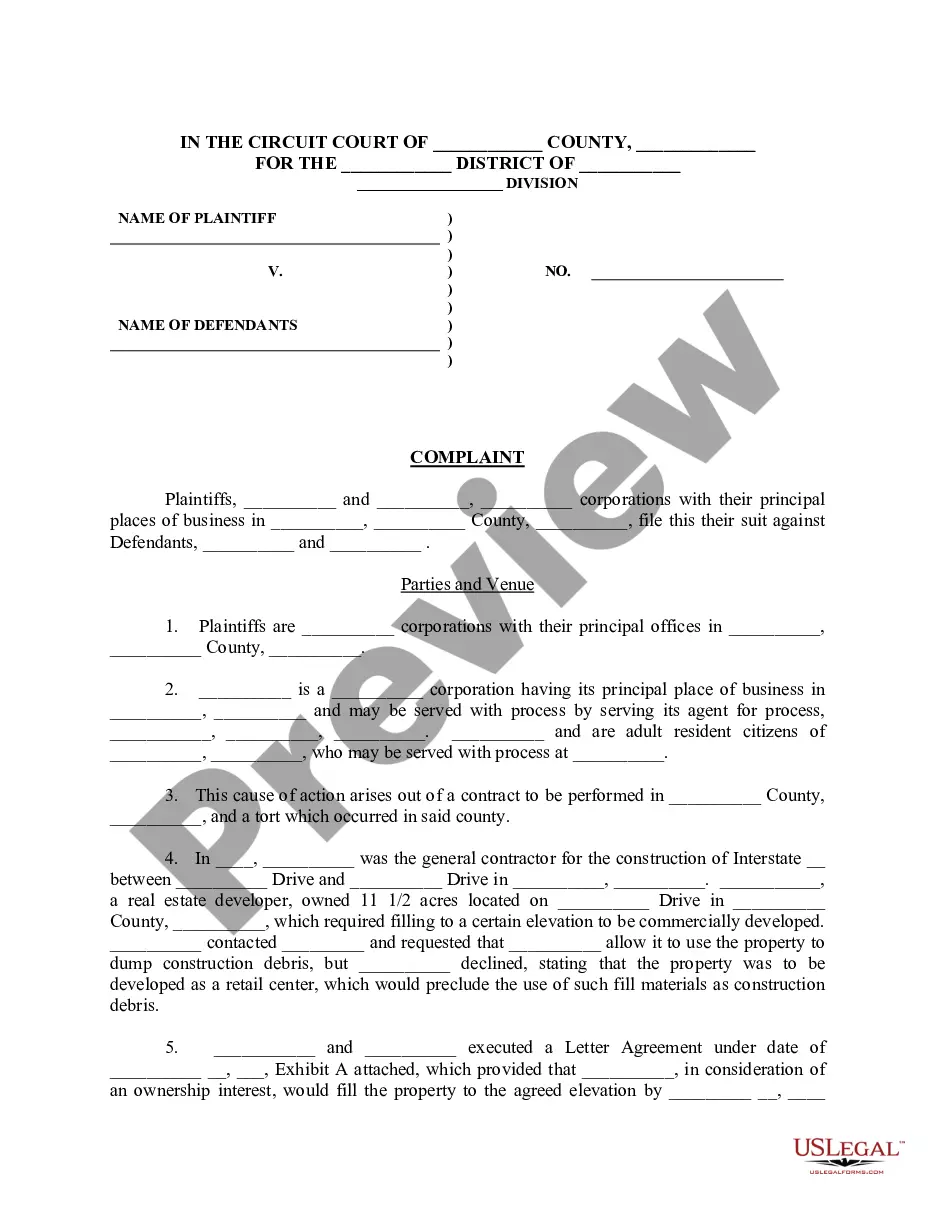

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the appropriate area/nation.

- Step 2. Use the Preview choice to look through the form`s articles. Never forget about to read through the information.

- Step 3. When you are not happy together with the form, take advantage of the Research discipline on top of the screen to locate other variations in the authorized form format.

- Step 4. Upon having found the shape you want, click the Acquire now button. Select the costs plan you prefer and include your references to sign up on an profile.

- Step 5. Process the transaction. You should use your bank card or PayPal profile to perform the transaction.

- Step 6. Choose the structure in the authorized form and download it in your gadget.

- Step 7. Full, modify and printing or sign the Delaware Expense Limitation Agreement.

Every authorized file format you purchase is the one you have eternally. You might have acces to each form you downloaded inside your acccount. Click the My Forms area and decide on a form to printing or download once again.

Contend and download, and printing the Delaware Expense Limitation Agreement with US Legal Forms. There are thousands of specialist and state-certain kinds you can utilize for your personal company or personal needs.

Form popularity

FAQ

This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

Late Filing Penalty: It amounts to 5% the tax due per month, and can't exceed 50% of the total tax due. 3. Late Payment Penalty: A penalty for failing to pay is imposed when the taxpayer doesn't pay the tax due on time. It amounts to 1% of the total tax due per month, and can't exceed 25% of the total tax due.

U.S. Federal NOL Carryback Provisions At the federal level, businesses cannot carry back their net operating losses. Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, businesses could carry back losses for two years.

Delaware permits businesses who have a net operating loss in one year to carry back no more than $30,000 for each of the prior 2 years in order to offset any profit.

2019 and after, NOL can no longer be carried back to the past 2 years. 2013 through 2018, NOL can be carried back to each of the past 2 years.

Delaware follows federal law regarding itemized deductions, and taxpayers will be entitled to an itemized deduction for state and local taxes equal to the total real property taxes and local income taxes paid ? up to the maximum $10,000 (or $5,000 for married individuals filing a separate or combined separate return).

Businesses thus are taxed on average profitability, making the tax code more neutral. In the U.S., a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income.

NOL 80% carryforward limitation The aggregate of the net operating loss carryovers to such year, plus the net operating loss carrybacks to such year. 80% (or 100% for NOLs generated in tax years beginning before 2021) of taxable income computed without regard to the allowable NOL deduction.