The Delaware Stock Option Plan for Federal Savings Associations is a comprehensive regulatory framework established by the state of Delaware specifically for Federal Savings Associations (FSA's). It outlines the rules and guidelines for FSA's to offer stock options to their employees as part of their compensation packages. This plan allows FSA's to grant stock options to eligible employees, giving them the right to purchase company stock at a predetermined price within a specified timeframe. By offering stock options, FSA scan incentivize and reward their employees for their contributions towards the success and growth of the organization. Under the Delaware Stock Option Plan for FSA's, there are various types of stock options that can be implemented: 1. Non-Qualified Stock Options: These options do not meet the requirements for favorable tax treatment and are subject to income tax upon exercise. However, they offer more flexibility in terms of eligibility requirements and vesting schedules. 2. Incentive Stock Options: These options meet the criteria outlined in the Internal Revenue Code and provide certain tax advantages. Employees do not incur immediate tax liability upon exercise, but rather when the stock acquired through the option is eventually sold. 3. Restricted Stock Units: In addition to traditional stock options, the plan also covers restricted stock units (RSS). RSS represents a promise to deliver company stock at a future date, subject to vesting conditions. They have gained popularity as an alternative to stock options due to their simplicity and alignment with long-term goals. 4. Performance Stock Options/Units: These options or units are granted based on specific performance criteria, such as achieving certain financial targets or reaching certain milestones. They provide employees with an even more direct link to the success of the company and can be structured to align with both short and long-term goals. The Delaware Stock Option Plan for FSA's provides flexibility and regulatory guidance for FSA's to effectively structure and administer stock option programs. It ensures compliance with state regulations while promoting employee engagement, motivation, and retention. By offering stock options, FSA scan attract top talent, align employee interests with those of the company, and foster a sense of ownership among their workforce.

Delaware Stock Option Plan For Federal Savings Association

Description

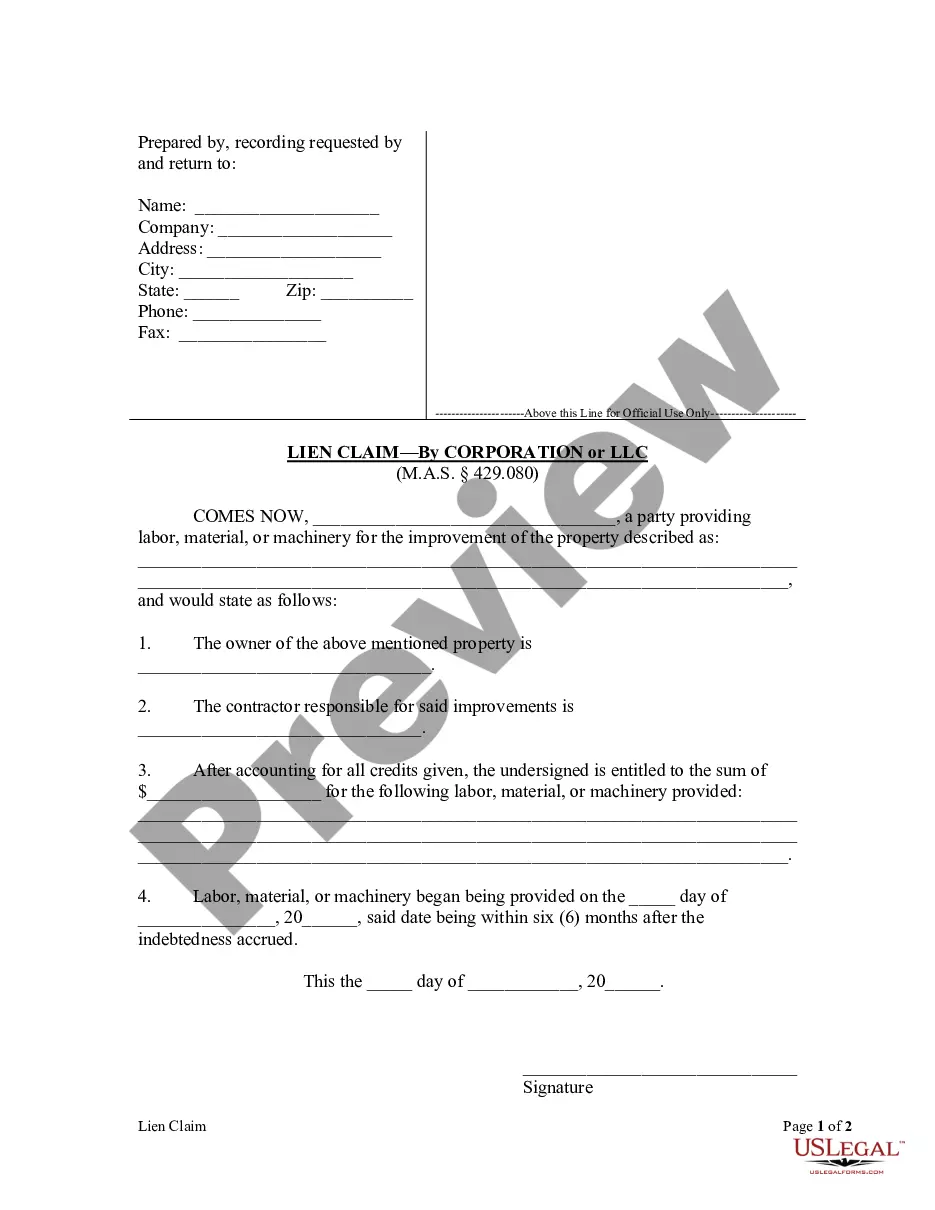

How to fill out Delaware Stock Option Plan For Federal Savings Association?

US Legal Forms - one of several most significant libraries of lawful kinds in the USA - offers a variety of lawful document templates you can down load or produce. Utilizing the internet site, you can find thousands of kinds for enterprise and specific functions, categorized by groups, claims, or keywords and phrases.You can get the newest types of kinds just like the Delaware Stock Option Plan For Federal Savings Association in seconds.

If you already have a registration, log in and down load Delaware Stock Option Plan For Federal Savings Association through the US Legal Forms local library. The Obtain option will show up on each and every type you view. You have access to all previously acquired kinds within the My Forms tab of your bank account.

If you wish to use US Legal Forms for the first time, here are basic instructions to obtain started:

- Be sure you have selected the best type for your personal area/region. Click the Review option to review the form`s information. Browse the type outline to ensure that you have chosen the right type.

- In case the type doesn`t suit your needs, utilize the Search field on top of the display screen to obtain the one who does.

- If you are pleased with the shape, affirm your option by clicking the Purchase now option. Then, opt for the rates plan you like and supply your qualifications to sign up for the bank account.

- Approach the deal. Use your charge card or PayPal bank account to finish the deal.

- Select the file format and down load the shape on your gadget.

- Make modifications. Complete, edit and produce and sign the acquired Delaware Stock Option Plan For Federal Savings Association.

Each and every web template you added to your account does not have an expiration date and is also yours eternally. So, if you wish to down load or produce one more copy, just visit the My Forms area and then click about the type you require.

Get access to the Delaware Stock Option Plan For Federal Savings Association with US Legal Forms, the most comprehensive local library of lawful document templates. Use thousands of skilled and express-specific templates that fulfill your business or specific requires and needs.

Form popularity

FAQ

Section 242 of the DGCL governs the procedures by which a corporation may amend its certificate of corporation, or charter, and generally requires approval by (a) the board of directors and (b) holders of a majority in voting power of the outstanding stock entitled to vote thereon and by the holders of a majority in ...

Stock Option Plan (the ?Plan?) is to assist Delaware Management Holdings, Inc., a Delaware corporation (the ?Corporation?), and its subsidiaries in attracting, retaining, and rewarding high-quality executives, investment professionals, employees, and other persons who provide services to the Corporation and/or its ...

(a) A corporation may, whenever desired, integrate into a single instrument all of the provisions of its certificate of incorporation which are then in effect and operative as a result of there having theretofore been filed with the Secretary of State 1 or more certificates or other instruments pursuant to any of the ...

Section 232 - Delivery of notice; notice by electronic transmission (a) Without limiting the manner by which notice otherwise may be given effectively to stockholders, any notice to stockholders given by the corporation under any provision of this chapter, the certificate of incorporation, or the bylaws may be given in ...

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

§ 243. Retirement of stock. (a) A corporation, by resolution of its board of directors, may retire any shares of its capital stock that are issued but are not outstanding.

The standard stock option plan grants your employee a stock option that invests over four years. After the first year, there's a cliff?they don't own anything for their first 12 months, but after their first year, they invest in 25% of all the options you give them.

If (1) one corporation's (?the parent?) ownership in another corporation[1] or corporations (?the subsidiary?) amounts to at least 90% of the outstanding shares of each class of stock entitled to vote on a merger and (2) at least one of these corporations is a Delaware corporation and unless the laws or a foreign ...