Delaware Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation

Description

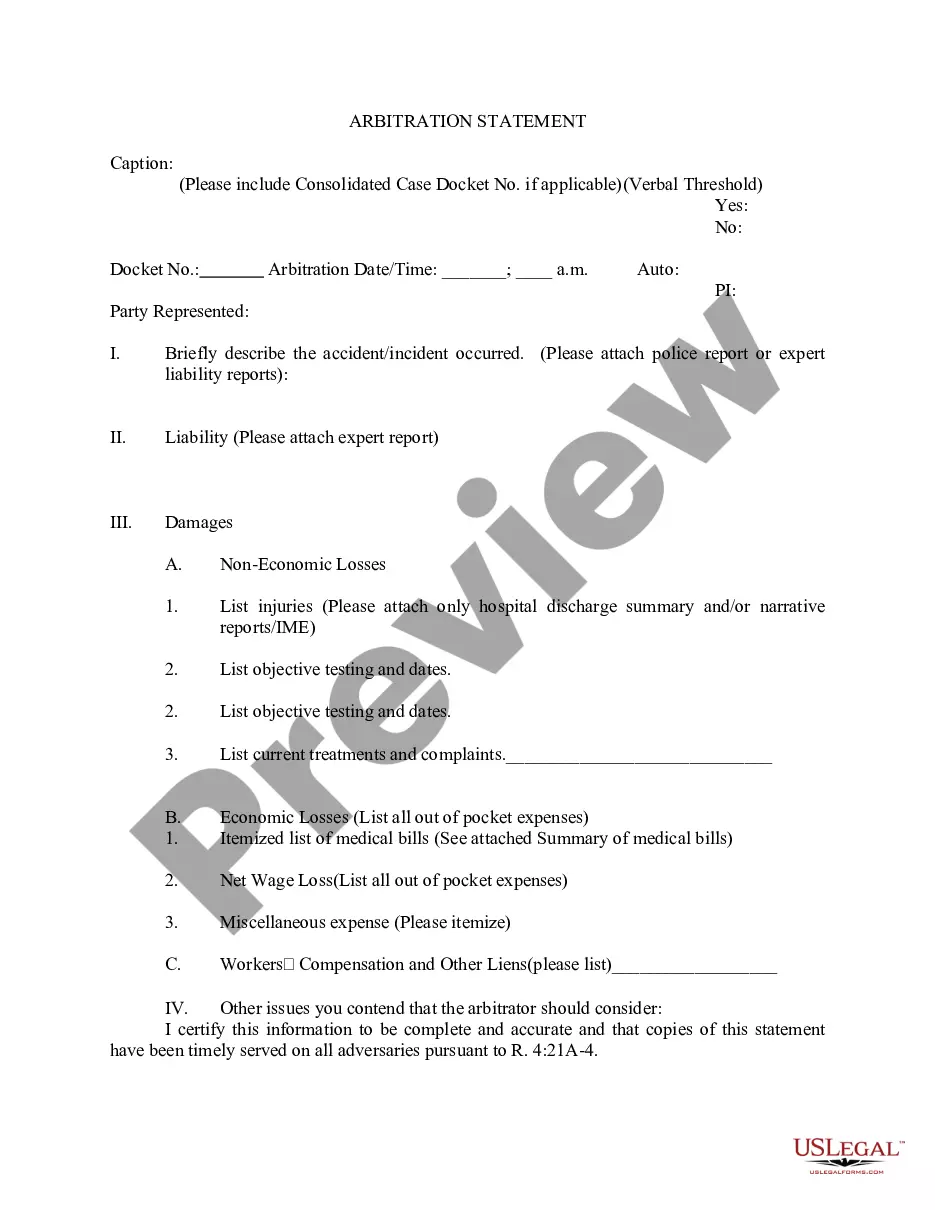

How to fill out Sample Stock Purchase Agreement For Purchase Of Common Stock Of Wholly-Owned Subsidiary By Separate Corporation?

US Legal Forms - one of many greatest libraries of authorized kinds in the USA - provides a wide array of authorized file layouts you can obtain or print out. While using website, you may get a huge number of kinds for organization and person reasons, categorized by categories, claims, or key phrases.You can get the latest types of kinds just like the Delaware Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation within minutes.

If you have a membership, log in and obtain Delaware Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation in the US Legal Forms local library. The Acquire option will appear on each kind you perspective. You have accessibility to all in the past acquired kinds inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms the very first time, listed here are simple guidelines to get you started out:

- Be sure to have picked the right kind for the town/region. Select the Review option to examine the form`s content material. See the kind description to ensure that you have selected the proper kind.

- In the event the kind doesn`t fit your requirements, take advantage of the Research discipline on top of the screen to find the one that does.

- In case you are pleased with the form, validate your decision by clicking the Buy now option. Then, choose the rates prepare you want and provide your references to sign up for an accounts.

- Process the deal. Make use of charge card or PayPal accounts to complete the deal.

- Select the format and obtain the form on your own product.

- Make modifications. Fill out, revise and print out and indicator the acquired Delaware Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation.

Each template you added to your account does not have an expiration date and it is your own property forever. So, if you want to obtain or print out an additional version, just check out the My Forms area and click in the kind you require.

Get access to the Delaware Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation with US Legal Forms, one of the most extensive local library of authorized file layouts. Use a huge number of expert and condition-specific layouts that satisfy your organization or person requires and requirements.

Form popularity

FAQ

If you are planning to buy or sell shares, a correctly drafted share purchase agreement (SPA) is essential. An SPA is a legal document and it must therefore comply with legislation by providing either party in the transaction with accurate information.

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

The purpose of Share Purchase agreement is to easily transfer the ownership of shares in a company from a seller to a purchaser. Two parties, where one is a seller and the other is a buyer, often comes into an agreement called Share Purchase Agreement.

A shareholders agreement will usually contain provisions requiring directors and shareholders keep confidential all matters relating to company business. In addition, it may contain provisions preventing shareholders starting competing businesses or dealing with customers of the company.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A share purchase agreement typically covers the following key areas: Purchase Price: The price the buyer will pay for the shares. Payment Terms: How and when the buyer will pay for the shares. Representations and Warranties: Statements made by the seller about the company's financial, legal, and operational status.