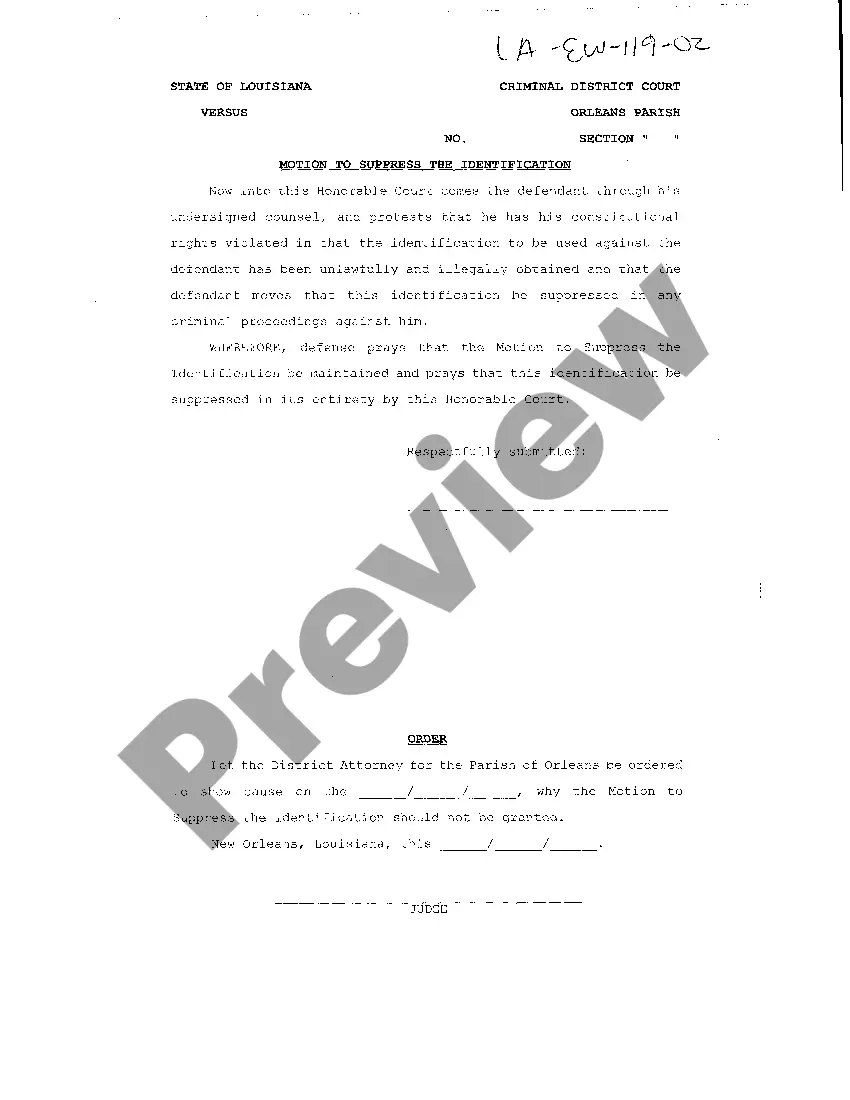

Delaware Summons to Debtor in Involuntary Case - B 250E

Description

How to fill out Summons To Debtor In Involuntary Case - B 250E?

US Legal Forms - one of the biggest libraries of lawful varieties in the States - offers a variety of lawful record templates you can obtain or print out. Making use of the website, you may get a large number of varieties for enterprise and specific functions, sorted by classes, claims, or key phrases.You can find the most up-to-date types of varieties such as the Delaware Summons to Debtor in Involuntary Case - B 250E within minutes.

If you already have a monthly subscription, log in and obtain Delaware Summons to Debtor in Involuntary Case - B 250E through the US Legal Forms collection. The Obtain button will show up on each and every type you look at. You have accessibility to all formerly delivered electronically varieties within the My Forms tab of your respective bank account.

If you want to use US Legal Forms initially, listed below are basic recommendations to obtain began:

- Be sure you have chosen the correct type for your town/state. Click on the Review button to review the form`s information. See the type description to actually have chosen the right type.

- In case the type doesn`t suit your demands, make use of the Look for industry towards the top of the display to obtain the one who does.

- In case you are happy with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing strategy you like and supply your qualifications to register for the bank account.

- Approach the purchase. Use your charge card or PayPal bank account to accomplish the purchase.

- Pick the format and obtain the form on the product.

- Make adjustments. Fill out, revise and print out and indication the delivered electronically Delaware Summons to Debtor in Involuntary Case - B 250E.

Each design you included in your bank account lacks an expiration date and is your own for a long time. So, if you wish to obtain or print out an additional version, just visit the My Forms segment and then click about the type you want.

Gain access to the Delaware Summons to Debtor in Involuntary Case - B 250E with US Legal Forms, by far the most extensive collection of lawful record templates. Use a large number of skilled and status-distinct templates that meet up with your small business or specific demands and demands.

Form popularity

FAQ

A debtor in possession (DIP) is a business or individual that has filed for Chapter 11 bankruptcy protection but still holds property to which creditors have a legal claim under a lien or other security interest. A DIP may continue to do business using those assets.

An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

Limitations on Involuntary Bankruptcy If the debtor has more than 12 unsecured creditors, meanwhile, at least three of them must participate in the bankruptcy petition, and they must meet a threshold amount of unsecured debt as a group, which also increases periodically. Involuntary Bankruptcy Filings & Legal Requirements - Justia justia.com ? bankruptcy ? involuntary-bank... justia.com ? bankruptcy ? involuntary-bank...

The person who owes you money is the Judgment Debtor. If you don't know what assets the Debtor has, you can ask for a Judgment Debtor Hearing. At the hearing, you can ask questions about the debtor's job, bank account, home, car, and other assets.