Delaware Alternative Method

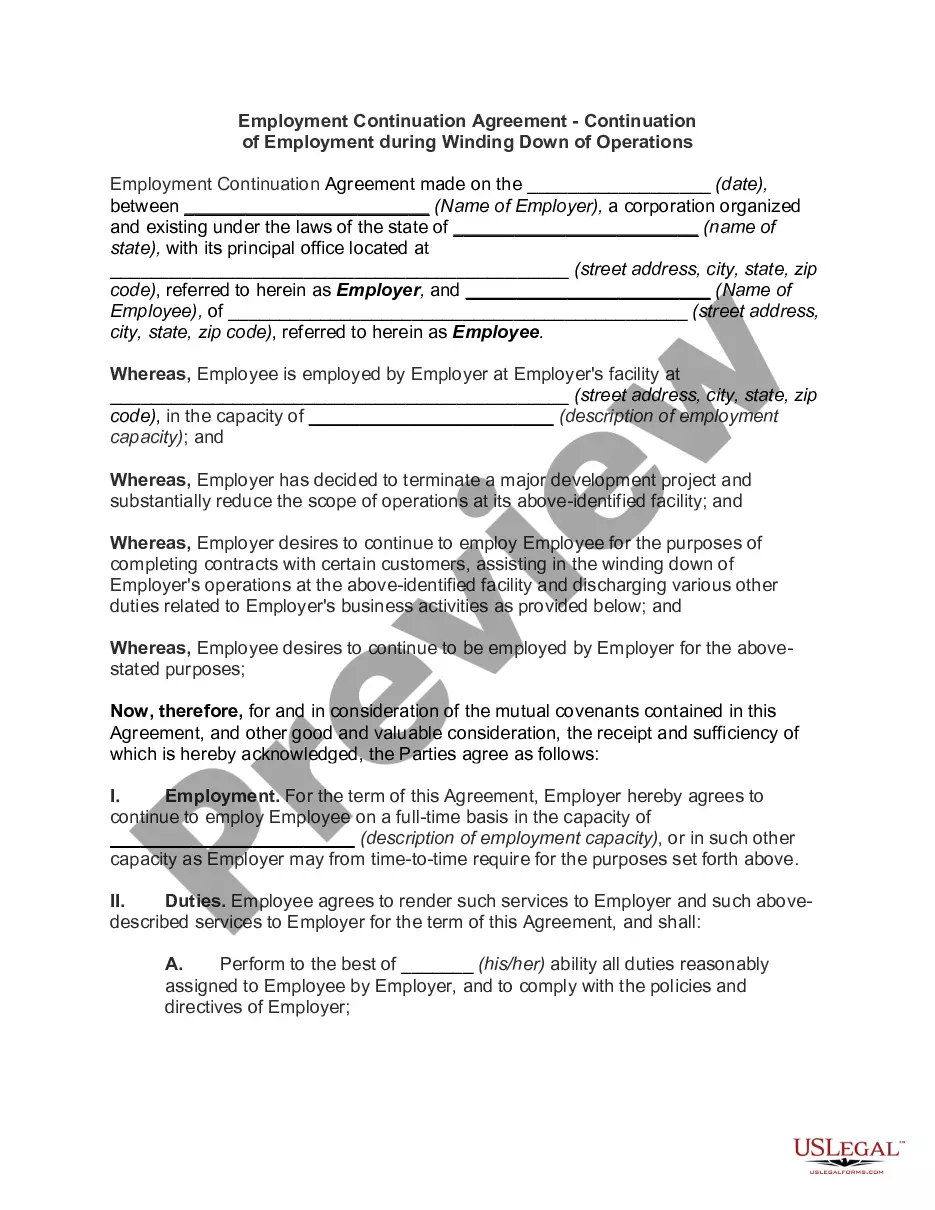

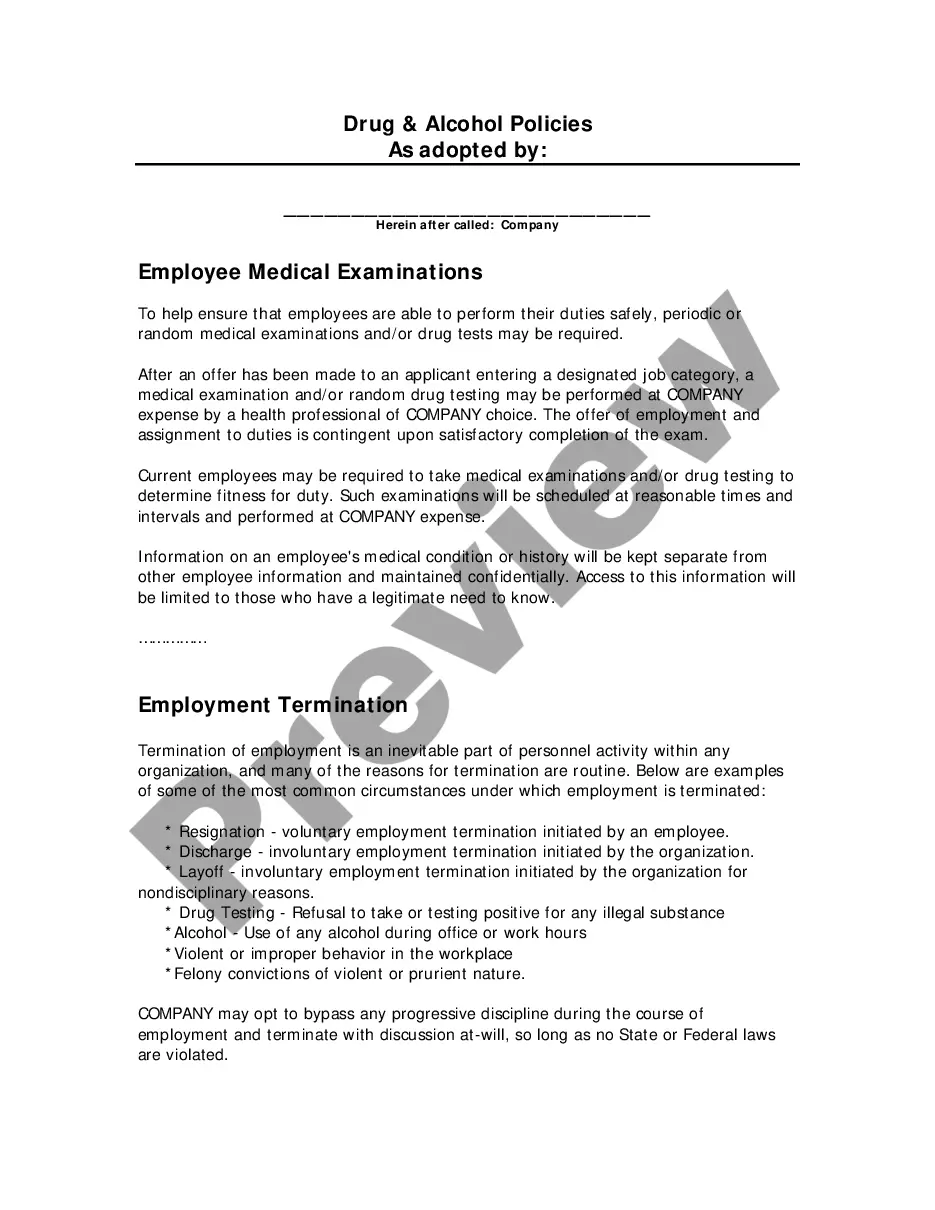

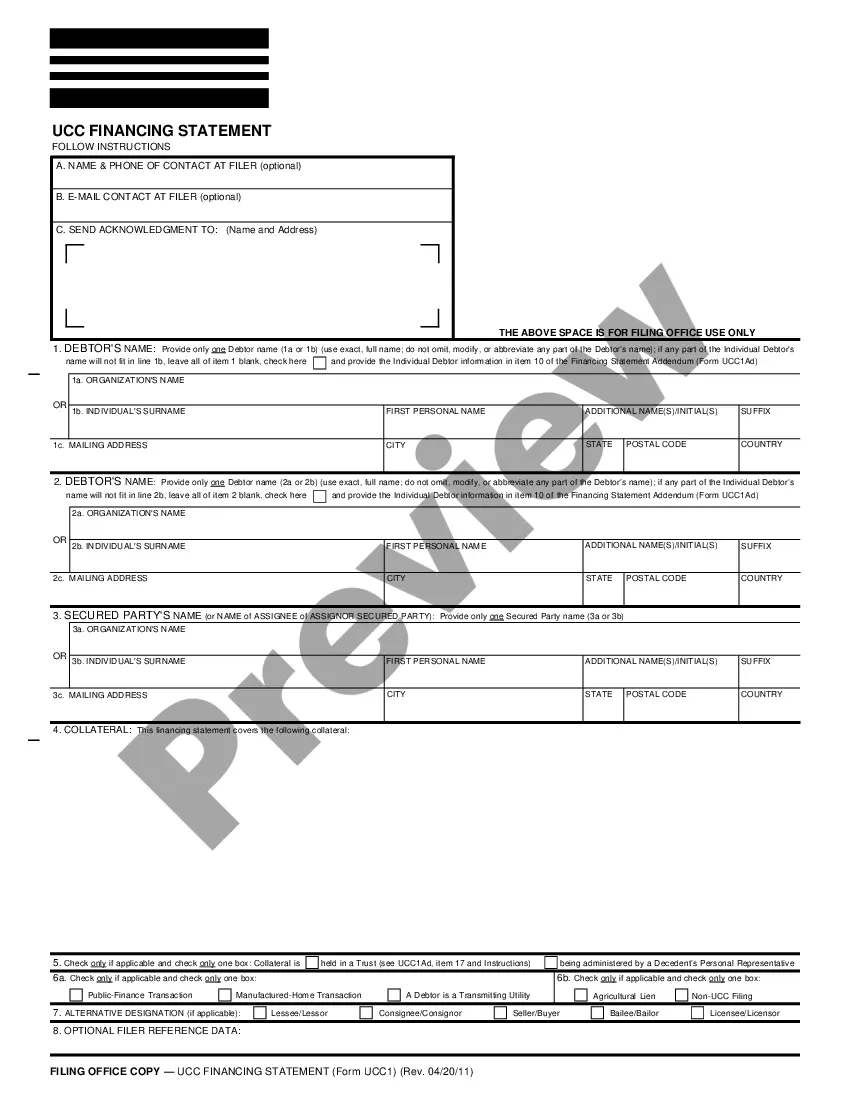

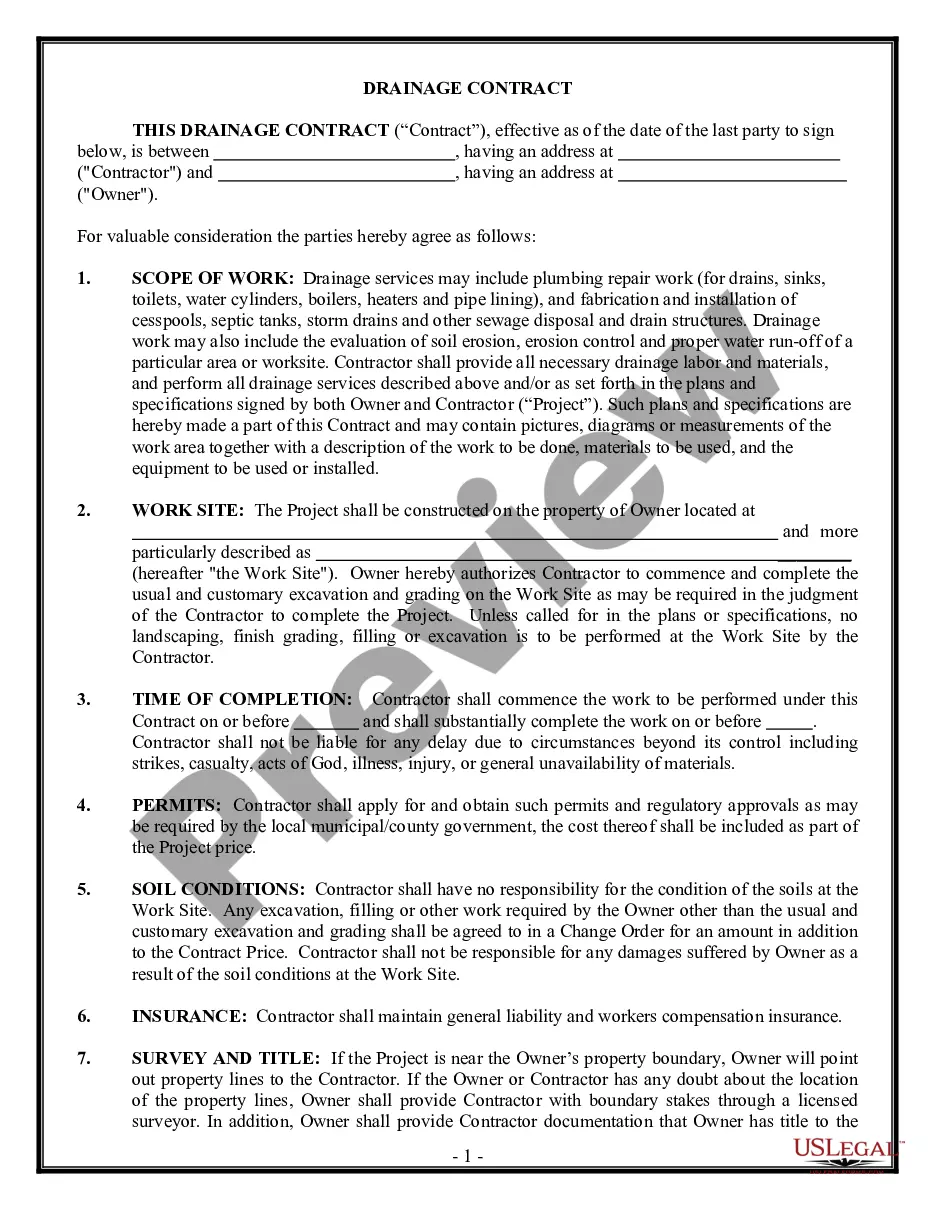

Description

How to fill out Alternative Method?

You might dedicate time online looking for the legal document template that meets your federal and state requirements.

US Legal Forms offers a vast array of legal templates that have been assessed by professionals.

You can conveniently access or create the Delaware Alternative Method through our service.

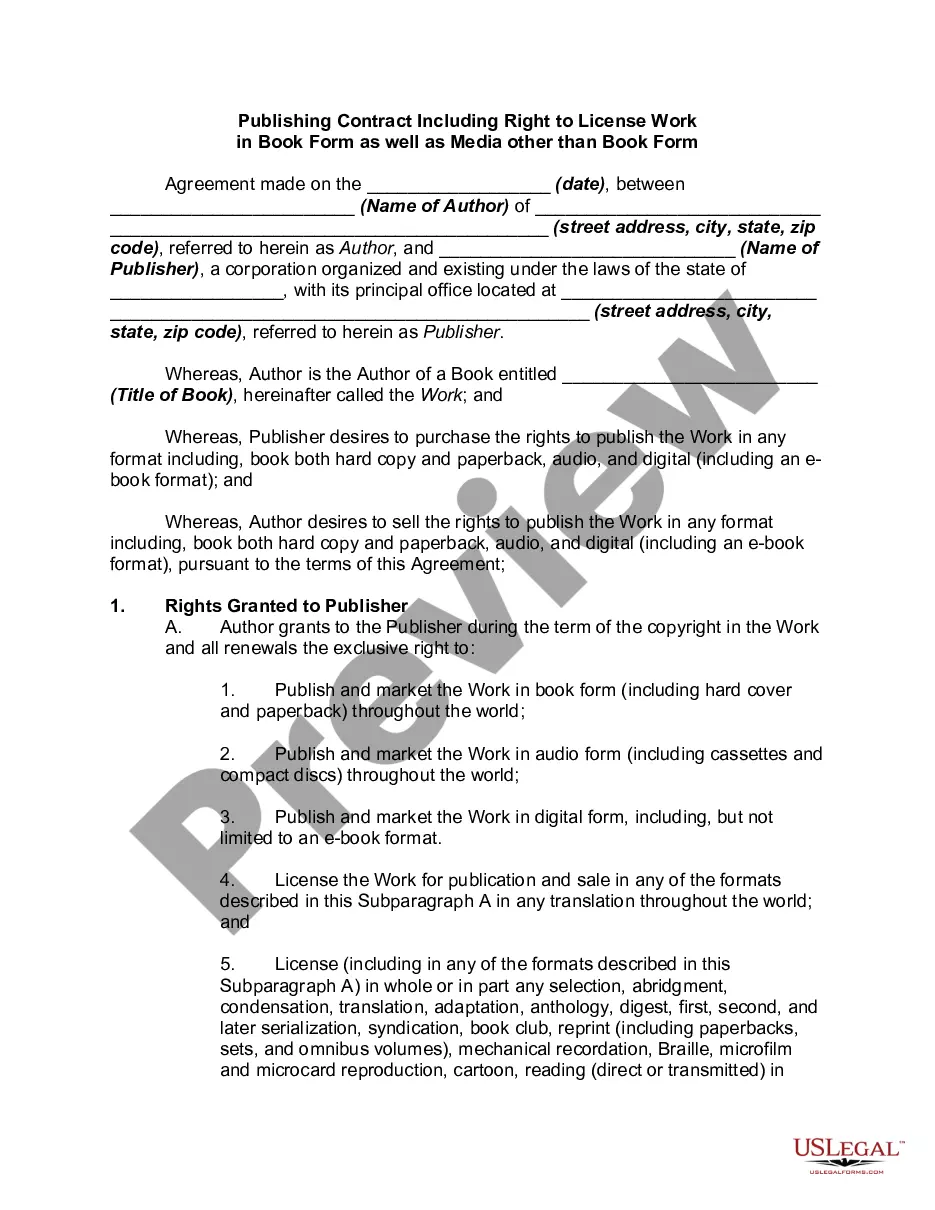

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Purchase button.

- Subsequently, you can complete, modify, print, or sign the Delaware Alternative Method.

- Every legal document template you acquire belongs to you permanently.

- To retrieve an additional copy of the purchased form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/area you choose.

- Review the form description to confirm you have selected the appropriate template.

Form popularity

FAQ

Failure to pay the franchise tax by the deadline will result in $200 penalty and interest charges assessed by the State of Delaware at the rate of 1.5% a month. It will also prevent the business from getting a certificate of good standing and may eventually lead to your business declared void by the State.

Delaware's default method of calculating annual franchise tax is based only on how many shares a Company has authorized in its charter: 5,000 shares or less (minimum tax) $175.00. 5,001 10,000 shares $250.00. Each additional 10,000 shares or portion thereof add $85.00.

Franchise Tax is the fee imposed by the State of Delaware for the right or privilege to own a Delaware company. The tax has no bearing on income or company activity; it is simply required by the State of Delaware to maintain the good standing status of your company.

If you don't want to pay your Delaware franchise tax yourself, you can hire a registered agent to do it for you. The registered agent will charge a small fee to complete the filing of your Delaware franchise tax. The goal of the Delaware franchise tax is to make owning a business in Delaware simple.

Total Gross Assets shall be those total assets reported on the IRS Form 1120, Schedule L relative to the company's fiscal year ending the calendar year of the report. The tax rate under this method is $400 per million or portion of a million.

Total Gross Assets shall be those total assets reported on the IRS Form 1120, Schedule L relative to the company's fiscal year ending the calendar year of the report. The tax rate under this method is $400 per million or portion of a million.

Delaware Franchise Tax calculations are prorated if a corporation's authorized and/or issued shares change during the year.

Failure to pay the tax will result in a $200 penalty in addition to the tax, plus interest and immediate loss of Good Standing status, so it's important to pay the tax by the due date. You may also pay franchise tax for the year at any time before the tax is becomes due.

Figure your tax by dividing the assumed par value capital, rounded up to the next million if it is over $1,000,000, by 1,000,000 and then multiply by $400.00. The minimum tax for the Assumed Par Value Capital Method of calculation is $400.00.