Delaware New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

If you want to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the required form, click the Get Now option. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Delaware New Company Benefit Notice with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download option to obtain the Delaware New Company Benefit Notice.

- You can also access forms you previously downloaded from the My documents tab in your account.

- In case you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct region/country.

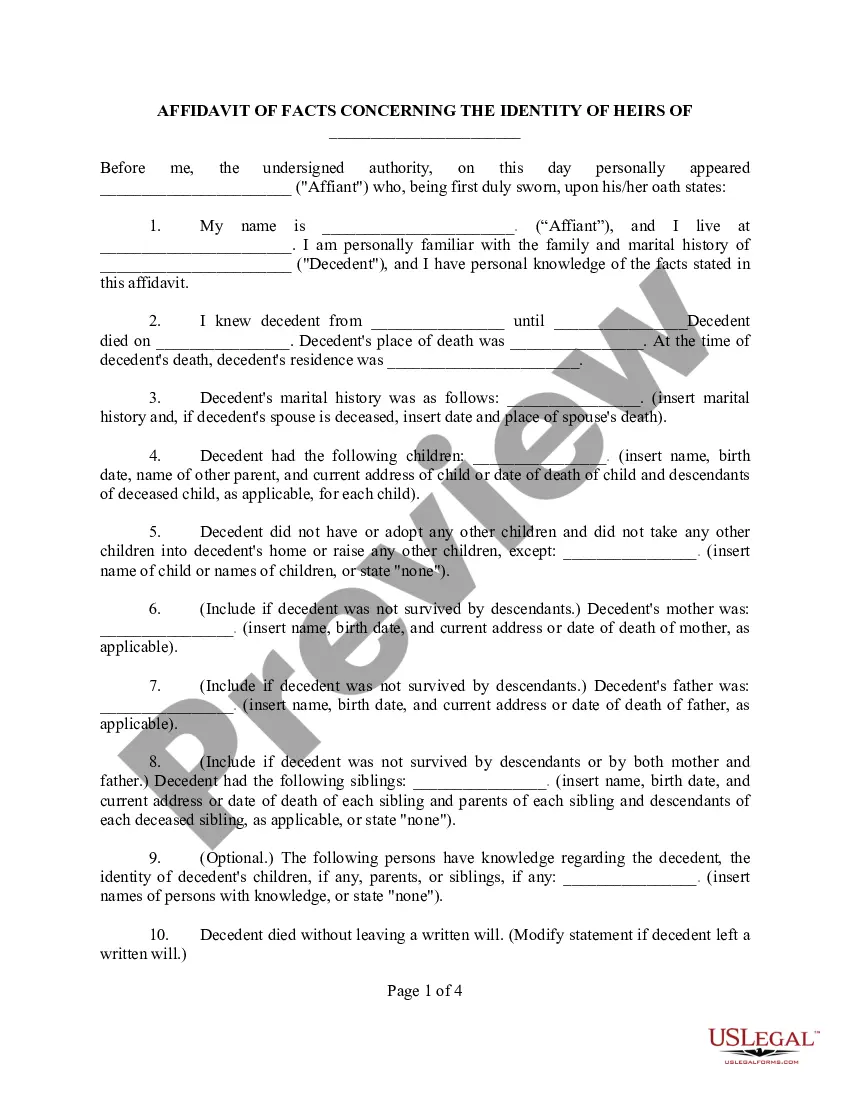

- Step 2. Utilize the Preview option to review the content of the form. Remember to read through the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The other major reason corporations choose to incorporate in Delaware is the quality of Delaware courts and judges. Delaware has a special court, the Court of Chancery, to rule on corporate law disputes without juries. Corporate cases do not get stuck on dockets behind the multitude of non-corporate cases.

Public benefit corporation legislation was enacted in Delaware in 2013. As defined under the statute, a public benefit corporation is a for-profit corporation that is intended to produce a public benefit or public benefits and to operate in a responsible and sustainable manner.

Delaware LLCs provide liability protection for owners. When you own a business structured as a properly formed LLC, even if someone wins a judgment against your LLC, the liabilities are enforced against the LLC's property, not your personal property.

Becoming a benefit corporation gives companies increased options at the point of sale because they can: 1) encourage competition based on commitment to mission in addition to price; 2) consider other factors besides price when making the decision of whether and to whom to sell; and 3) retain or relinquish its benefit

In order to become a public benefit corporation (a PBC), a traditional Delaware corporation must draft an amendment to its certificate of incorporation (an Amendment). The amendment must be approved by the board of directors, and then by the stockholders.

Delaware is one of the most popular states for people to set up their businesses for liability and asset protection purposes. It also provides ownership privacy, an efficient legal system for business disputes, and tax benefits for assets.

No State TaxesThe state does not have a corporate tax on interest or other investment income that a Delaware holding company earns. If a holding corporation owns fixed-income investments or equity investments, it isn't taxed on its gains on the state level. Delaware also does not have any personal property tax.

Advantages of a Delaware LLCAdvantage #1: Custom LLC Business Structure and Rules.Advantage #2: Asset Protection Against Creditors.Advantage #3: Statutory Limitation on Member Personal Liability.Advantage #4: Beneficial Tax Treatment by the IRS.Advantage #5: Simple Startup and Minimal Requirements.More items...

For large businesses, Delaware holds many advantagesbut smaller business may not find it as beneficial. Here are the highlights: Delaware's business law is one of the most flexible in the country. The Delaware Court of Chancery focuses solely on business law and uses judges instead of juries.

Of course, there are also the traditional benefits of starting an LLC in Delaware, as opposed to starting another entity type. LLCs offer their members personal liability protection, they have very few reporting and record-keeping requirements, and they avoid the double taxation that C-corporations face.