Delaware Service Site Report

Description

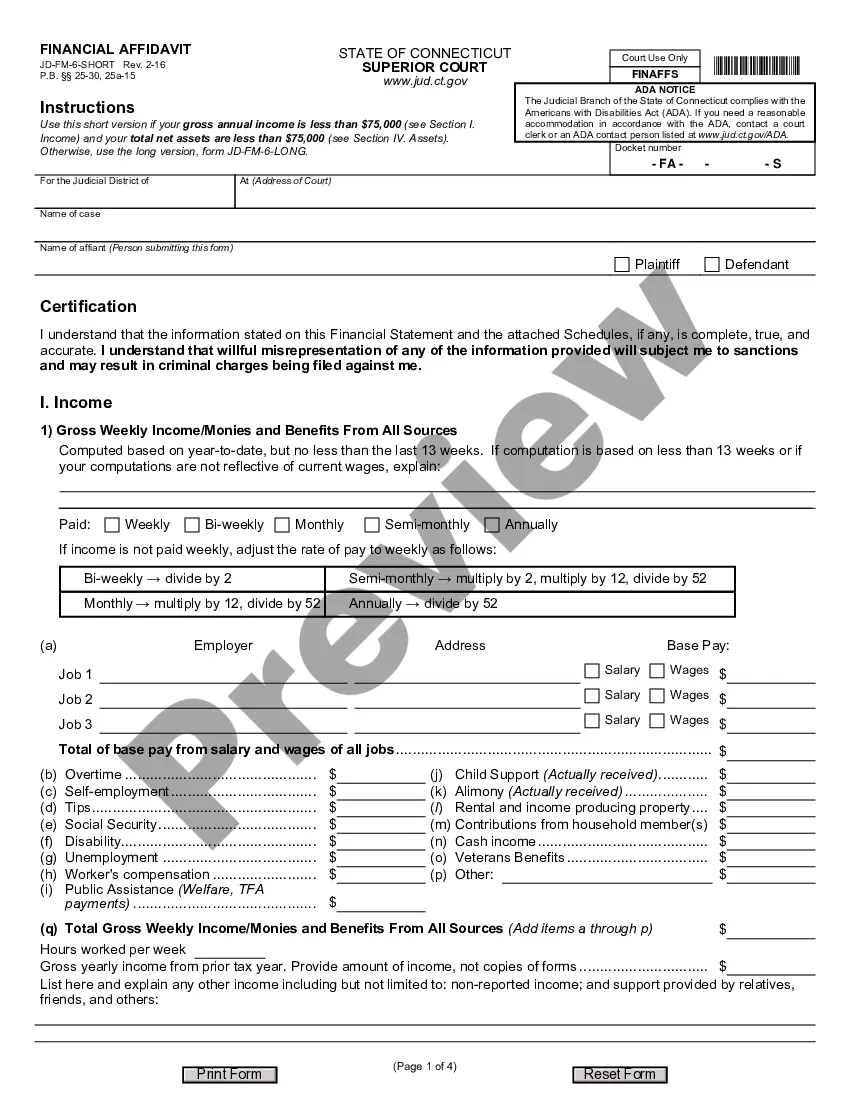

How to fill out Service Site Report?

Selecting the appropriate legal document template can be a challenge. It goes without saying that there are numerous designs accessible on the web, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Delaware Service Site Report, which can be utilized for business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, sign in to your account and click the Download button to obtain the Delaware Service Site Report. Use your account to search for the legal documents you have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Delaware Service Site Report. US Legal Forms is the largest repository of legal forms where you will discover various document templates. Utilize this service to obtain professionally crafted papers that adhere to state requirements.

- First, ensure that you have selected the correct document for your specific city/county.

- You can browse the form using the Preview option and read the form description to confirm it is suitable for you.

- If the document does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are certain the form is appropriate, click the Download now button to obtain the document.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

The law prohibits business from making false statements about their own goods or services or the goods and services offered by other businesses. If you are unable to fill out the following Consumer Complaint Form, please call (800) 220-5424 or e-mail consumer.protection@delaware.gov for assistance.

Delaware does NOT require an annual report. All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300. The annual taxes for the prior year are due on or before June 1st.

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report.

A Delaware annual report is a document that contains specific business information. The Delaware annual report is a form that is submitted at the time of payment of the Delaware franchise tax. The information required by a Delaware annual report is: The address of the corporation's physical location.

Financial reportingDelaware does not require corporations to file any financial reports. A basic annual franchise tax report must be filed annually on or before 1 March (with a fee of USD50).

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic corporations is $25.

How to File Your Delaware Annual ReportDetermine your filing fees, franchise tax (if applicable), and due date.Complete your report online and pay any necessary franchise taxes.Submit your report and tax to the Delaware Secretary of State, Division of Corporations.

A Delaware annual report is a document that contains specific business information. The Delaware annual report is a form that is submitted at the time of payment of the Delaware franchise tax. The information required by a Delaware annual report is: The address of the corporation's physical location.

Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state. Some states also require an initial report when first starting a business. When businesses fail to file on time, they might get hit with fines or other penalties.