Delaware Revocation of Will

Description

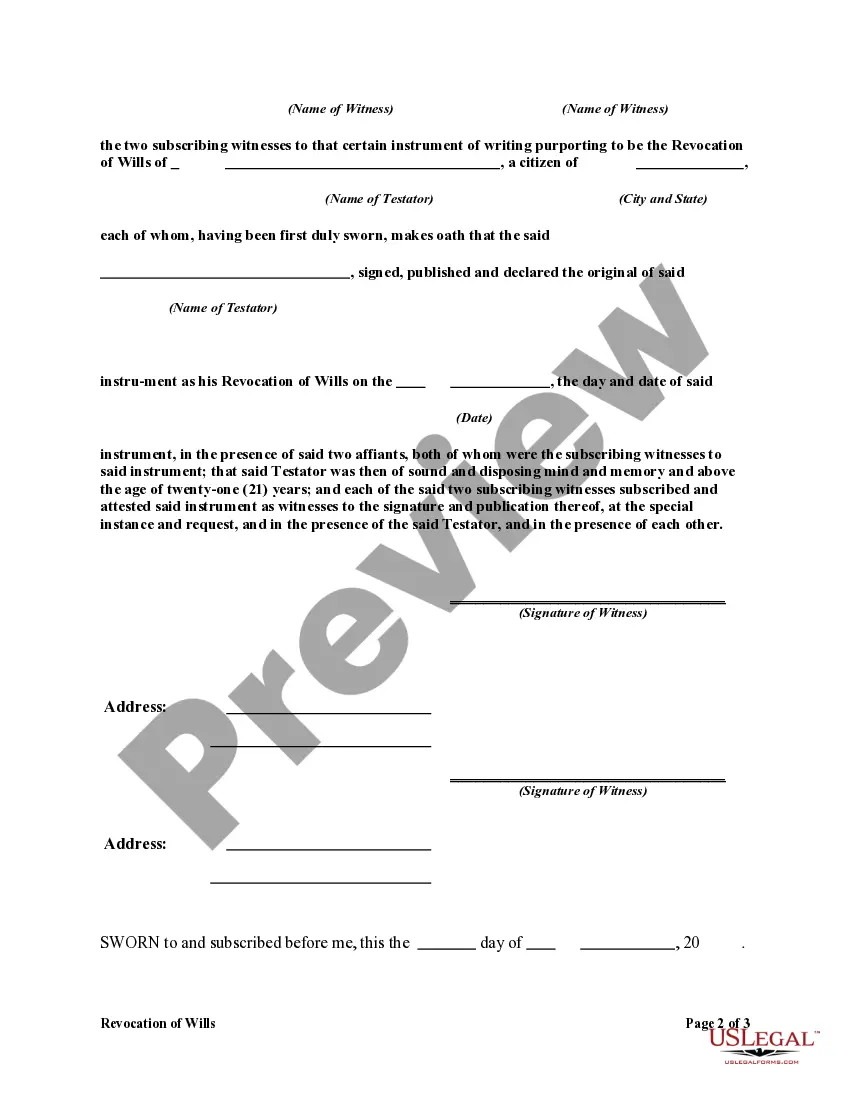

How to fill out Revocation Of Will?

You are able to commit time online attempting to find the authorized papers format which fits the state and federal demands you need. US Legal Forms provides a huge number of authorized forms which can be reviewed by professionals. You can easily down load or produce the Delaware Revocation of Will from the service.

If you have a US Legal Forms bank account, you are able to log in and click on the Down load switch. Afterward, you are able to complete, edit, produce, or indicator the Delaware Revocation of Will. Every authorized papers format you acquire is your own property eternally. To acquire an additional version for any bought form, proceed to the My Forms tab and click on the related switch.

If you use the US Legal Forms website the first time, keep to the basic instructions below:

- Initial, make sure that you have chosen the correct papers format for the state/town that you pick. Look at the form information to make sure you have picked out the proper form. If readily available, use the Preview switch to look from the papers format as well.

- If you would like find an additional edition in the form, use the Research field to get the format that fits your needs and demands.

- When you have identified the format you want, click Get now to carry on.

- Choose the rates plan you want, type your accreditations, and register for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal bank account to cover the authorized form.

- Choose the structure in the papers and down load it in your system.

- Make changes in your papers if needed. You are able to complete, edit and indicator and produce Delaware Revocation of Will.

Down load and produce a huge number of papers templates utilizing the US Legal Forms web site, that offers the greatest variety of authorized forms. Use skilled and status-particular templates to handle your organization or specific demands.

Form popularity

FAQ

Section 3343 - Authority to allocate trustee duties among multiple trustees (a) The power to appoint a successor trustee under a governing instrument shall be deemed to include the power to appoint multiple successor trustees.

(5) The term ?wilful misconduct? means intentional wrongdoing, not mere negligence, gross negligence, or recklessness and ?wrongdoing? means malicious conduct or conduct designed to defraud or seek an unconscionable advantage. 25 Del. Laws, c. 226, § 3; Code 1915, § 3875; 37 Del.

The amount of time you have to file a personal injury case in Delaware varies depending on the specifics of each case. Here are some general statutes of limitation: Negligence: 2 years.

(5) The term ?wilful misconduct? means intentional wrongdoing, not mere negligence, gross negligence, or recklessness and ?wrongdoing? means malicious conduct or conduct designed to defraud or seek an unconscionable advantage. 25 Del. Laws, c. 226, § 3; Code 1915, § 3875; 37 Del.

So, why is everyone talking about Delaware trusts? to modify the duty to diversify trust investment, and to permit the trustee to hold high risk portfolios, closely held business interests, and overly concentrated stock positions in the stock of family businesses gone public without fear of liability.

A person receiving such written notice who wishes to contest the will shall file a proceeding in the Court of Chancery no later than 120 days following receipt of such notice.

Section 3303(d) invokes the designated representative statute, providing: ?[d]uring any period of time that a governing instrument restricts or eliminates the right of a beneficiary to be informed of the beneficiary's interest in a trust, unless otherwise provided in the governing instrument, any designated ...

(a) Where 1 or more persons are given authority by the terms of a governing instrument to direct, consent to or disapprove a fiduciary's actual or proposed investment decisions, distribution decisions or other decision of the fiduciary, such persons shall be considered to be advisers and fiduciaries when exercising ...