Delaware Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained

Description

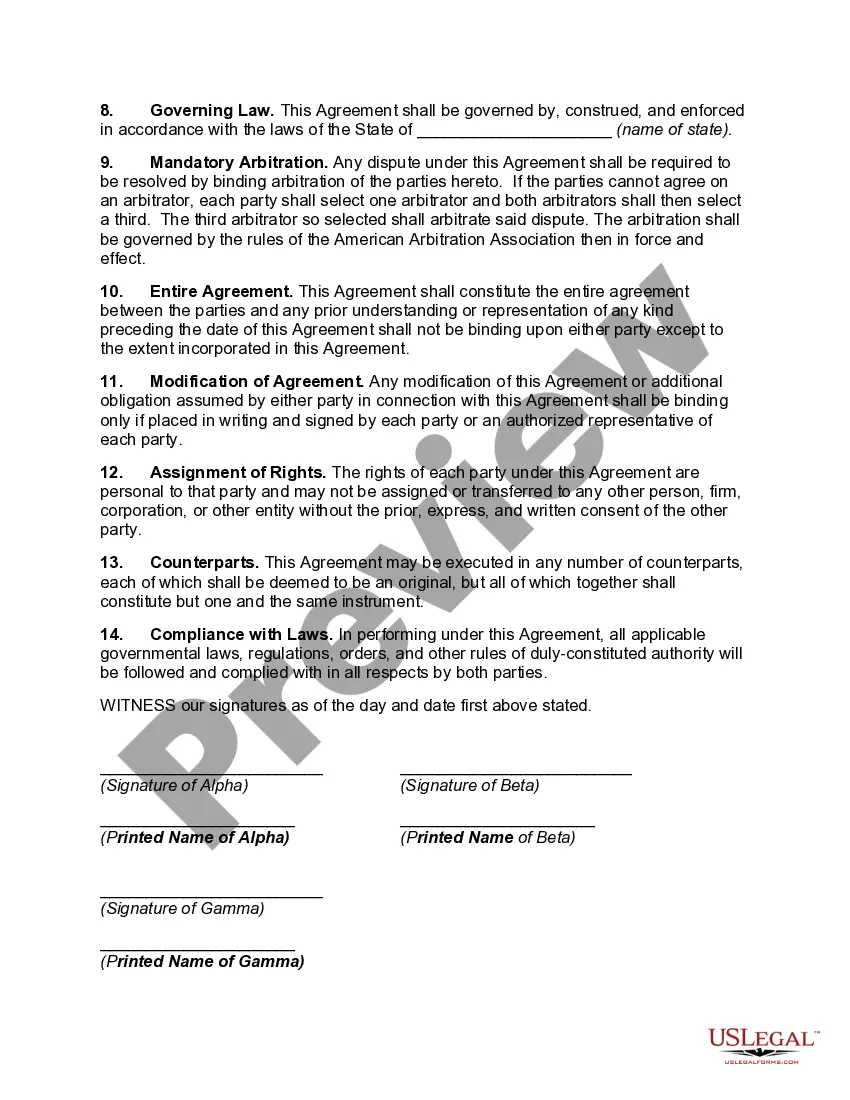

How to fill out Agreement To Form Partnership In The Future In Order To Carry Out A Contract To Be Obtained?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can obtain or create. Through the website, you can find thousands of forms for commercial and personal use, organized by categories, states, or keywords.

You may discover the most recent forms such as the Delaware Agreement to Form Partnership in the Future for executing a contract available within seconds.

If you already hold a membership, Log In to download the Delaware Agreement to Form Partnership in the Future for executing a contract from the US Legal Forms repository. The Download button will appear for every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill in, alter, print, and sign the downloaded Delaware Agreement to Form Partnership in the Future for executing a contract. Each design you added to your purchase has no expiration date, meaning it is yours permanently. So, if you wish to obtain or create another version, simply go to the My documents section and click on the form you need. Access the Delaware Agreement to Form Partnership in the Future for executing a contract with US Legal Forms, the most extensive collection of legal form templates. Utilize a wide array of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the description of the form to confirm you have chosen the right one.

- If the form does not match your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A Delaware Limited Partnership refers to a business entity in the state of Delaware that consists of at least one general partner and at least one limited partner. The general partner can be either an individual or an entity, such as a corporation.

A limited partnership must have at least one general partner and at least one limited partner. The principal distinguishing feature of a limited partnership is that the limited partners are not personally liable for the debts and obligations of the partnership. The general partner remains fully liable.

If you want to start a general partnership in the state of Delaware, there is no formal process to complete. Forming a general partnership in Delaware only requires you to work with your partner or partners. LLCs don't have any filing requirements like annual reports that corporations and nonprofits do.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

How to Form a Delaware Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

Delaware Revised Uniform Limited Partnership Act (the "Act"). An ELP as such is not an entity with separate legal personality, and cannot own property in its own right; the general statutory position is that the property of the ELP will be held on statutory trusts by the GPs jointly under section 6(2) of the Law.

A key advantage of forming a limited liability company is the limited personal liability it grants to every single one of its owners. This is in contrast to limited partnerships wherein only the limited partner has their personal liability shielded by the limited partnership business structure.

An LP allows certain investors (limited partners) to invest without having a management role or any personal liability, while the general partners carry all the liability.