Delaware Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Finding the appropriate legal document template might be challenging. Naturally, there are numerous templates available online, but how will you obtain the legal form that you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Delaware Agreement to Form Partnership in Future to Conduct Business, that can serve both business and personal needs. All documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and select the Acquire button to access the Delaware Agreement to Form Partnership in Future to Conduct Business. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents tab in your account to obtain another copy of the document you need.

Fill out, modify, print, and sign the acquired Delaware Agreement to Form Partnership in Future to Conduct Business. US Legal Forms is the largest repository of legal documents where you can access various document templates. Take advantage of the service to download well-crafted files that comply with state regulations.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

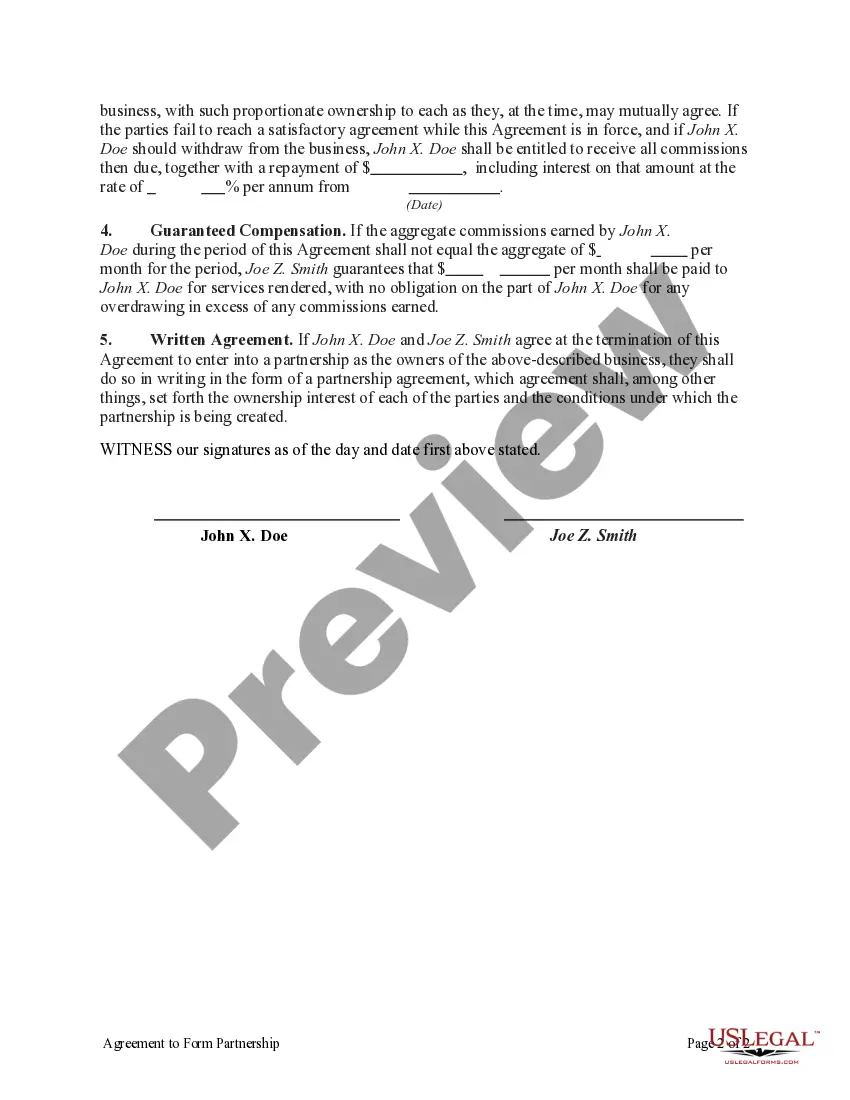

- First, ensure that you have selected the correct form for your city/county. You can review the form using the Preview button and read the form description to confirm it meets your needs.

- If the form does not satisfy your requirements, use the Search field to locate the appropriate document.

- Once you are confident that the form is suitable, click the Buy now button to acquire it.

- Choose the pricing plan that you wish to select and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

A Delaware LLC can be treated as a partnership if it has multiple members, allowing it to benefit from the pass-through taxation of a partnership. This arrangement can simplify tax obligations while providing limited liability protection for each member. Crafting a Delaware Agreement to Form Partnership in Future to Conduct Business will clarify each member's roles and responsibilities. Consulting with a professional can help you navigate this structure effectively.

Creating a partnership form begins with drafting a partnership agreement that outlines the partnership's key elements. A Delaware Agreement to Form Partnership in Future to Conduct Business is a great template to start with, as it covers essential terms like profit sharing, responsibilities, and decision-making procedures. You may want to use online platforms like uslegalforms to generate accurate and compliant forms easily. This way, you can ensure your partnership document is thorough and legally binding.

Yes, a Delaware LLC can operate as a partnership for tax purposes. This is often referred to as a multi-member LLC, which provides flexibility while allowing the benefits of a partnership. A Delaware Agreement to Form Partnership in Future to Conduct Business can help clarify the responsibilities and expectations within this structure. Using the correct documentation ensures your LLC complies with both state and federal regulations.

To form a partnership, you need a clear understanding of each partner's roles and contributions. A Delaware Agreement to Form Partnership in Future to Conduct Business is essential for laying out these details. Having a partnership agreement helps prevent disputes and promotes transparency between partners. Depending on your business type, you may also need any required licenses or permits to operate legally.

To form a partnership in Delaware, you first need to decide on the structure that best suits your business needs. A Delaware Agreement to Form Partnership in Future to Conduct Business outlines the terms and responsibilities of each partner. You should also consider drafting a partnership agreement that details profit distribution and decision-making processes. Finally, you may want to register your partnership if you choose a name that differs from the partners' names.

To set up a business partnership agreement, first, gather all potential partners to discuss the terms of your partnership. It’s essential to define each partner's roles, responsibilities, and profit-sharing structure. Next, create a comprehensive document that outlines the agreement, ensuring it includes all necessary clauses. Using a Delaware Agreement to Form Partnership in Future to Conduct Business can provide a solid legal framework to protect your interests and facilitate a smooth partnership.

Section 17 302 establishes the requirement for limited partnerships to maintain a registered office and a registered agent in Delaware. This provision enhances transparency and accountability for partnerships operating within the state. Understanding this section is important when considering the Delaware Agreement to Form Partnership in Future to Conduct Business, as compliance helps in maintaining good standing.

Yes, Delaware recognizes Limited Liability Partnerships (LLPs). This structure offers personal asset protection for partners while allowing flexibility in management. If you are exploring options for a Delaware Agreement to Form Partnership in Future to Conduct Business, an LLP may be an attractive choice for liability protection.

Delaware does not legally require LLCs to have an operating agreement, but it is highly advisable. An operating agreement outlines management structure and ownership stakes, which can prevent future disputes. To create a strong foundation for your Delaware Agreement to Form Partnership in Future to Conduct Business, consider drafting this crucial document.

Although formal partnerships can be formed without a written agreement, having one is critical for operational success. A written agreement protects the interests of all parties and serves as a reference point in case of disagreements. This is especially true when considering a Delaware Agreement to Form Partnership in Future to Conduct Business, as it provides clarity and legal support.