Delaware Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

Are you in a situation where you need documentation for business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

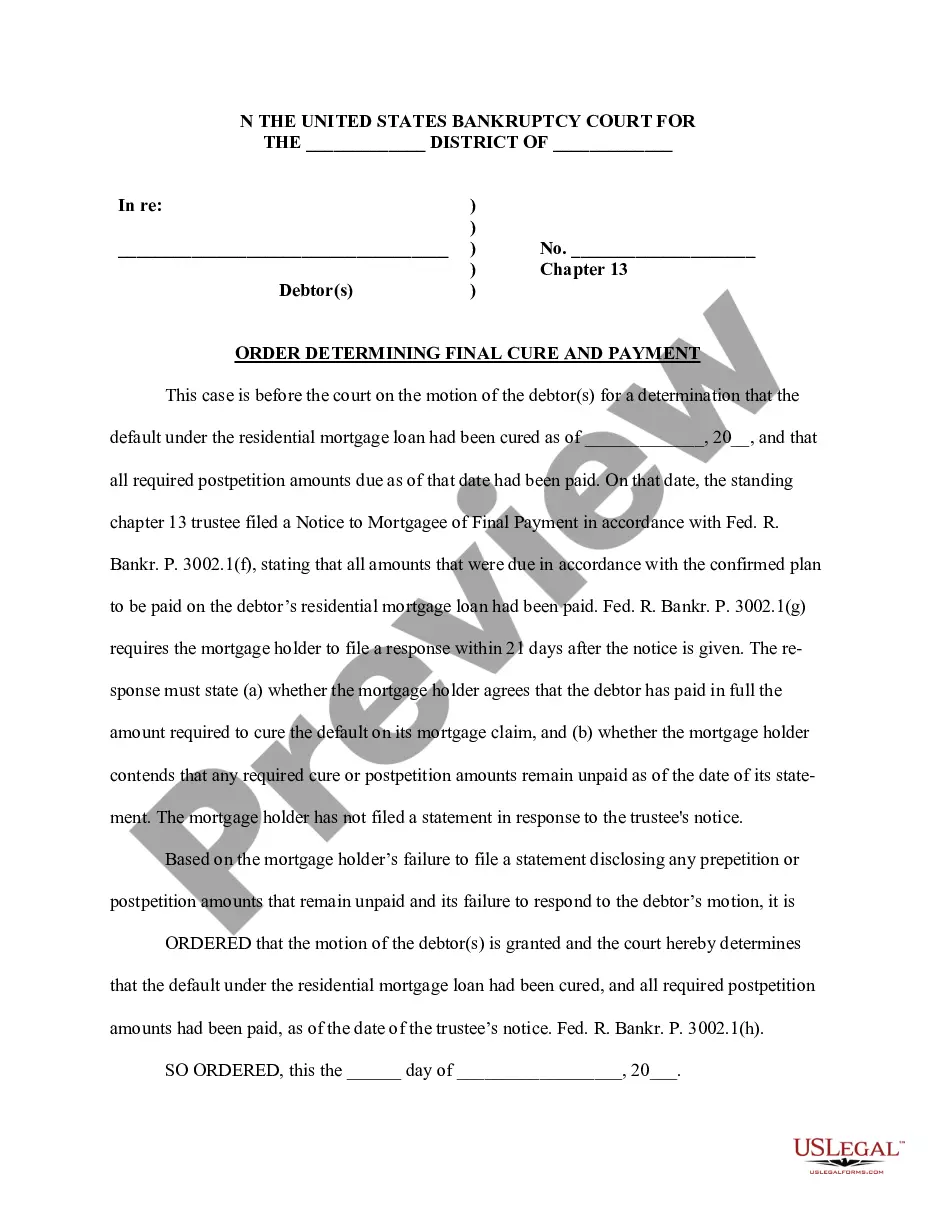

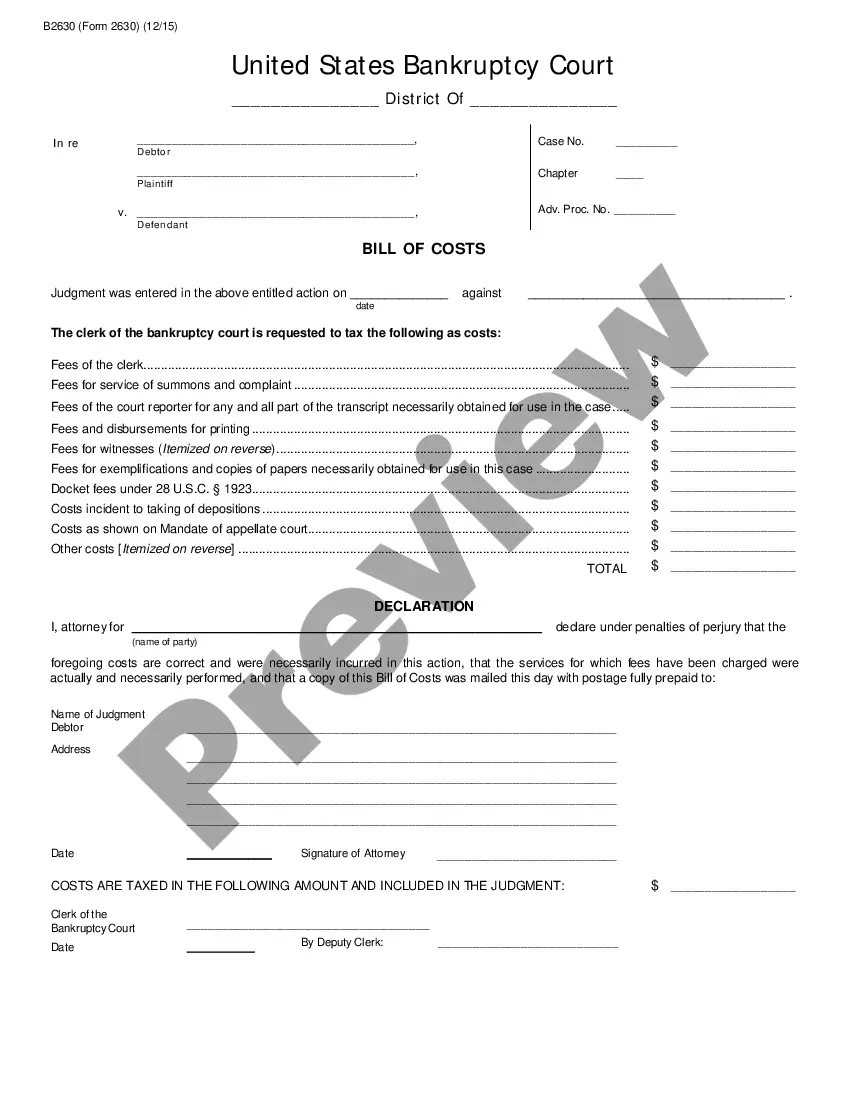

US Legal Forms provides a vast array of form templates, including the Delaware Notice of Returned Check, crafted to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Delaware Notice of Returned Check template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need, ensuring it corresponds to your specific city/region.

- Utilize the Preview button to view the form.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs.

- Once you find the correct form, simply click Buy now.

Form popularity

FAQ

In some cases, banks may redeposit returned checks automatically after a certain period. However, this is not always guaranteed, and you may receive a Delaware Notice of Returned Check that instructs you on your next steps. To ensure you don't miss any options, it's advisable to communicate with your bank directly about their policy regarding redepositing checks.

A returned check is generally marked as unpaid and sent back to the payee. The bank will notify you through a Delaware Notice of Returned Check, indicating why the check could not be processed. It is crucial to understand the implications of this situation, as it can affect your banking relationship and credit score if not addressed promptly.

To collect a returned check, first review the Delaware Notice of Returned Check for details regarding the failure. You should contact the issuer of the check to request payment and resolve the matter directly. If necessary, you may also consult a service like USLegalForms to assist you with drafting formal collection letters or documents that can help in this process.

It depends on your circumstances, particularly if you earn income in multiple states. If you are a Delaware resident, you must file a separate state return even if you file a federal return. To simplify your filing and avoid potential issues, including receiving a Delaware Notice of Returned Check, consider using tools offered by uslegalforms.

If you are a resident of Delaware or have earned income in the state, you typically must file a Delaware return. Some exceptions exist, depending on your income level and specific circumstances. To avoid complications, such as receiving a Delaware Notice of Returned Check, consider using services like uslegalforms to ensure your filing is correct.

You should send your Delaware state tax return to the address provided on the form or the official Delaware Division of Revenue website. For most taxpayers, this will be the address for the Wilmington office. If you're unsure, check any correspondence from the Division of Revenue regarding your Delaware Notice of Returned Check to confirm the proper mailing location.

The form for Delaware non-resident tax returns is the Delaware Non-Resident Personal Income Tax Return (Form 200-01). This form captures income accrued from Delaware sources. When filling out this form, ensure that all information is accurate to avoid receiving a Delaware Notice of Returned Check.

All individuals and entities earning income within Delaware must file a Delaware return. This requirement includes both residents and non-residents. It is vital to file correctly to avoid complications, such as receiving a Delaware Notice of Returned Check due to processing issues.

Any partnerships conducting business in Delaware must file a Delaware partnership return. This requirement applies regardless of where the partners reside. Failure to comply could result in penalties, including receiving a Delaware Notice of Returned Check if payments are inadequate.

If you have inquiries about your Delaware tax refund, reach out to the Delaware Division of Revenue. They can provide information specific to your situation, especially if you’ve recently encountered a Delaware Notice of Returned Check. Keeping communication open can help resolve issues efficiently.