Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

Are you presently situated in the location where you require documents for either business or personal activities almost all the time.

There are numerous legal document templates accessible on the web, but locating ones you can trust isn’t straightforward.

US Legal Forms provides a vast array of document templates, including the Delaware Demand for Accounting from a Fiduciary, which are created to comply with state and federal regulations.

Once you locate the correct document, click Buy now.

Choose the payment plan you desire, complete the necessary information to create your account, and process the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Delaware Demand for Accounting from a Fiduciary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and make sure it is for the suitable municipality/county.

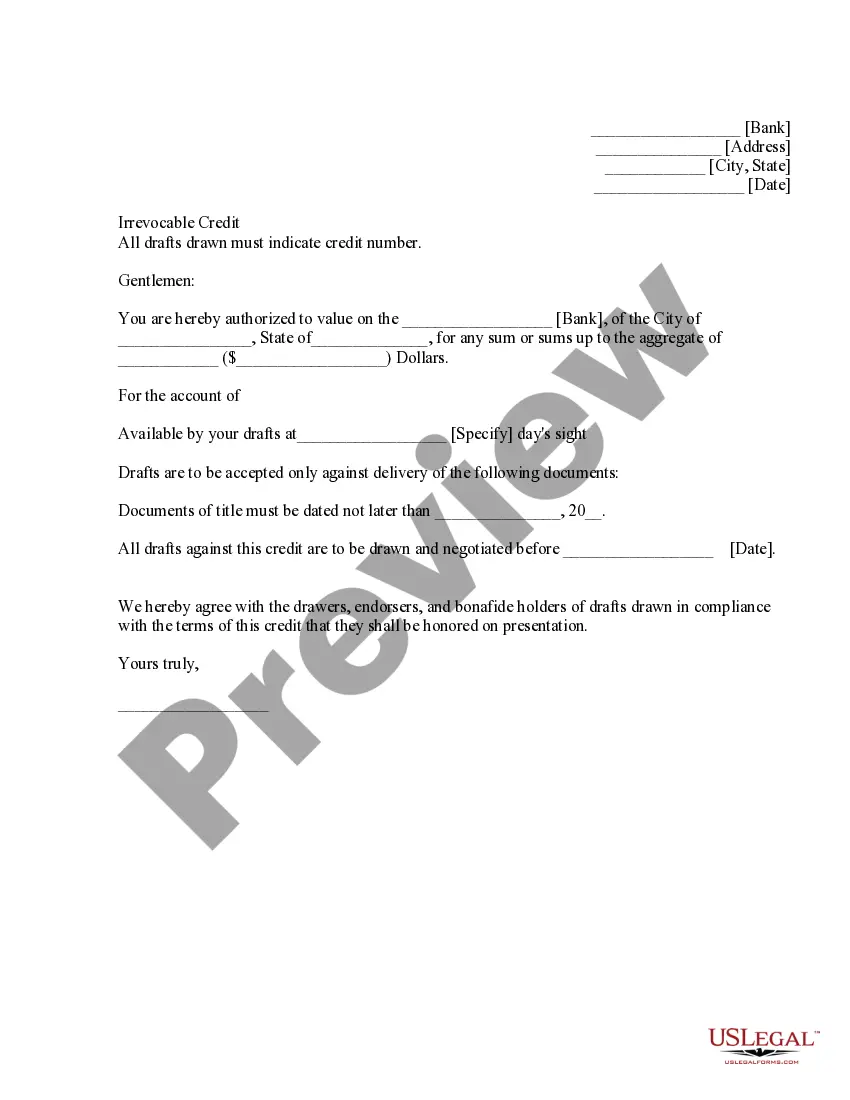

- Utilize the Preview button to examine the form.

- Check the details to ensure you have selected the correct document.

- If the document isn’t what you’re looking for, use the Search field to find the form that matches your requirements.

Form popularity

FAQ

The threshold for filing Form 1041 depends on the income generated by the trust or estate during the tax year. Generally, if the income exceeds a certain limit set by the IRS, filing becomes necessary. Staying informed about these thresholds is essential, especially when addressing the Delaware Demand for Accounting from a Fiduciary.

Fiduciaries managing a trust or estate, particularly those that generate income, are typically required to file a fiduciary tax return. This includes executors, administrators, and trustees. Understanding the nuances of your role helps in addressing the Delaware Demand for Accounting from a Fiduciary effectively.

A fiduciary return must be filed when the gross income of a trust or estate exceeds a specified amount. This threshold can change, so it's wise to stay updated on current tax laws. Meeting these requirements is crucial for any fiduciary facing the Delaware Demand for Accounting from a Fiduciary.

Form 1041 must be filed annually if the trust or estate generates sufficient income. The requirement depends on the type of trust and its income level. Regularly reviewing your obligations can simplify the process of meeting the Delaware Demand for Accounting from a Fiduciary and ensure compliance.

Yes, Delaware imposes a fiduciary income tax on trusts and estates. The tax applies to income generated by the trust’s assets, so it's essential to keep accurate financial records. Navigating the intricacies of taxes can be challenging, but resources like US Legal Forms can help clarify your obligations regarding the Delaware Demand for Accounting from a Fiduciary.

To demand an accounting of a trust, you need to send a formal request to the fiduciary managing the trust. This request should detail the information you seek, including overall trust activity and specific transactions. Understanding your rights under the Delaware Demand for Accounting from a Fiduciary will help ensure transparency and accountability.

In the context of Delaware law, anyone managing a trust or estate representing a deceased person generally needs to file IL 1041. This includes fiduciaries responsible for distributing assets to beneficiaries. It's vital to understand your role and responsibility in the accounting process to comply with the Delaware Demand for Accounting from a Fiduciary.

In Delaware, the statute of limitations for a breach of fiduciary duty typically spans three years. This period begins from the date you become aware of the breach. If you suspect wrongdoing involving a Delaware Demand for Accounting from a Fiduciary, it is crucial to take action promptly. For those needing guidance, US Legal Forms offers resources to help navigate through this legal process effectively.

The fiduciary duty of a corporation encompasses its responsibilities to act in the best interests of its shareholders while adhering to legal and ethical standards. This duty includes managing corporate resources responsibly and ensuring transparency in operations. When facing challenges like transparency issues, a Delaware Demand for Accounting from a Fiduciary can provide a structured approach to seek answers and uphold these corporate responsibilities.

The fiduciary duty of accounting requires fiduciaries to provide a full and fair account of all financial transactions and holdings. This duty ensures that stakeholders can assess the fiduciary's management of resources and verify compliance with their obligations. A Delaware Demand for Accounting from a Fiduciary can be an important tool to enforce this duty, ensuring accountability and transparency in financial dealings.