As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Delaware Report of Independent Accountants after Audit of Financial Statements

Description

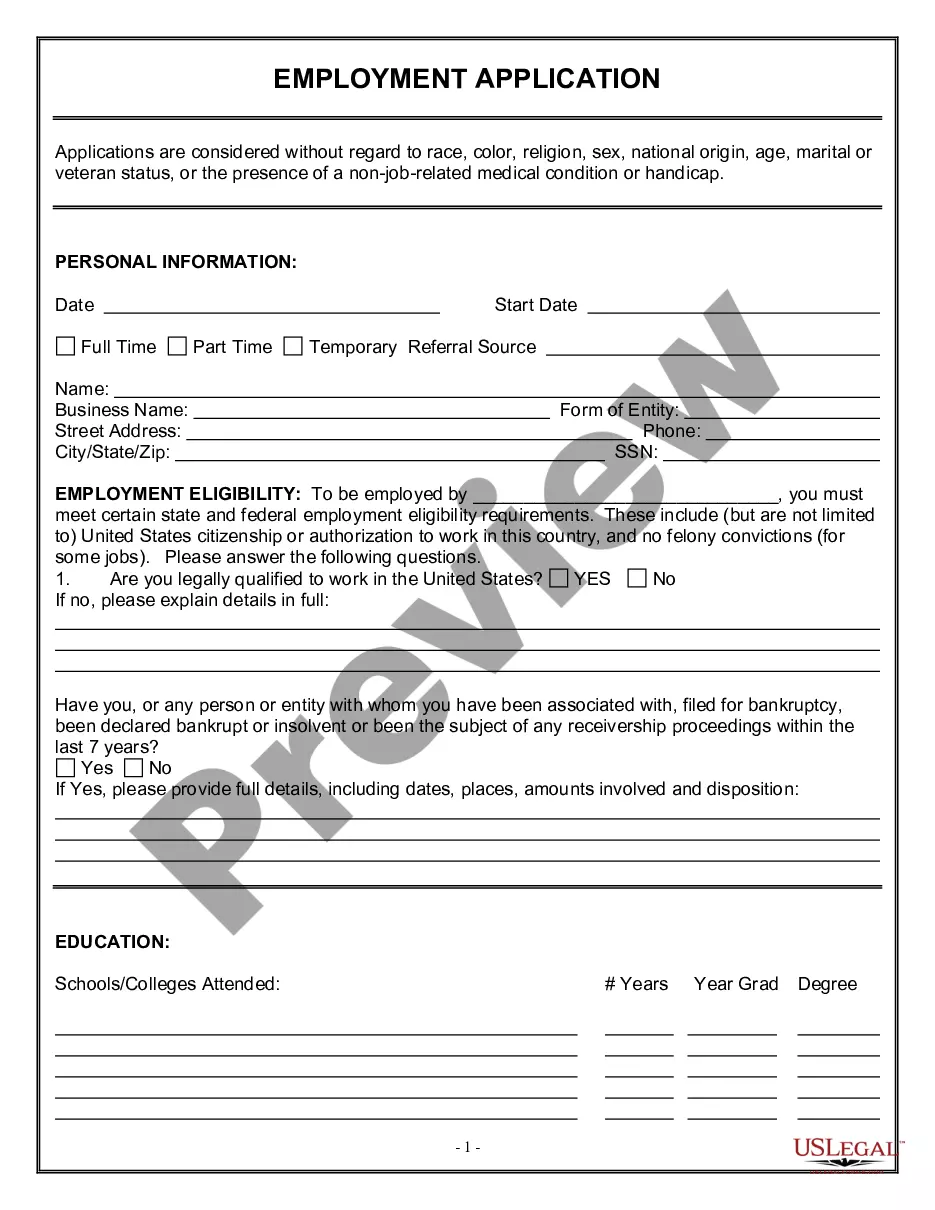

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

If you desire to be thorough, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Make the most of the site's user-friendly and convenient search to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Delaware Report of Independent Accountants post Audit of Financial Statements with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Delaware Report of Independent Accountants post Audit of Financial Statements with just a few clicks.

- In case you are an existing US Legal Forms user, Log In to your account and click on the Download option to find the Delaware Report of Independent Accountants post Audit of Financial Statements.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for your appropriate area/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the outline.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to locate other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Get now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Delaware Report of Independent Accountants post Audit of Financial Statements.

Form popularity

FAQ

It is not advisable for an auditor to prepare and then audit the same set of financial statements due to potential conflicts of interest. Maintaining independence is crucial for the integrity of the audit process, especially for a Delaware Report of Independent Accountants after Audit of Financial Statements. Engaging different professionals for preparation and auditing ensures unbiased reviews. If you're navigating these regulations, uslegalforms can guide you through the right steps.

Whether your financial statements need an audit depends on several factors, including business size, industry requirements, and stakeholder expectations. A Delaware Report of Independent Accountants after Audit of Financial Statements can ensure your reports are credible and compliant. If you are unsure about your situation, consider consulting resources like uslegalforms, which can help you determine your specific needs and facilitate the audit process.

Entities such as public companies, certain nonprofit organizations, and banks are usually required to file audited financial statements. If your business plans on going public or is seeking substantial financing, a Delaware Report of Independent Accountants after Audit of Financial Statements is essential. Compliance with these standards fosters trust with stakeholders and regulatory bodies. For assistance, you can explore the services provided by uslegalforms.

Not all financial statements require an audit; it typically depends on the size and nature of your business. Regardless, securing a Delaware Report of Independent Accountants after Audit of Financial Statements can provide assurance of accuracy and reliability. It's crucial for businesses that plan to secure funding or partners as an audit can highlight the financial controls in place. You can find guidance on navigating these requirements through uslegalforms.

Small businesses often do not need audited financial statements unless they meet specific criteria or seek outside investment. However, having a Delaware Report of Independent Accountants after Audit of Financial Statements can enhance credibility with lenders and investors. It demonstrates a commitment to financial transparency, which can be crucial for growth. Additionally, utilizing the uslegalforms platform can simplify the process of obtaining the necessary audits.

You can find independent auditor's reports through various channels, including company websites, financial statements filed with regulatory agencies, or databases that provide access to such documents. If you're seeking a reliable template or assistance in generating a Delaware Report of Independent Accountants after Audit of Financial Statements, consider using the services offered by US Legal Forms as a comprehensive solution.

Yes, financial accounting is often subjected to audits to ensure accuracy and compliance with established accounting principles. Audits help identify any discrepancies or potential areas for improvement. Thus, obtaining a Delaware Report of Independent Accountants after Audit of Financial Statements is a critical step for businesses wanting to maintain financial integrity.

An independent audit report is a document produced by an auditor, who evaluates the accuracy and completeness of an organization's financial statements. This report provides an unbiased opinion on whether the statements reflect the true financial situation of the entity. For businesses in Delaware, the report is integral and is often referred to as the Delaware Report of Independent Accountants after Audit of Financial Statements.

Audited financial statements can be public information, especially for companies that are publicly traded or required by law to disclose financial performance. Stakeholders, investors, and regulatory bodies often access this information. A Delaware Report of Independent Accountants after Audit of Financial Statements contributes to transparency, which is vital for informed decision-making by the public.

Yes, Certified Public Accountants (CPAs) are often the professionals who conduct audits on financial accounting reports. They possess the necessary qualifications and expertise to assess financial health and ensure adherence to regulations. When you receive a Delaware Report of Independent Accountants after Audit of Financial Statements, it is likely prepared by a qualified CPA, which adds significant value to the document.