A sale of all or substantially all corporate assets is authorized by statute in most jurisdictions, and the procedures and requirements set forth in the applicable statutes must be complied with. Typical requirements for a sale of all or substantially all corporate assets include appropriate action by the directors establishing the need for and directing the sale, and approval by a prescribed number or percentage of the shareholders.

Delaware Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation

Description

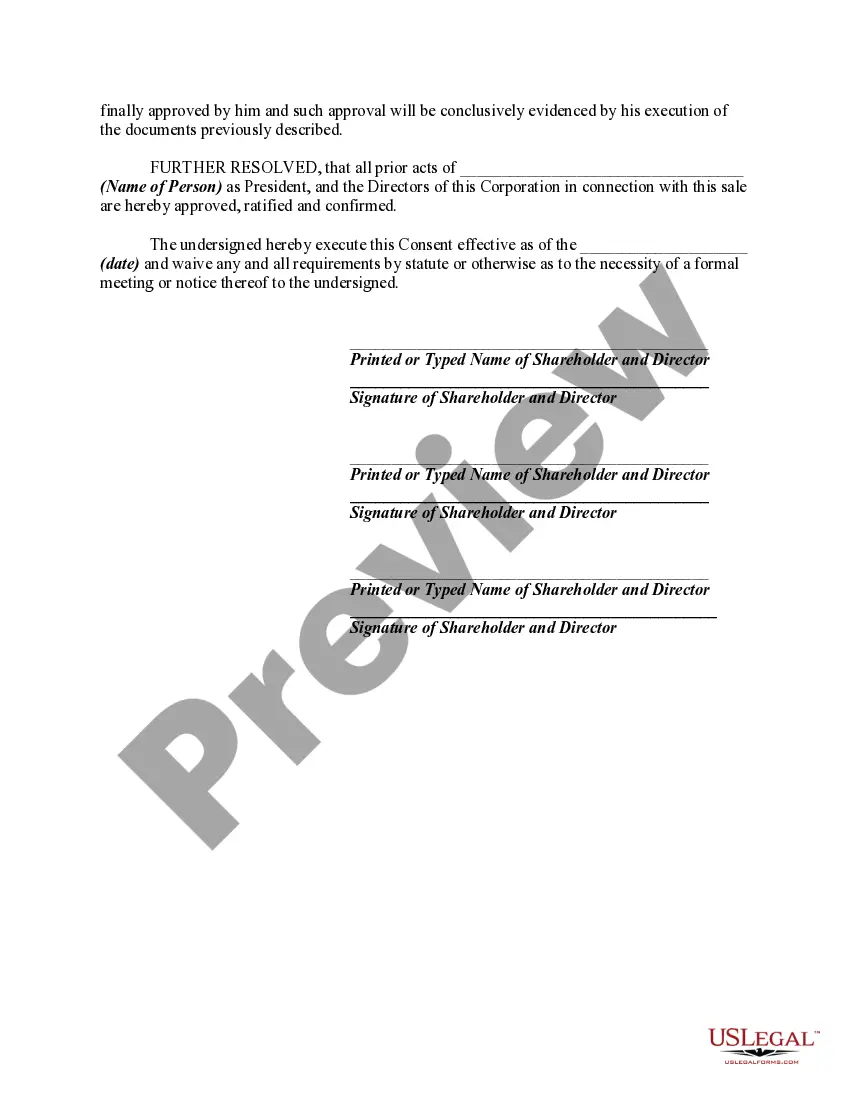

How to fill out Unanimous Written Consent By Shareholders And The Board Of Directors Electing A New Director And Authorizing The Sale Of All Or Substantially Of The Assets Of A Corporation?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a range of legal template papers that you can download or print.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can instantly access the latest versions of forms such as the Delaware Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation.

Review the form description to ensure you've chosen the correct document.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you already possess a monthly subscription, Log In and download the Delaware Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation from your US Legal Forms account.

- The Obtain button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/state.

- Click the Preview button to check the form's content.

Form popularity

FAQ

Shareholder consent refers to the process by which shareholders approve or reject actions taken by the board of directors or corporate management. In Delaware, this can take the form of unanimous written consent, allowing for swift decisions on important matters, such as electing directors and approving large transactions. Utilizing the Delaware Unanimous Written Consent empowers shareholders to have their voices heard while maintaining corporate responsiveness.

Unanimous written consent of the board of directors in Delaware allows all board members to agree on a decision without meeting in person. This method is particularly useful for urgent matters, such as electing a new director or authorizing substantial asset sales. Ensuring harmony and efficiency, the Delaware Unanimous Written Consent serves as a vital tool for board governance.

Section 276 of the Delaware corporation law addresses procedures for dissolving a corporation and distributing its assets. Understanding this section is crucial for shareholders involved in significant decisions like selling corporate assets. Ultimately, the Delaware Unanimous Written Consent by Shareholders and the Board of Directors can streamline the necessary approvals to comply with this law.

In Delaware, stockholders need to approve significant actions such as electing directors, approving mergers, or authorizing the sale of assets. The necessity for unanimous written consent highlights the importance of alignment among stockholders on key corporate decisions. Embracing the Delaware Unanimous Written Consent ensures that stockholders can efficiently navigate these approvals while protecting their interests.

A written consent of stockholders in Delaware enables shareholders to approve actions without holding a traditional meeting. This process enhances the engagement of stockholders while allowing for timely decisions, including the approval of director elections and asset sales. The Delaware Unanimous Written Consent provides a practical means for stockholders to voice their approval on critical issues.

A written consent for directors in Delaware is a formal document that allows board members to make decisions outside of a scheduled meeting. This method is essential for businesses that require swift action, such as electing a new director. By leveraging the Delaware Unanimous Written Consent, boards can quickly authorize necessary steps, like the sale of substantial corporate assets.

Section 228 of the Delaware corporate law permits shareholders to act by written consent instead of holding a formal meeting. This provision underscores the importance of shareholder participation while enabling faster decision-making. Utilizing Delaware Unanimous Written Consent by Shareholders and the Board of Directors supports effective governance when electing directors or making significant sales.

Action by written consent in Delaware allows the board of directors or shareholders to make decisions without convening a meeting. This streamlined process facilitates quicker actions such as electing a new director or approving the sale of corporate assets. The Delaware Unanimous Written Consent by Shareholders and the Board of Directors ensures that important decisions can be made efficiently, providing flexibility for corporations.

Delaware consent laws permit directors and shareholders to execute written consents in lieu of holding a formal meeting. These laws ensure that all parties can provide their approval on crucial corporate actions promptly and efficiently. Understanding these regulations helps corporations utilize the Delaware Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation effectively, promoting smoother operations and compliance.

Yes, Delaware law allows for unanimous written consent as a viable alternative to traditional meetings for corporations. This means that decisions can be made effectively, provided all involved parties agree. It is particularly advantageous for swift actions like electing a new director or approving an asset sale, making the Delaware Unanimous Written Consent by Shareholders and the Board of Directors Electing a New Director and Authorizing the Sale of All or Substantially of the Assets of a Corporation an essential tool for business operations.