A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

Delaware Assignment of Business License as Security for a Loan

Description

How to fill out Assignment Of Business License As Security For A Loan?

If you wish to full, acquire, or print out lawful file themes, use US Legal Forms, the most important collection of lawful forms, that can be found online. Take advantage of the site`s simple and easy handy look for to find the documents you want. Numerous themes for business and specific purposes are sorted by groups and states, or search phrases. Use US Legal Forms to find the Delaware Assignment of Business License as Security for a Loan in just a few clicks.

Should you be already a US Legal Forms buyer, log in for your bank account and click on the Download switch to get the Delaware Assignment of Business License as Security for a Loan. You can also entry forms you formerly downloaded in the My Forms tab of your respective bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for that proper metropolis/nation.

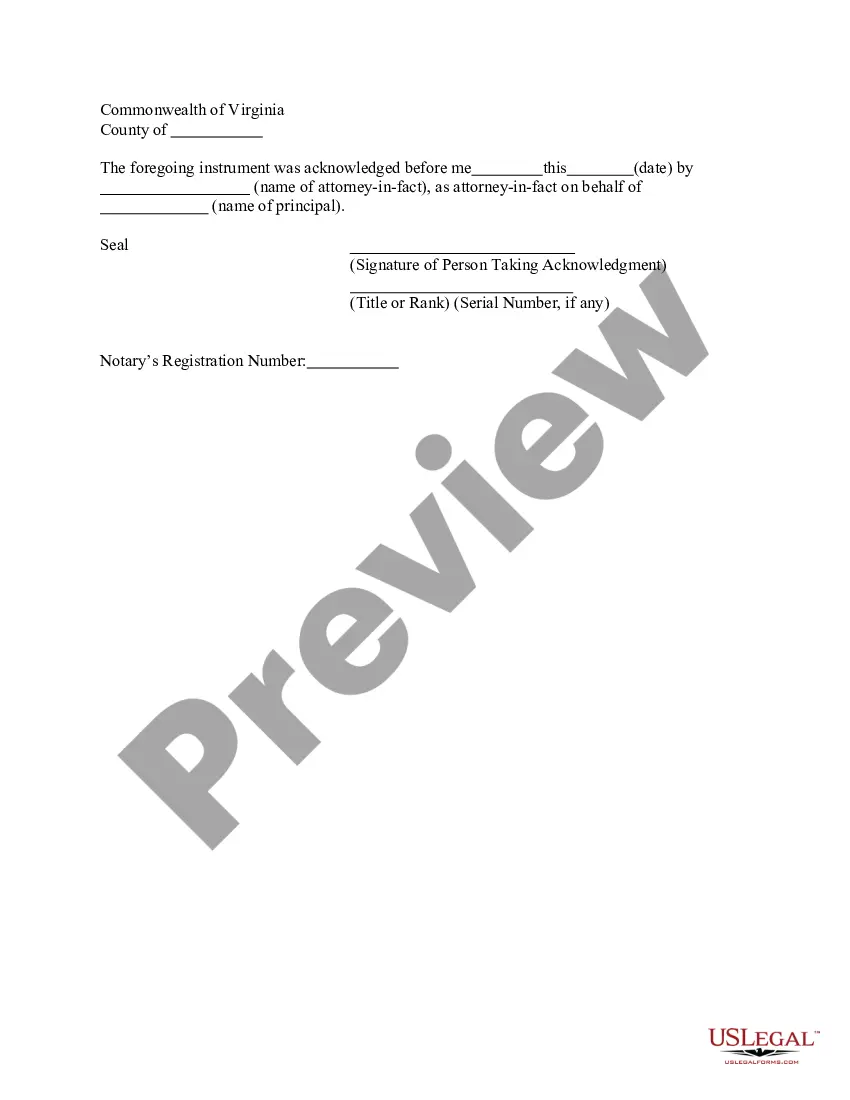

- Step 2. Utilize the Preview solution to look over the form`s information. Do not neglect to see the outline.

- Step 3. Should you be unhappy using the kind, take advantage of the Look for discipline at the top of the monitor to locate other models from the lawful kind format.

- Step 4. Upon having found the shape you want, click on the Acquire now switch. Opt for the rates strategy you choose and include your credentials to sign up on an bank account.

- Step 5. Approach the purchase. You can utilize your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Select the format from the lawful kind and acquire it in your system.

- Step 7. Total, revise and print out or indication the Delaware Assignment of Business License as Security for a Loan.

Every single lawful file format you purchase is yours for a long time. You possess acces to each and every kind you downloaded with your acccount. Go through the My Forms portion and pick a kind to print out or acquire once again.

Remain competitive and acquire, and print out the Delaware Assignment of Business License as Security for a Loan with US Legal Forms. There are millions of expert and condition-distinct forms you can utilize for your personal business or specific requires.

Form popularity

FAQ

§§ 9-203. Attachment and enforceability of security interest; proceeds; supporting obligations; formal requisites. (a) Attachment. ? A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment.

(1) A security interest in chattel paper or negotiable documents may be perfected by filing. A security interest in the right to proceeds of a written letter of credit can be perfected only by the secured party's taking possession of the letter of credit.

? A security interest in a certificated security in registered form is perfected by delivery when delivery of the certificated security occurs under Section 8-301 and remains perfected by delivery until the debtor obtains possession of the security certificate.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

§ 2301. Legal rate; loans insured by Federal Housing Administration. (a) Any lender may charge and collect from a borrower interest at any rate agreed upon in writing not in excess of 5% over the Federal Reserve discount rate including any surcharge thereon.

Filing a Financing Statement to Perfect the Security Interest. Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

The only way that a secured party may perfect its security interest in money is by possession. Instruments. A lender may perfect a security interest in an instrument either by filing or possession.