Delaware Sample Letter for Tax Deeds

Description

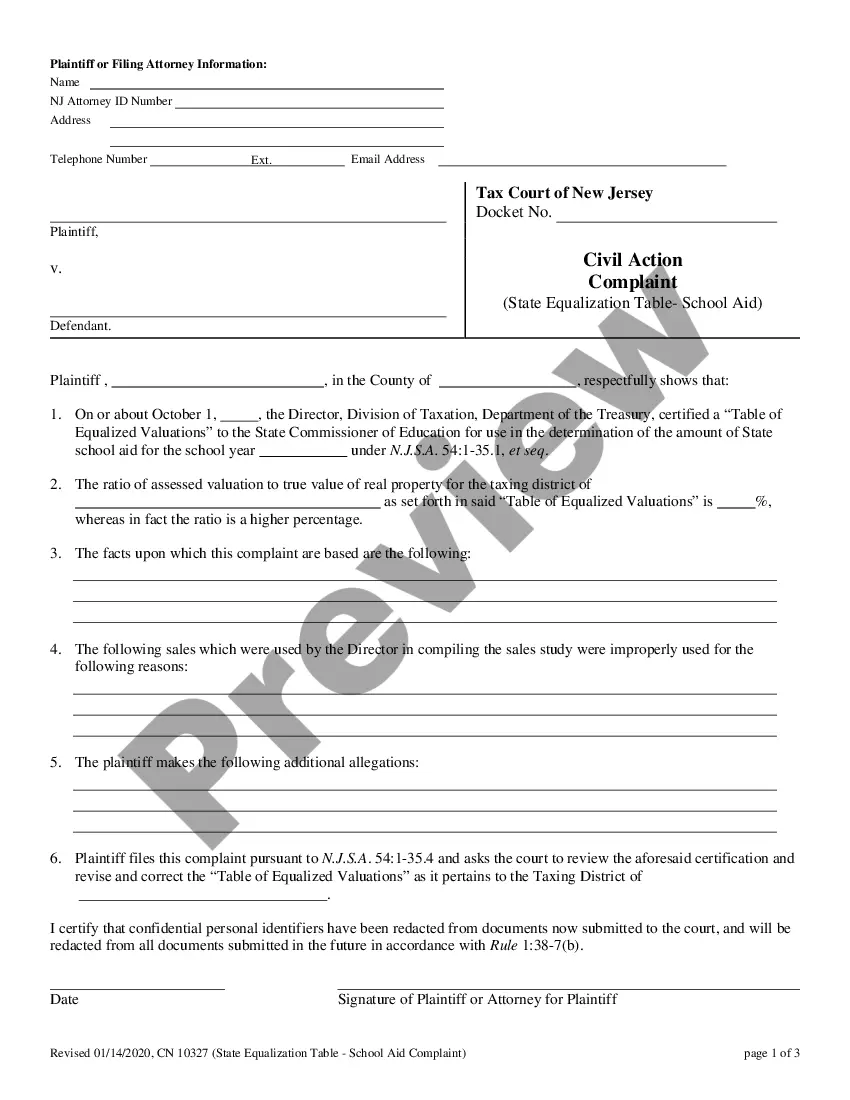

How to fill out Sample Letter For Tax Deeds?

You might spend multiple hours online looking for the legal documents template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal documents that have been reviewed by experts.

It is easy to download or print the Delaware Sample Letter for Tax Deeds from their services.

If available, use the Review button to examine the document template as well. To find another version of the document, use the Search field to locate the template that suits your needs and specifications. Once you have found the template you require, click Buy now to proceed. Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to the document if possible. You can complete, modify, and sign and print the Delaware Sample Letter for Tax Deeds. Access and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Delaware Sample Letter for Tax Deeds.

- Each legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased document, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the document description to confirm you have chosen the right document.

Form popularity

FAQ

Essential Elements of a Valid Deed Use of the proper statutory form of deed. Competent parties: grantor and grantee. Words of grant or operative words of conveyance. Sufficient description of the property to be conveyed. Proper execution. Delivery and acceptance.

In order for a deed to be valid and enforceable, it must be in writing; describe with specificity the property conveyed; specify the names of the grantor and grantee; be signed; be sealed; be acknowledged; and be delivered.

The Process of Transferring Property Identify the recipient or donee. Discuss the terms and conditions of the transfer with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

In Delaware, the tax sale is a public auction where the home is sold to the highest bidder. So, Delaware is considered a tax deed state.

In Delaware a Tax Status Compliance Certificate is called a Certificate of Tax Clearance and is issued by the Delaware Division of Revenue for a Company or Sole Proprietor which has met all of its Delaware tax obligations.

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation.

A deed is a signed legal document that transfers ownership of an asset to a new owner. Deeds are most commonly used to transfer ownership of property or vehicles between two parties. The purpose of a deed is to transfer a title, the legal ownership of a property or asset, from one person or company to another.

Deed. A written document, properly signed and delivered, that conveys title to real property. Some examples? General Warranty Deed ? a deed in which the grantor agrees to protect the grantee against any other claim to title of the property and provides other promises.