Delaware Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Finding the right authorized papers web template can be quite a struggle. Naturally, there are plenty of templates available on the net, but how can you discover the authorized kind you require? Take advantage of the US Legal Forms web site. The service gives thousands of templates, including the Delaware Agreement for Purchase of Business Assets from a Corporation, which can be used for organization and personal requires. Every one of the varieties are checked out by professionals and satisfy federal and state demands.

If you are currently authorized, log in to your bank account and click on the Acquire button to find the Delaware Agreement for Purchase of Business Assets from a Corporation. Use your bank account to check from the authorized varieties you may have ordered earlier. Proceed to the My Forms tab of your respective bank account and get an additional version from the papers you require.

If you are a fresh customer of US Legal Forms, listed here are easy recommendations so that you can stick to:

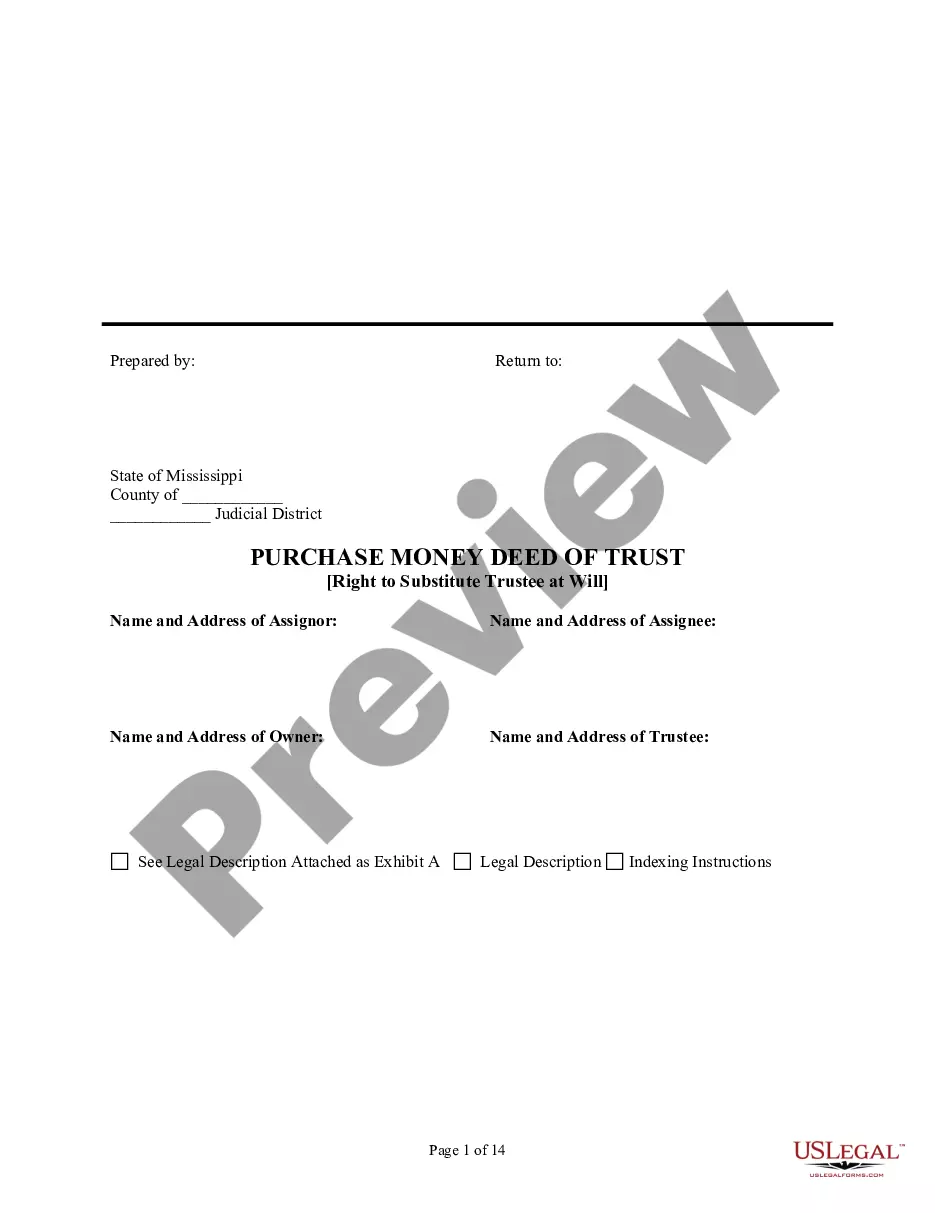

- First, make sure you have selected the appropriate kind for the city/area. It is possible to look over the shape using the Review button and browse the shape information to guarantee it is the best for you.

- When the kind will not satisfy your expectations, use the Seach industry to obtain the correct kind.

- When you are positive that the shape is suitable, click on the Get now button to find the kind.

- Choose the rates prepare you need and type in the necessary information and facts. Create your bank account and buy the transaction using your PayPal bank account or bank card.

- Pick the submit file format and down load the authorized papers web template to your device.

- Total, modify and print out and indicator the obtained Delaware Agreement for Purchase of Business Assets from a Corporation.

US Legal Forms may be the most significant library of authorized varieties where you can find a variety of papers templates. Take advantage of the service to down load skillfully-made documents that stick to status demands.

Form popularity

FAQ

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

Asset Sale ? Capital Gains Tax Capital gains tax is the proceeds of your asset sale minus the original cost. You'll pay tax on the capital gain or loss on the assets sold. Here's a quick equation: Sale price ? purchase price = net proceeds.

Your company will also still exist after an asset sale, and administratively you will still need to take steps to dissolve the company and deal with any remaining liabilities and assets. Unlike a stock sale, 100% of the interests of a company can usually be transferred without the consent of all of the stockholders.

The purpose of an "as is" clause is to force the buyer to rely upon its own investigation, rather than upon the seller's representations, in determining whether or not to purchase the property.

After signing a letter of intent and completing due diligence, a business purchase agreement marks the official start to the legally binding transaction of a business. This agreement requires the buyer to purchase the business ing to the terms and price outlined in the agreement.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Seller Disadvantages Prior to completion the seller will need to obtain releases of any securities affecting the assets of the business from their financiers. An asset sale can lead to a double tax charge. An initial Corporation Tax charge will arise on any capital gains in the hands of the company following the sale.