Delaware Balloon Unsecured Promissory Note

Description

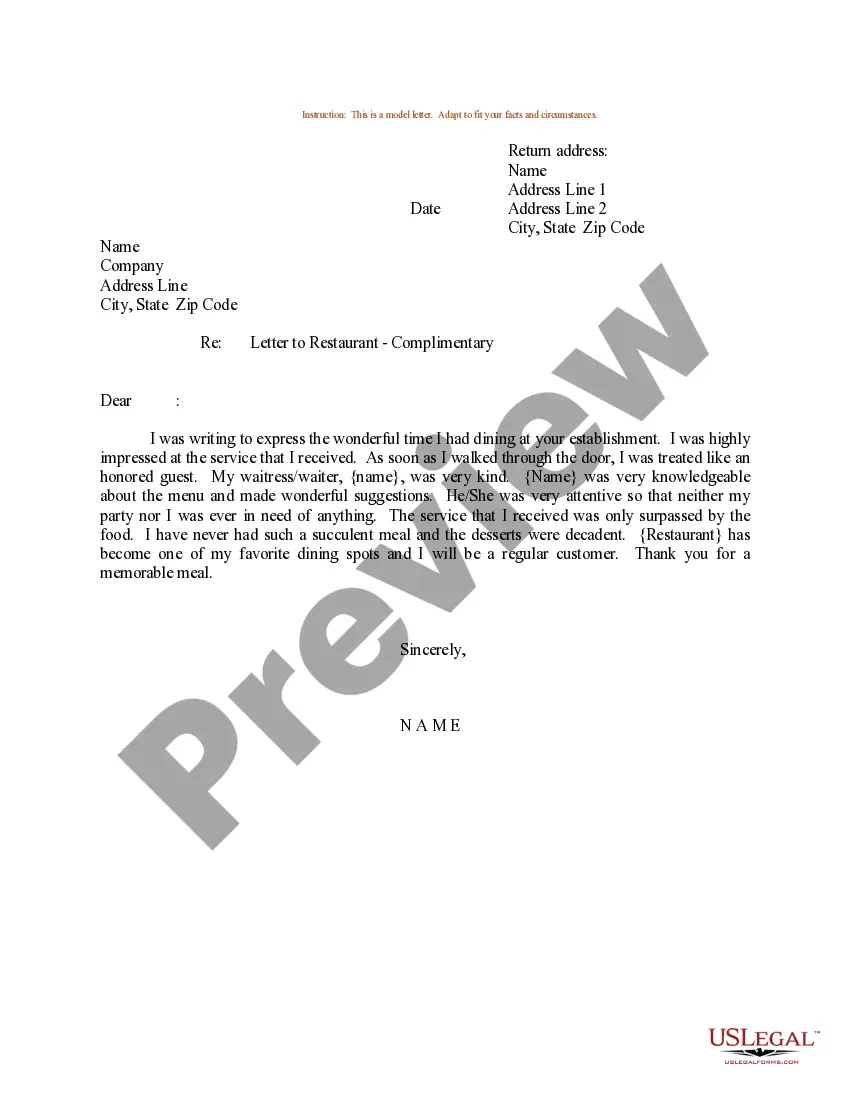

How to fill out Balloon Unsecured Promissory Note?

If you need to tally, obtain, or print authentic document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Numerous templates for professional and personal purposes are categorized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Leverage US Legal Forms to locate the Delaware Balloon Unsecured Promissory Note in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Delaware Balloon Unsecured Promissory Note.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms within the legal form template.

Form popularity

FAQ

An on-demand promissory note is a document that requires repayment upon the lender's request. For instance, if a borrower owes $10,000 with an implied interest rate, the lender can demand full payment at any time. Such notes are vital for flexible financing situations, much like the Delaware Balloon Unsecured Promissory Note, which can have specific demand features.

A promissory note typically follows a structured format. It includes sections for the heading, parties involved, principal amount, interest rate, repayment schedule, and signatures. The format ensures that all necessary information is communicated clearly, especially in notes like the Delaware Balloon Unsecured Promissory Note, where terms can be complex.

Filling out a demand promissory note involves several key steps. Start by entering the borrower's name and address at the top of the document. Include the principal amount, interest rate, and repayment terms. Be sure to sign and date the note, acknowledging the obligations of both parties. This type of note is essential when dealing with a Delaware Balloon Unsecured Promissory Note, as it outlines when repayment may be demanded.

To obtain your Delaware Balloon Unsecured Promissory Note, you can utilize reliable platforms like US Legal Forms. Start by visiting their website, where you will find a user-friendly interface to guide you through the process. Select the appropriate form, customize it to fit your needs, and follow the prompts to generate your document. This method ensures that you have a legally binding promissory note ready for use in no time.

Promissory notes can be exempt from federal securities regulations in certain situations. However, it is essential to review the specific criteria, as exemptions may vary based on the note's terms and the financial context. The Delaware Balloon Unsecured Promissory Note can offer potential advantages if correctly structured to meet these exemption criteria.

An unsecured promissory note typically does not qualify as a security. While it serves as a legal contract outlining repayment, it lacks the characteristics that define financial securities, such as investment intent or collateral backing. This is particularly relevant in the case of a Delaware Balloon Unsecured Promissory Note, which operates outside the realm of traditional securities.

Promissory notes can be either secured or unsecured, depending on whether they are backed by collateral. An unsecured note does not provide the lender with a claim to any assets if the borrower defaults. The Delaware Balloon Unsecured Promissory Note specifically refers to instances where no collateral is involved, offering flexibility but also higher risk for lenders.

An unsecured promissory note is generally not considered a security. Since it does not have collateral backing it, it typically lacks the investment characteristics associated with securities. When dealing with instruments like the Delaware Balloon Unsecured Promissory Note, understanding this distinction can help you make informed financial decisions.

Generally, a promissory note is not classified as a security. However, if the note is secured by collateral or investment characteristics, it might fall under security regulations. Understanding the legal distinctions can be crucial, particularly when dealing with a Delaware Balloon Unsecured Promissory Note, which typically remains unsecured.