Delaware Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

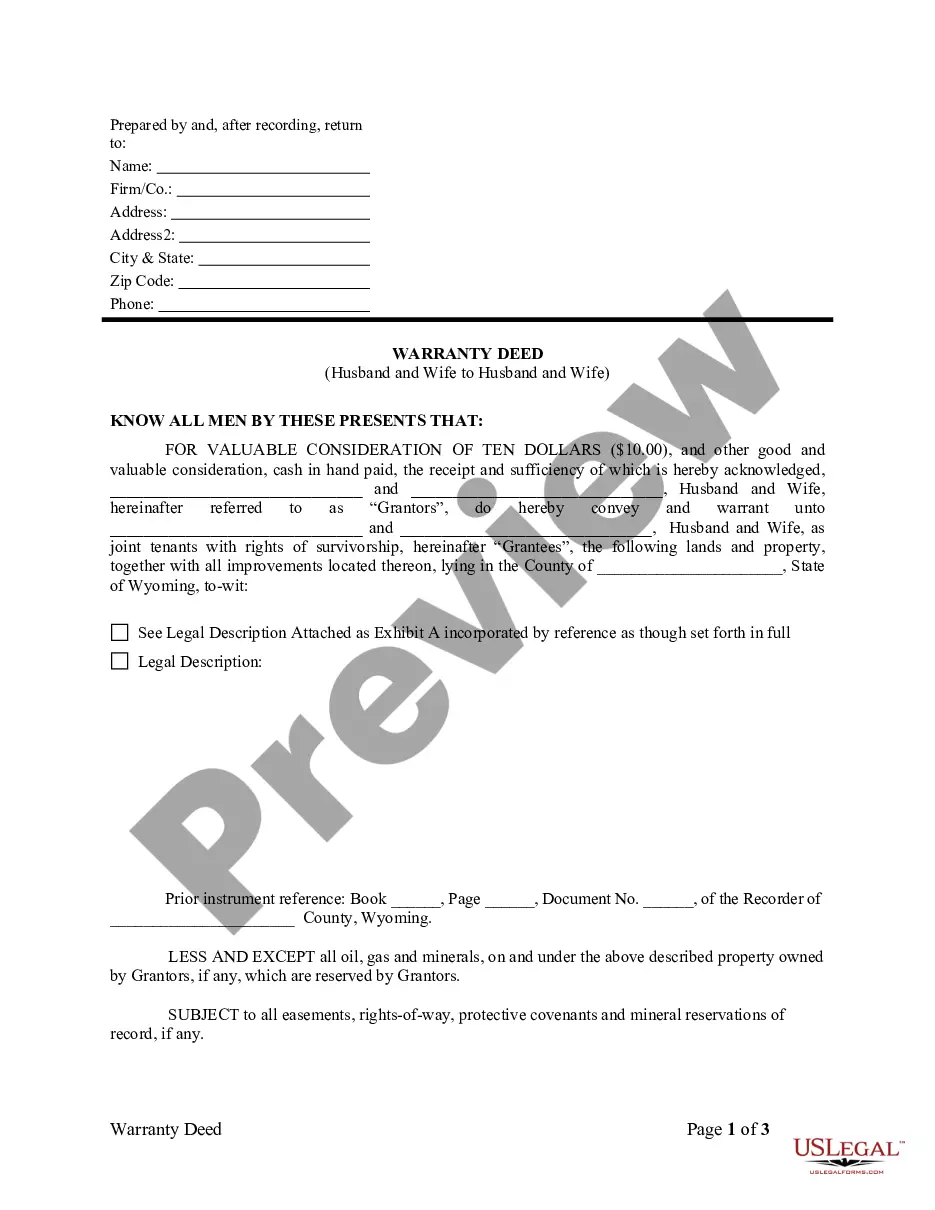

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

US Legal Forms - one of the largest libraries of legitimate varieties in the States - offers a wide array of legitimate papers web templates it is possible to down load or print out. While using website, you can find 1000s of varieties for enterprise and personal functions, sorted by types, claims, or search phrases.You will discover the latest variations of varieties like the Delaware Oil, Gas and Mineral Deed - Individual to Two Individuals within minutes.

If you already have a monthly subscription, log in and down load Delaware Oil, Gas and Mineral Deed - Individual to Two Individuals from your US Legal Forms local library. The Obtain switch can look on every kind you view. You gain access to all in the past delivered electronically varieties within the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, here are simple instructions to get you started out:

- Be sure you have chosen the best kind for your area/area. Click on the Preview switch to examine the form`s content. Look at the kind description to ensure that you have chosen the proper kind.

- When the kind doesn`t satisfy your demands, use the Lookup discipline towards the top of the display to discover the one that does.

- Should you be satisfied with the shape, confirm your choice by clicking on the Acquire now switch. Then, choose the prices plan you prefer and supply your accreditations to register for an accounts.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal accounts to perform the transaction.

- Find the format and down load the shape on your product.

- Make changes. Fill out, edit and print out and indication the delivered electronically Delaware Oil, Gas and Mineral Deed - Individual to Two Individuals.

Each and every web template you included in your account does not have an expiry day which is yours for a long time. So, if you wish to down load or print out an additional duplicate, just visit the My Forms portion and then click in the kind you want.

Gain access to the Delaware Oil, Gas and Mineral Deed - Individual to Two Individuals with US Legal Forms, by far the most considerable local library of legitimate papers web templates. Use 1000s of skilled and status-certain web templates that meet up with your company or personal requires and demands.

Form popularity

FAQ

Mineral rights may also be subject to transfers by way of a will. In the event of death, the right to the minerals passes to the person(s) named as beneficiaries. In the absence of specific heirs, the mineral rights pass to the beneficiary of the residual surface estate and real estate.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

Transfer By Will If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. It is also possible and often easier to create a family holding company and assign mineral rights to this company, creating a limited liability company (LLC) or partnership.

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

This legal document conveys the actual rights to the minerals while still remaining separate from the surface rights. A mineral deed can convey either 100 percent of the rights, or a percentage of those rights. If a percentage is granted with this legal document, then the holder of that grant owns that percentage.