Delaware Minutes for Partnership

Description

How to fill out Minutes For Partnership?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous trustworthy document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Delaware Minutes for Partnership, designed to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you want, enter the required information to create your account, and complete the transaction with your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Delaware Minutes for Partnership template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Get the form you need and ensure it is for the correct city/county.

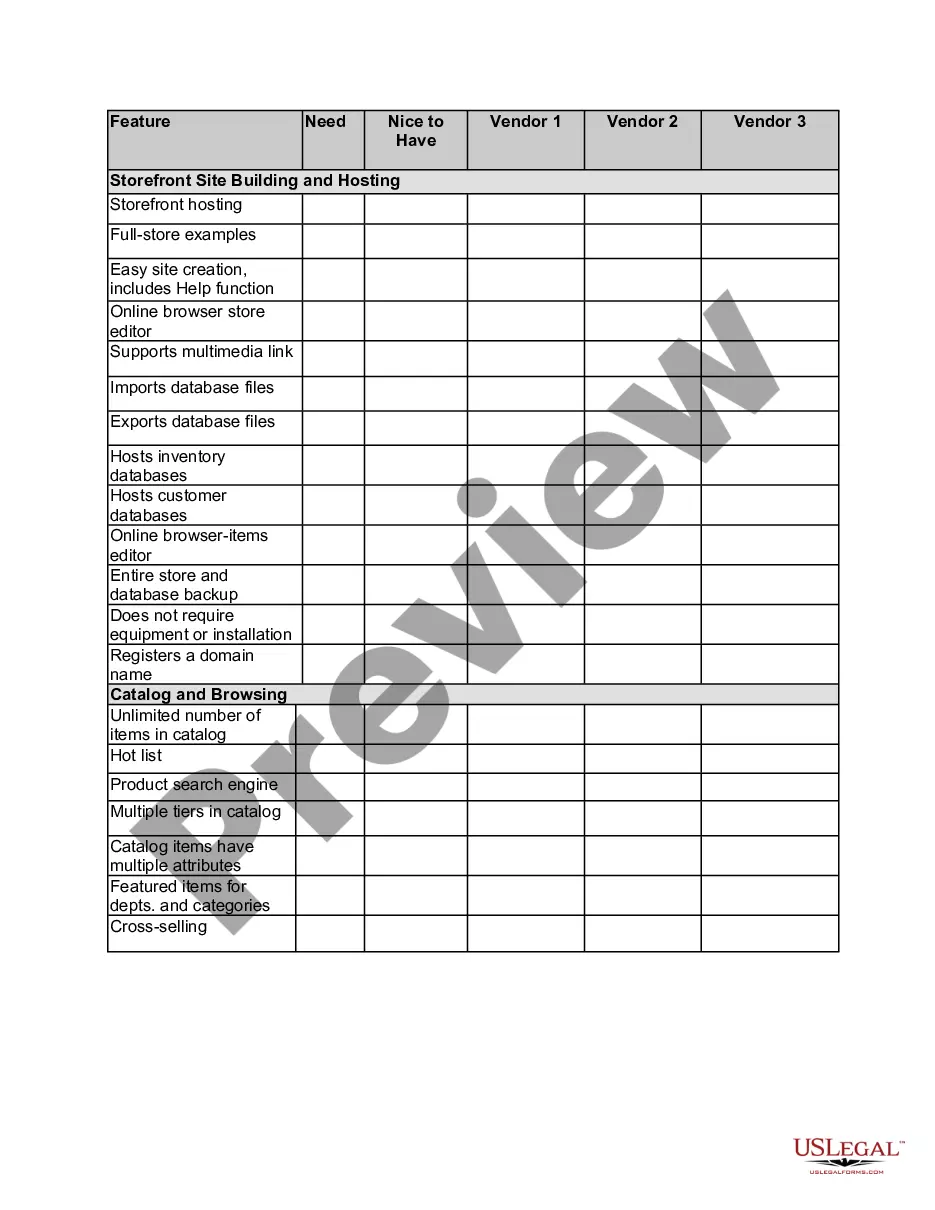

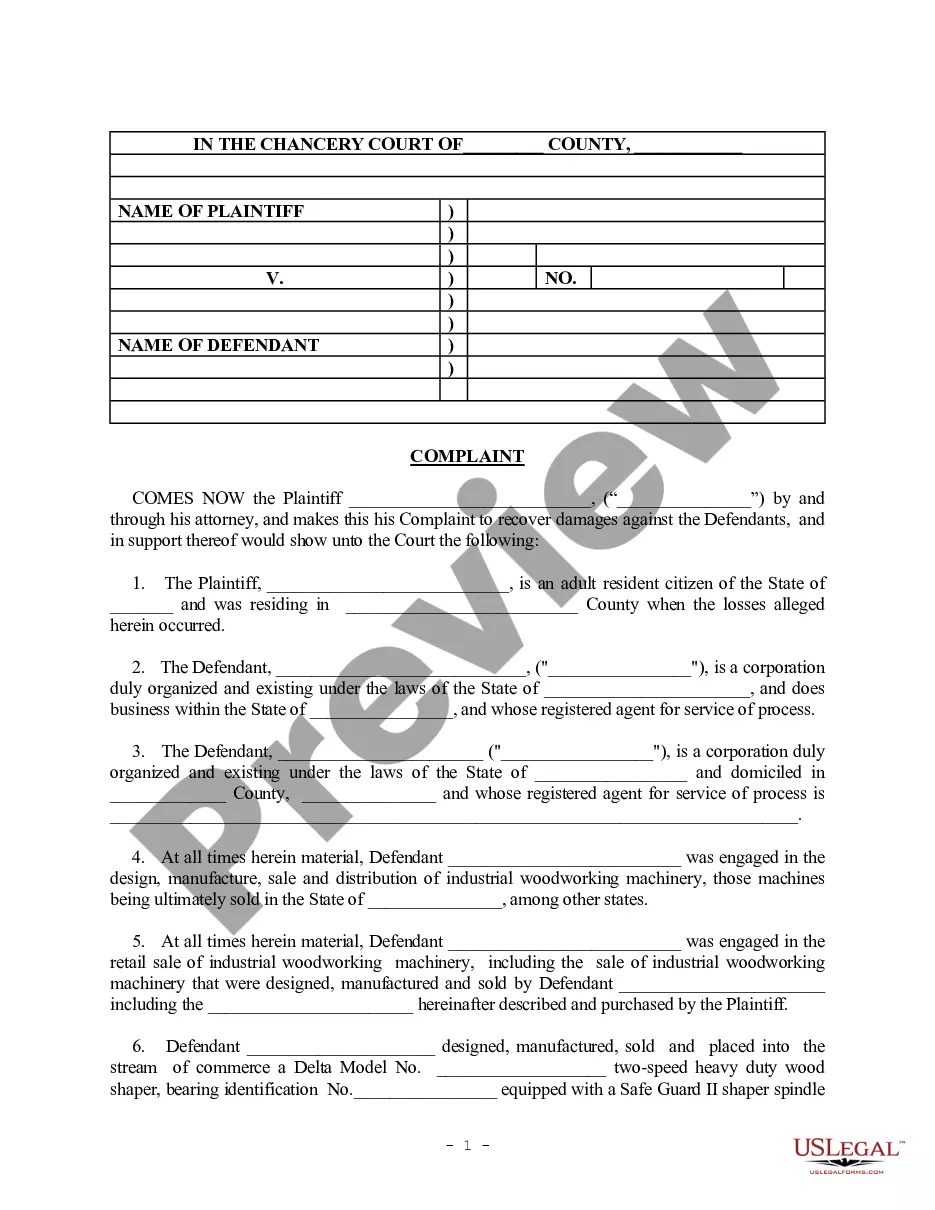

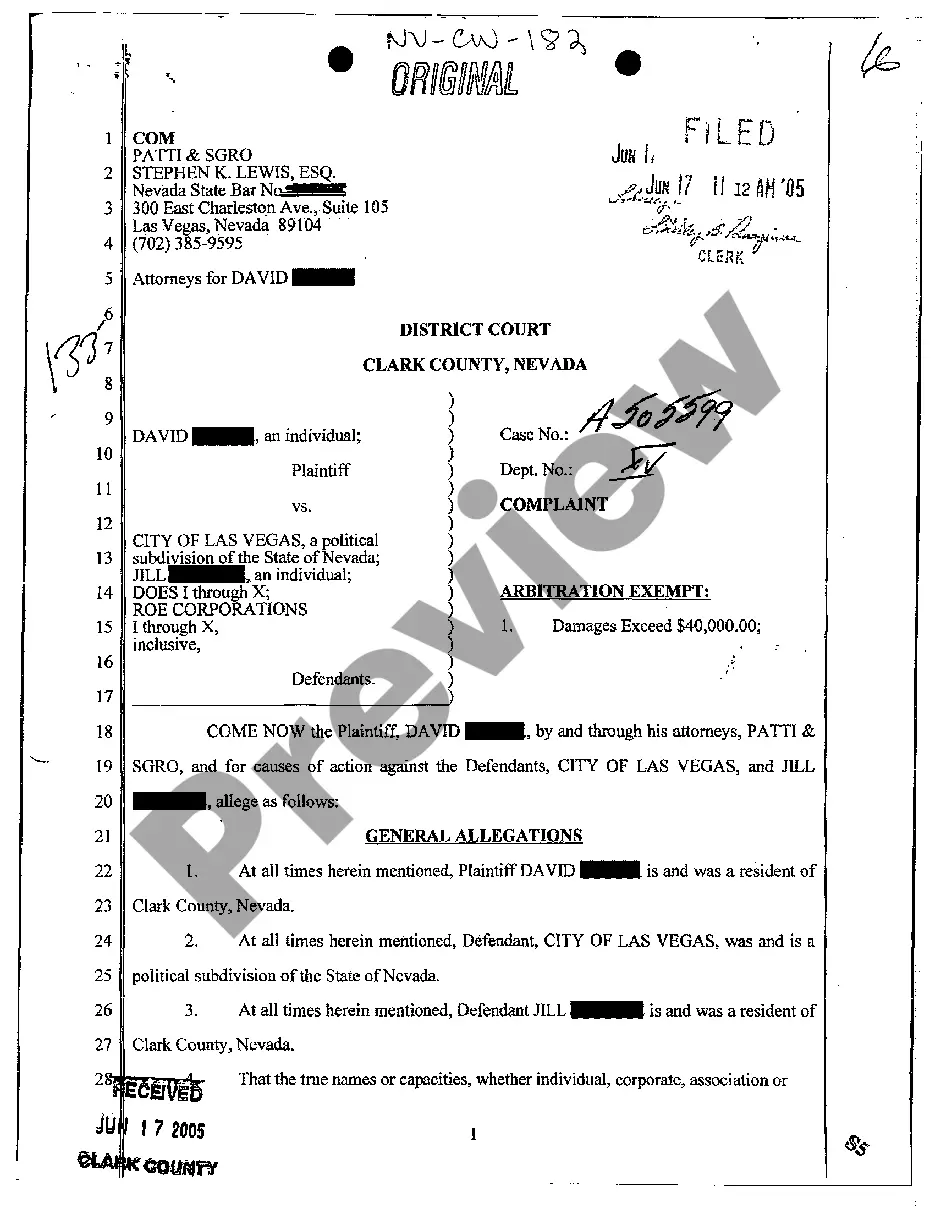

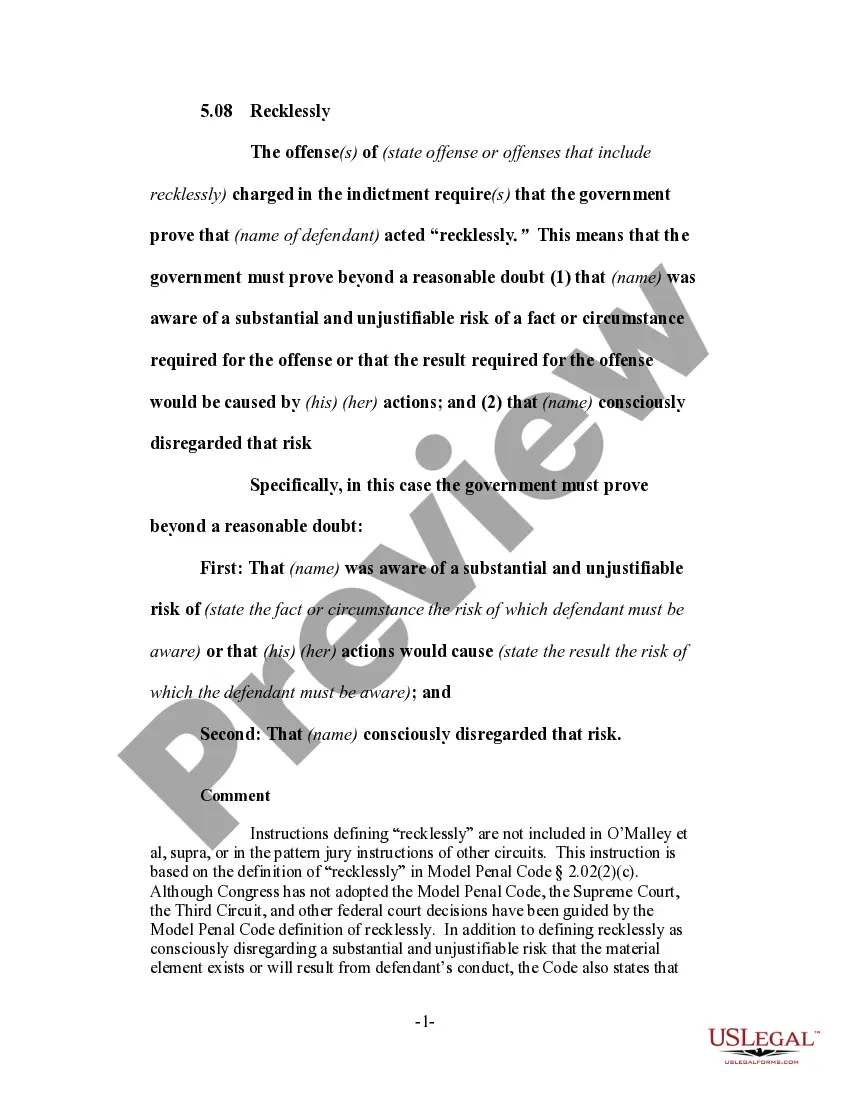

- Use the Review option to scrutinize the form.

- Read the details to confirm that you have chosen the correct form.

- If the form is not what you need, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

Five disadvantages of a partnership include shared profits, unlimited liability, potential for disputes, challenges in decision-making, and a limited lifespan. These factors can complicate the management of a partnership. However, effective practices and well-maintained Delaware Minutes for Partnership can help mitigate these issues and promote smoother operations.

Yes, New Jersey does accept the federal extension for partnerships. This makes it easier for partners to manage their filing deadlines. It's beneficial to use Delaware Minutes for Partnership to keep comprehensive records and ensure that your state filings align with federal extensions.

The duration of a partnership is typically defined in the partnership agreement. It can be set for a specific term or established as an ongoing arrangement until dissolved by the partners. Having well-documented Delaware Minutes for Partnership can help track any changes to the partnership's duration and ensure compliance.

Running a partnership meeting involves setting a clear agenda and allowing all partners to contribute. Begin with updates, discuss key decisions, and allocate time for questions. Documenting these discussions using Delaware Minutes for Partnership is critical, as it provides a formal record of what transpired and supports transparent communication.

Delaware does not legally mandate a limited partnership agreement, but having one is highly advisable. This agreement outlines the rights, responsibilities, and profit-sharing regarded by partners. Incorporating Delaware Minutes for Partnership can enhance the clarity and enforceability of this crucial document.

Minnesota does accept federal extensions for partnerships. However, specific rules apply, so it’s important to confirm eligibility and follow the state’s guidelines. Keeping clear Delaware Minutes for Partnership can assist you in tracking important filing dates and ensuring compliance across state lines.

Delaware does allow for extensions on partnership tax returns. If you require more time to file, you can request an extension through the appropriate channels. Ensuring your Delaware Minutes for Partnership are up to date can help you manage timelines and avoid penalties effectively.

Yes, Delaware has specific filing requirements for partnerships. While partnerships do not need to file an annual report, they must file a tax return. Utilizing Delaware Minutes for Partnership can help you document compliance and maintain organized records for any required filings.

Partnerships do not typically have units like corporations. Instead, partners own percentage interests in the partnership, which determine their share of profits and losses. Keeping track of these interests can be streamlined with accurate Delaware Minutes for Partnership. This ensures clarity in ownership and decision-making.

To request an extension for a partnership in Delaware, you must file a form with the Delaware Division of Corporations. Start by obtaining the necessary paperwork, which you can find on the official Delaware government website. When completing the form, ensure you provide accurate details about your partnership and clearly state the reason for the extension. For more streamlined assistance, consider using USLegalForms, which offers guidance and templates tailored to Delaware Minutes for Partnership.