Delaware Partnership Resolution to Sell Property

Description

How to fill out Partnership Resolution To Sell Property?

It is feasible to spend several hours online trying to locate the authentic document template that meets both state and federal requirements you need.

US Legal Forms provides a multitude of valid templates that have been reviewed by professionals.

You can obtain or print the Delaware Partnership Resolution to Sell Property from the service.

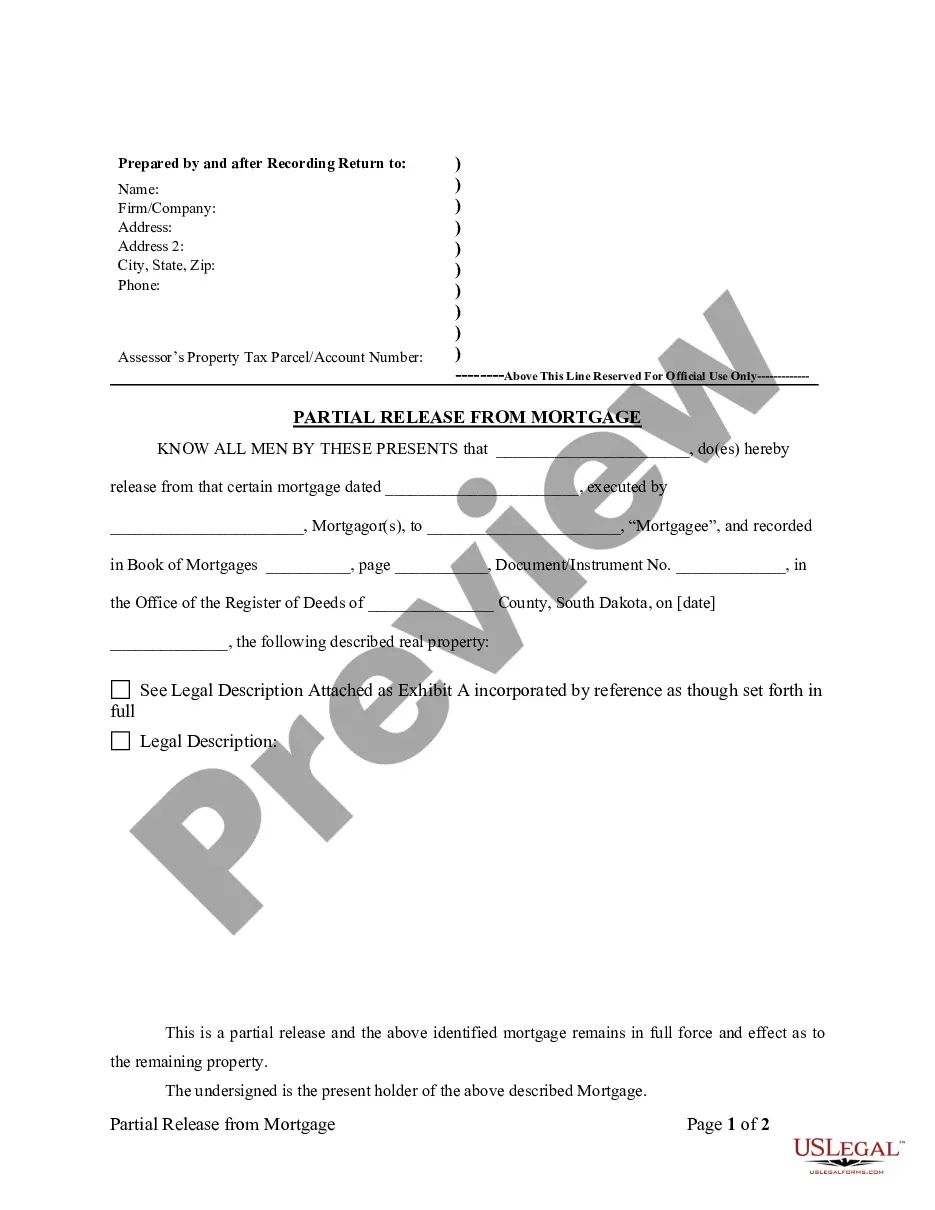

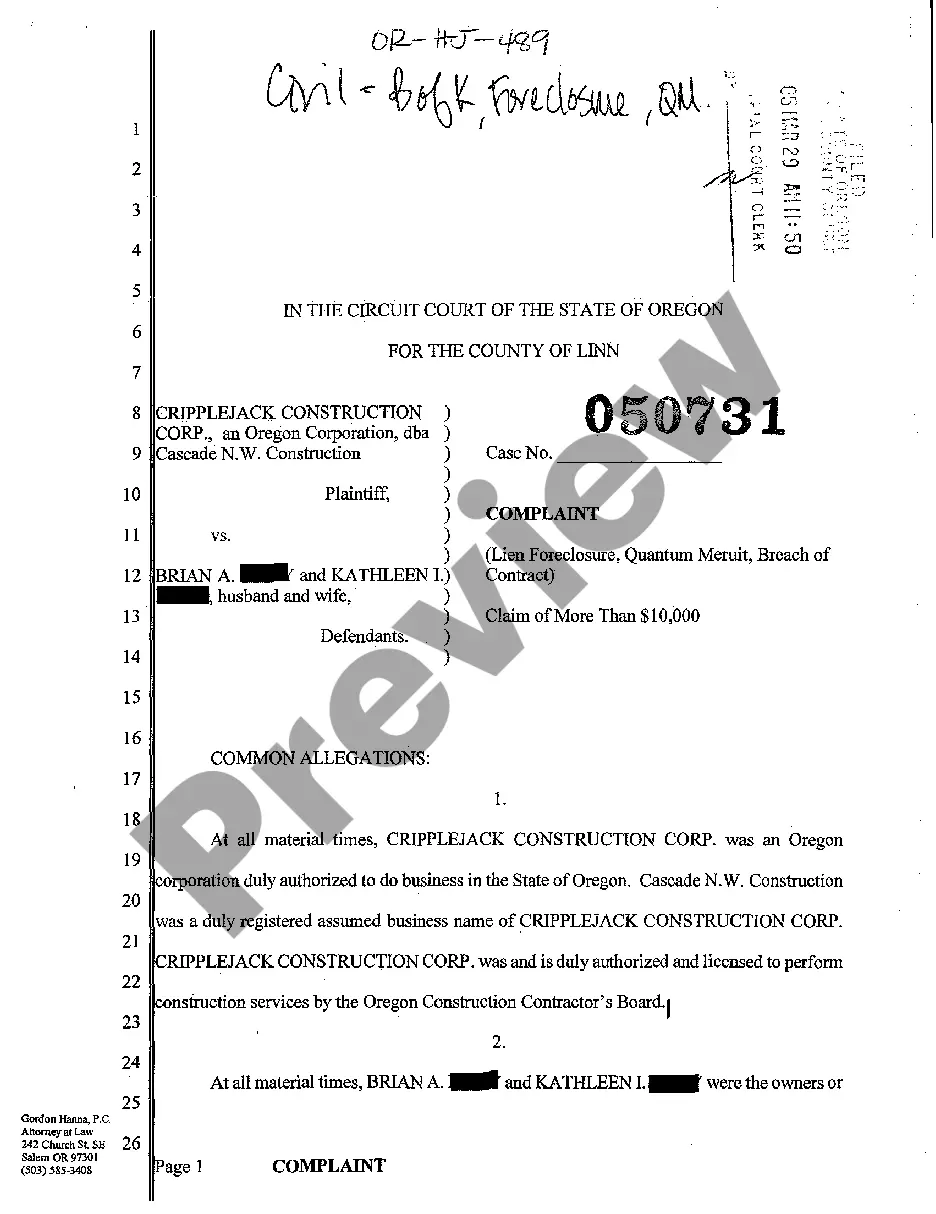

If available, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Delaware Partnership Resolution to Sell Property.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of the acquired form, go to the My documents section and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the straightforward guidelines below.

- First, ensure that you have chosen the correct document template for the region/city you select.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

Partnership resolution definition refers to resolving a dispute between partners in a business partnership. The way certain disputes in partnership will be handled should be spelled out in the partnership agreement.

Because the Agreement of Limited Partnership is considered an investment contract, the SEC classifies LP units as securities. If the partnership is sold to the public, then they must be registered under the Securities Act of 1933.

Even if the partnership failed to register with the SEC, it still has a separate juridical personality. Thus, the partnership, as a separate person can acquire its own property, bring actions in court in its own name and incur its own liabilities and obligations.

A limited partnership must have at least one general partner and at least one limited partner. The principal distinguishing feature of a limited partnership is that the limited partners are not personally liable for the debts and obligations of the partnership. The general partner remains fully liable.

Delaware Revised Uniform Limited Partnership Act (the "Act"). An ELP as such is not an entity with separate legal personality, and cannot own property in its own right; the general statutory position is that the property of the ELP will be held on statutory trusts by the GPs jointly under section 6(2) of the Law.

Limited partnership structures have become an increasingly common form of property investment vehicle over recent years and it is easy to forget that (unlike limited companies or limited liability partnerships) they are not legal personalities.

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership);

Delaware partnerships, which are separate legal entities, are governed by the Delaware Revised Uniform Partnership Act (for general partnerships and LLPs) and the Delaware Revised Uniform Limited Partnership Act (for LPs).

Each state has its own rules, but in general you must pay a fee and file papers with the state, usually a "certificate of limited partnership" or "certificate of limited liability partnership." This document is similar to the articles (or certificate) filed by a corporation or an LLC and includes information about the

In case of appointing a limited partner of a non-resident company, registration of an extra-provincial corporation in Ontario is not required. General partner and limited partner may be one and the same person. Therefore, one person is actually required to register LP.