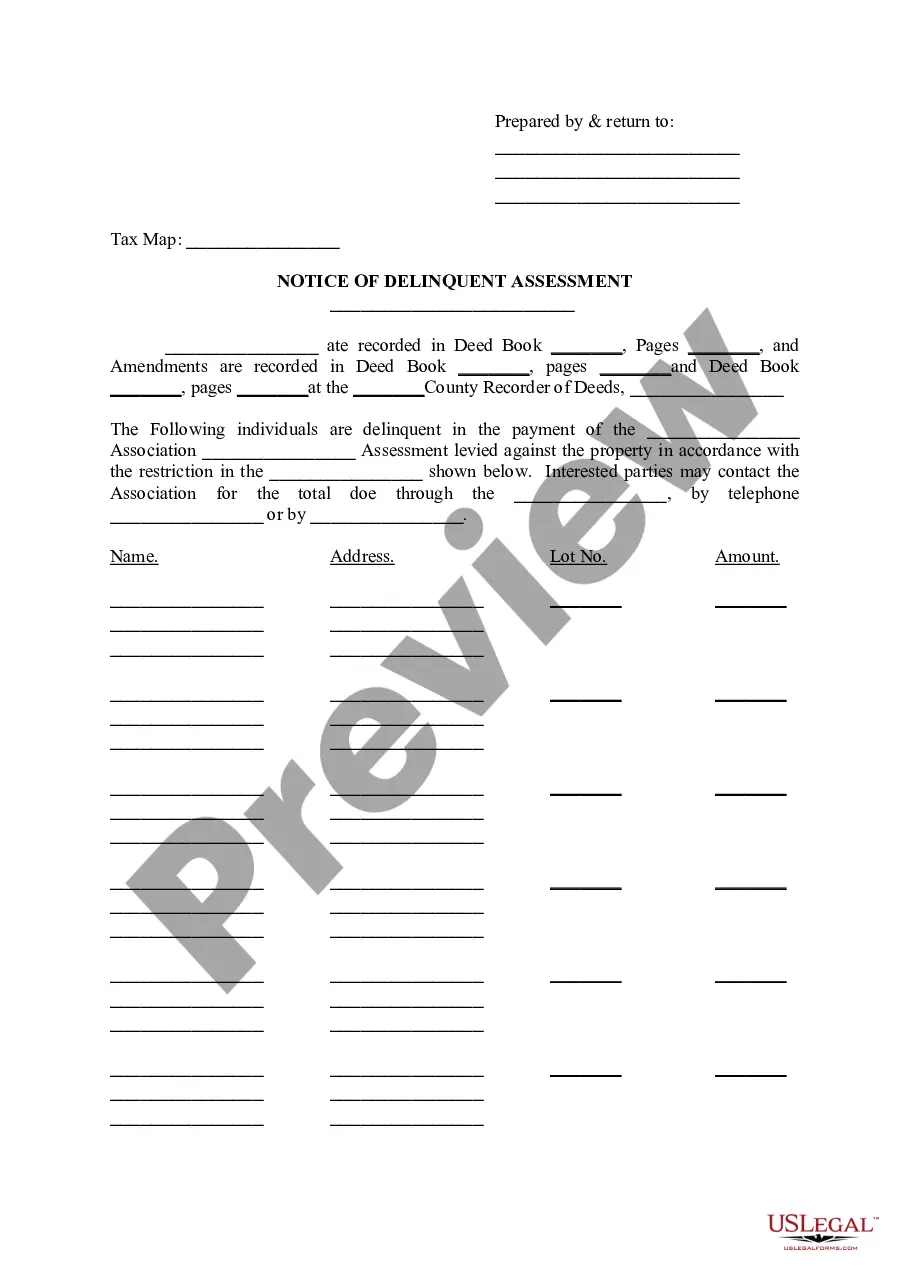

Delaware Notice of Delinquent Assessment

Description

How to fill out Delaware Notice Of Delinquent Assessment?

Utilize US Legal Forms to acquire a printable Delaware Notice of Delinquent Assessment.

Our court-recognized forms are crafted and frequently refreshed by expert attorneys.

Ours is the most comprehensive Forms repository online and offers cost-efficient and precise templates for consumers, legal practitioners, and small to medium-sized businesses.

Click Buy Now if it’s the template you wish. Create your account and pay via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. Use the search engine to find another document template. US Legal Forms offers a wide array of legal and tax templates and packages for business and personal requirements, including the Delaware Notice of Delinquent Assessment. Over three million users have successfully utilized our service. Choose your subscription plan and acquire high-quality documents in just a few clicks.

- Templates are sorted into state-specific categories, and several can be viewed prior to downloading.

- To download samples, users must possess a subscription and Log In to their account.

- Click Download next to any form you desire and locate it in My documents.

- For individuals without a subscription, follow the suggestions below to swiftly locate and retrieve the Delaware Notice of Delinquent Assessment.

- Ensure you obtain the correct template according to the state requirements.

- Examine the document by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

The term delinquent refers to failing to fulfill a financial obligation or duty by the agreed-upon deadline. In the context of homeowners associations, a delinquent status often pertains to unpaid assessments or dues. This can result in further action, such as the issuance of a Delaware Notice of Delinquent Assessment, which serves as an official reminder to rectify the outstanding payments and avoid additional penalties.

If your account is delinquent, it means you have not met your financial obligations by the due date. This could involve unpaid fees, assessments, or dues associated with your HOA or community association. Delinquent accounts could lead to enforcement actions, including the issuance of a Delaware Notice of Delinquent Assessment, which formally notifies you of your outstanding debts and the potential consequences.

Chapter 81 of Title 25 of Delaware relates to the administration of condominiums and community associations, including regulations around assessments. This chapter provides the legal framework for governance, financial obligations, and enforcement measures within homeowners associations. Understanding this chapter can offer essential insights into managing assessments and addressing the Delaware Notice of Delinquent Assessment effectively.

To dissolve a Homeowners Association (HOA) in Delaware, you must first review the association's governing documents. These documents typically outline the process for dissolution, including required votes from members. Additionally, you may need to settle any outstanding financial responsibilities and notify your members. If a Delaware Notice of Delinquent Assessment is pending, addressing it promptly is crucial to ensure a smooth dissolution.

In Delaware, property tax exemptions are not directly tied to a specific age, but many counties offer tax relief programs for seniors. Typically, individuals aged 65 and over may qualify for exemptions or reductions. It's crucial to check with your local tax authority to understand the specific benefits available to you. Properly navigating these benefits can help you manage your taxes, particularly in relation to any Delaware Notice of Delinquent Assessment you might receive.

Yes, Delaware LLCs are required to file an annual report with the state. This report includes basic information about the company and ensures that the business remains in good standing. Failure to file can result in penalties and could lead to the issuance of a Delaware Notice of Delinquent Assessment. Staying compliant with filing requirements helps you avoid unnecessary complications and fees.

In Delaware, certain individuals and entities may qualify for property tax exemptions. Common exemptions include those for veterans, active-duty military members, and nonprofits. Additionally, properties owned by senior citizens or persons with disabilities may be eligible for reduced property tax rates. Understanding your status is important, especially when dealing with the Delaware Notice of Delinquent Assessment, as exemptions can prevent unexpected charges.

Delinquent assessments refer to unpaid taxes that property owners owe to local governments. When these taxes go unpaid, municipalities issue a Delaware Notice of Delinquent Assessment to notify property owners of their outstanding obligations. This notice serves as an important document, as it can lead to tax sales if the debt is not resolved. Understanding your delinquent assessments can help you avoid losing your property and ensure you remain compliant with local regulations.