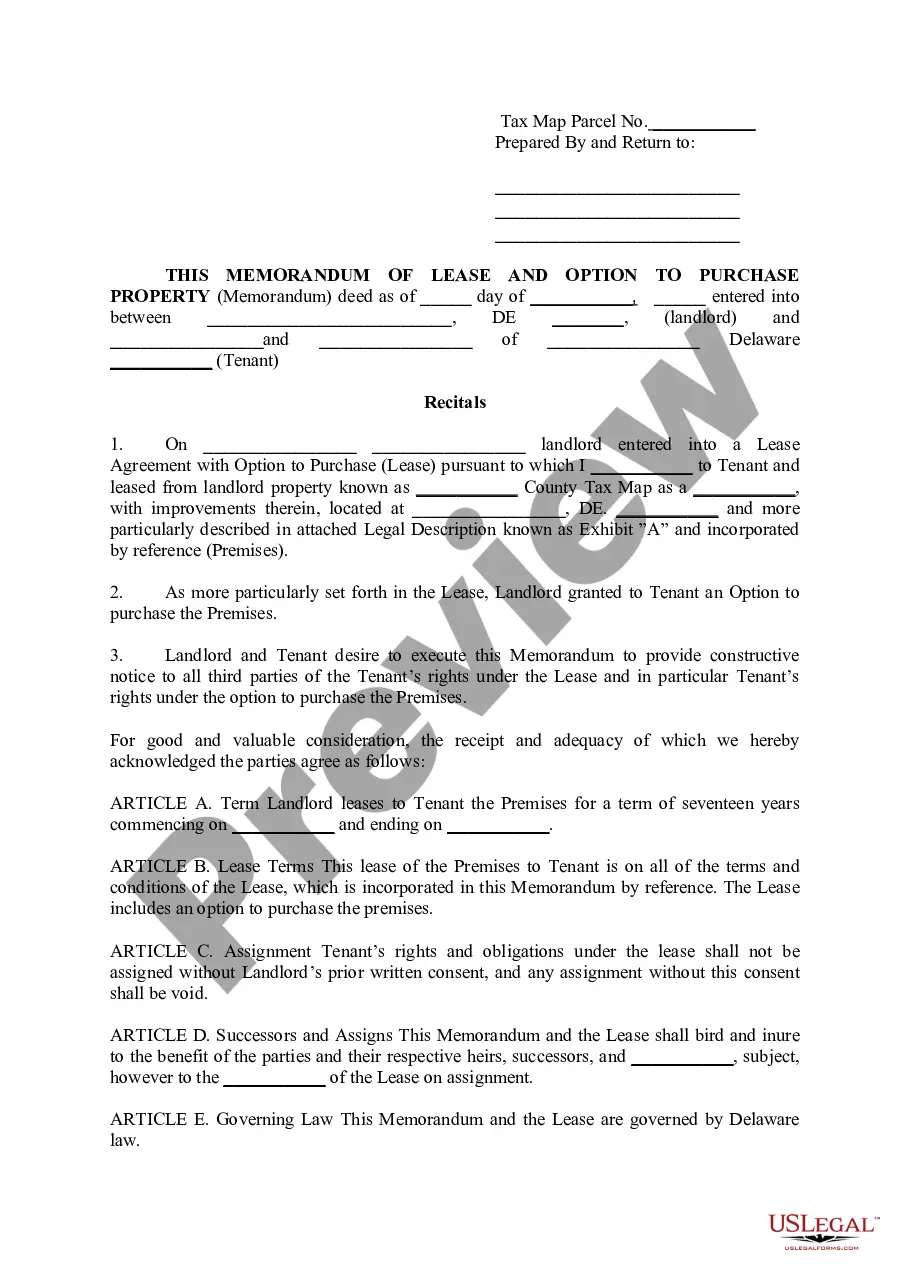

Delaware This Memorandum of Lease and Option to Purchase Property

Description

How to fill out Delaware This Memorandum Of Lease And Option To Purchase Property?

Utilize US Legal Forms to obtain a printable Delaware This Memorandum of Lease and Option to Buy Property.

Our court-acceptable forms are crafted and consistently revised by experienced attorneys.

Ours is the most comprehensive Forms collection on the web and offers economical and precise templates for clients, legal experts, and small to medium-sized businesses.

Hit Buy Now if it’s the template you require. Establish your account and pay using PayPal or credit card. Download the template to your device and feel free to use it repeatedly. Leverage the Search feature if you need to find another document template. US Legal Forms offers a vast array of legal and tax documents and bundles for both business and personal requirements, including Delaware This Memorandum of Lease and Option to Buy Property. More than three million users have already successfully used our platform. Choose your subscription option and obtain high-quality forms in just a few clicks.

- The templates are categorized according to state-specific sections, and some can be viewed prior to being downloaded.

- To acquire templates, users must possess a subscription and Log In to their account.

- Select Download next to any form you desire and locate it in My documents.

- For those without a subscription, adhere to the suggestions below to swiftly locate and download Delaware This Memorandum of Lease and Option to Buy Property.

- Confirm that you select the appropriate template for the required state.

- Examine the document by reviewing the details and utilizing the Preview function.

Form popularity

FAQ

The Delaware Memorandum of Lease serves as an important document that summarizes the main terms of a lease agreement. It provides a clear outline of the rights and responsibilities for both the landlord and tenant. This document does not replace the full lease but allows for easy reference and ensures both parties are aligned. By using this memorandum, you can reduce potential disputes and ensure a smoother leasing process.

To record a memorandum of lease in Delaware, you need to prepare the document, ensuring it contains all legal requirements. Next, you should file it with the appropriate county recorder’s office where the property is located. This process provides public notice of your lease agreement and your rights regarding the property in question. Using a reliable resource like USLegalForms can simplify this process and ensure all necessary details are included.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

Under a rent-to-own agreement, the buyer and seller agree on a sale price for a property and then the buyer pays rent on property for a certain predetermined period. A portion of the rent payments that the buyer makes toward the property during the rental period accrue as a down payment toward buying the property.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

To make money with a lease option the investor must find a renter to pay more than the amount the investor agreed to with the property owner. For example, if the investor agreed to pay $1500 each month but finds a tenant to pay $1800 each month, the investor makes a monthly income of $300 for the property.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period. It also precludes the owner from offering the property for sale to anyone else. When the term expires, the renter must either exercise the option or forfeit it.

Collect each party's information. Include specifics about your property. Consider all of the property's utilities and services. Know the terms of your lease. Set the monthly rent amount and due date. Calculate any additional fees. Determine a payment method. Consider your rights and obligations.

A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.