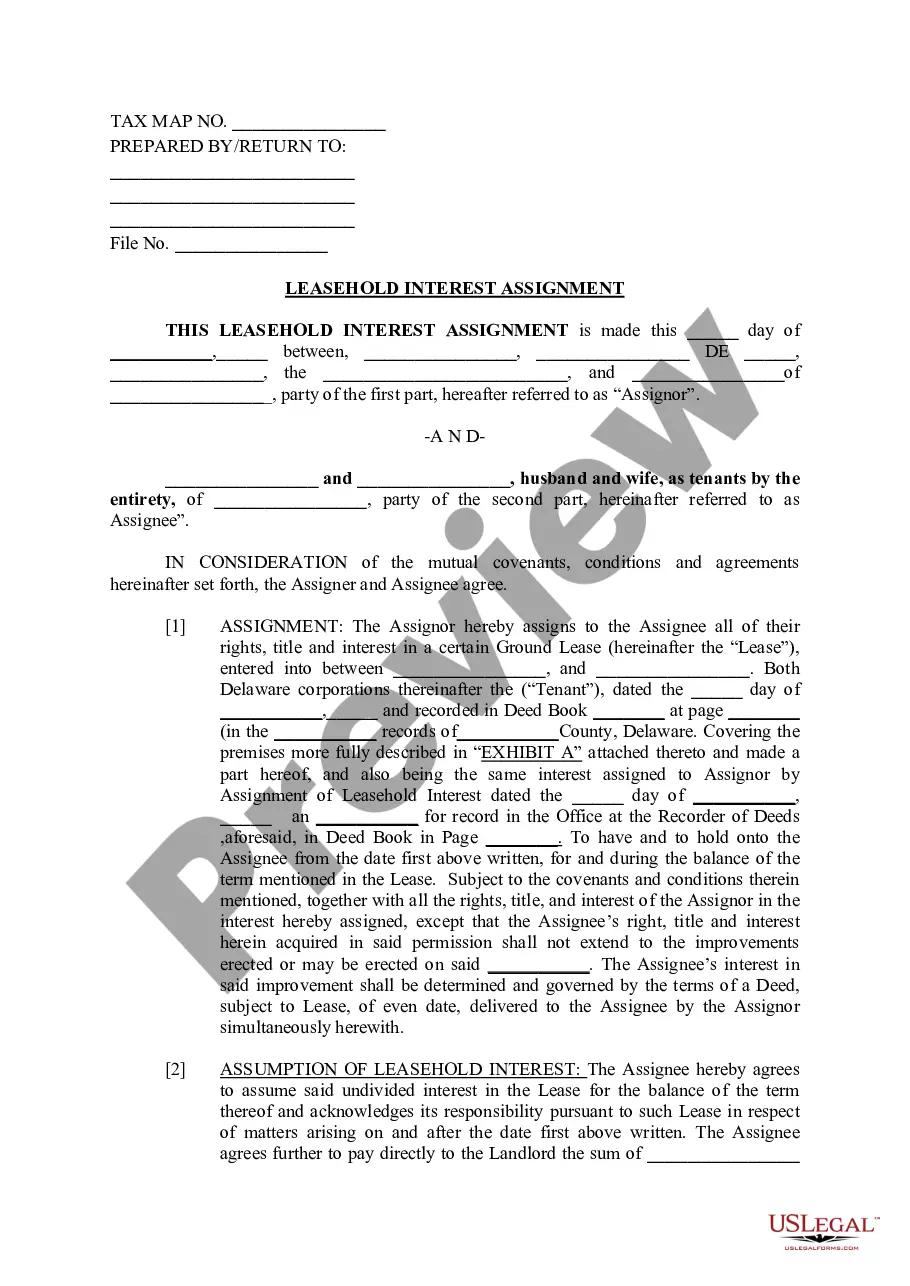

Delaware Leasehold Interest Assignment

Description

How to fill out Delaware Leasehold Interest Assignment?

Utilize US Legal Forms to obtain a printable Delaware Leasehold Interest Assignment.

Our court-acceptable documents are created and consistently refreshed by experienced attorneys.

Ours is the most comprehensive Forms collection available online and offers cost-effective and precise samples for individuals, attorneys, and small to medium-sized businesses.

Hit Buy Now if it is the document you need. Create your account and pay via PayPal or credit card. Download the template to your device and feel free to reuse it as needed. Use the Search field if you want to find another document template. US Legal Forms provides thousands of legal and tax samples and packages for both business and personal requirements, including Delaware Leasehold Interest Assignment. Over three million users have successfully used our platform. Select your subscription plan and obtain high-quality documents in just a few clicks.

- The documents are categorized by state, and several of them can be previewed before downloading.

- To download templates, users must have a subscription and need to Log In to their account.

- Click Download next to any template you wish and locate it in My documents.

- For users without a subscription, follow the guidelines below to easily find and download Delaware Leasehold Interest Assignment.

- Ensure you have the correct form according to the state it is required in.

- Examine the document by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

Certain transactions in Delaware are exempt from the realty transfer tax, such as transfers between spouses or inheritances. These exemptions apply to specific scenarios, providing relief for those engaged in a Delaware Leasehold Interest Assignment. Always verify your eligibility for any exemptions by consulting legal resources or platforms like U.S. Legal Forms to ensure you comply with all regulations.

Delaware's transfer tax is considered high compared to some other states because it helps fund local government services and infrastructure. This 3% tax is applied to all real estate transactions, including Delaware Leasehold Interest Assignments. While it may seem burdensome, these funds support public projects that benefit residents. Understanding the rationale behind this tax can help buyers and sellers navigate their expectations.

Delaware does not impose a sales tax on the sale of real property. This makes it an attractive market for buyers looking for a Delaware Leasehold Interest Assignment. However, keep in mind that other fees, such as transfer taxes, still apply. Be sure to review all potential costs when purchasing property in Delaware.

In Delaware, the seller typically pays the transfer taxes at closing. However, it is important to negotiate this during the sale process as both parties can agree on different arrangements. Understanding who pays these taxes is crucial for buyers and sellers involved in a Delaware Leasehold Interest Assignment. Sellers should plan accordingly to account for this expense when finalizing their sale.

Appraising leasehold interest involves evaluating the rights and benefits a tenant has under the lease. Factors like location, lease terms, and market conditions are considered to determine value. Understanding the process of Delaware Leasehold Interest Assignment can help you grasp how an appraisal influences the value during a transfer or sale.

A leasehold interest grants a tenant the right to use and occupy a property for a defined period in exchange for rent. This interest is tied to the terms specified in the lease, which can include various conditions and rights. When you look into Delaware Leasehold Interest Assignment, you are exploring how to transfer this valuable right to another party.

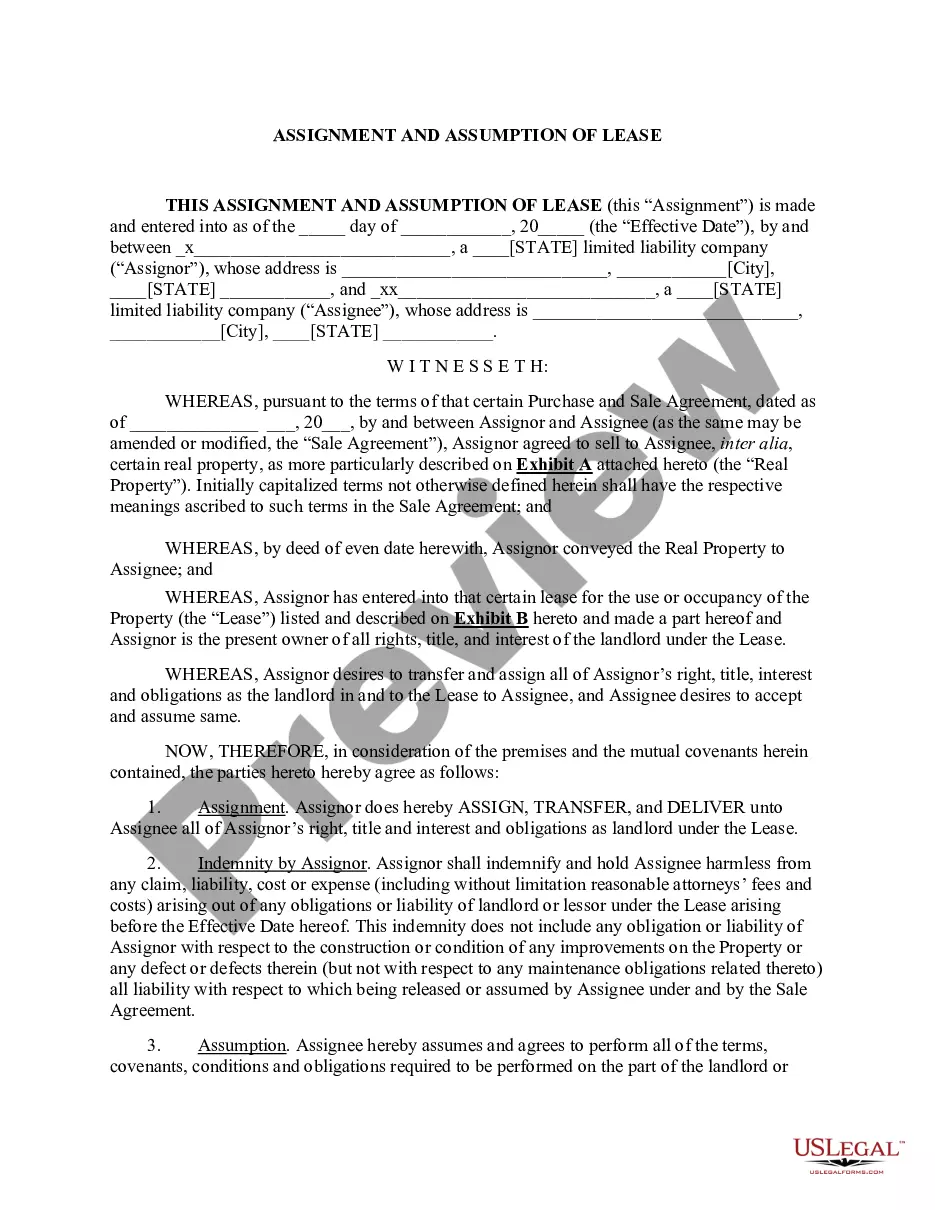

An assignment of leasehold is the transfer of a tenant's interest in a lease to a third party. This action allows the third party to step in as the tenant under the existing terms of the lease. In Delaware, this transaction is often facilitated through a Delaware Leasehold Interest Assignment, ensuring that all legal and procedural aspects are properly addressed.

The assignment of leasehold interest is a formal process by which a tenant transfers their rights and obligations to use a leased property to another individual or entity. This usually involves creating a Delaware Leasehold Interest Assignment document. It's essential to ensure that this assignment aligns with the original lease agreement and state regulations.

The assignment of interest refers to the process of transferring your rights in a leasehold interest to another party. This transfer is documented through a legal agreement, often referred to as a Delaware Leasehold Interest Assignment. By completing this process, you relinquish your rights and responsibilities under the lease, allowing someone else to step in.

Yes, you can sell a leasehold interest, but it's important to follow the lease terms and any state laws. The sale typically involves a Delaware Leasehold Interest Assignment, which legally transfers your rights and obligations to the new buyer. Always make sure that the lease permits such transactions and consult with an expert to ensure everything is done correctly.