Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership

Description

How to fill out Delaware Certificate Of Conversion From Statutory Trust To Limited Liability Partnership?

Handling legal paperwork necessitates focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals across the nation in achieving this for 25 years, so when you select your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership template from our collection, you can feel confident that it adheres to federal and state regulations.

Collaborating with our service is straightforward and swift. To access the required documents, all you need is an account with a valid subscription. Here’s a concise guideline for you to acquire your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership in just minutes.

All documents are designed for multiple uses, just like the Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership you see here. If you require them again, you can fill them out without repaying - simply navigate to the My documents tab in your profile and complete your document whenever necessary. Explore US Legal Forms and complete your business and personal paperwork quickly and in full legal compliance!

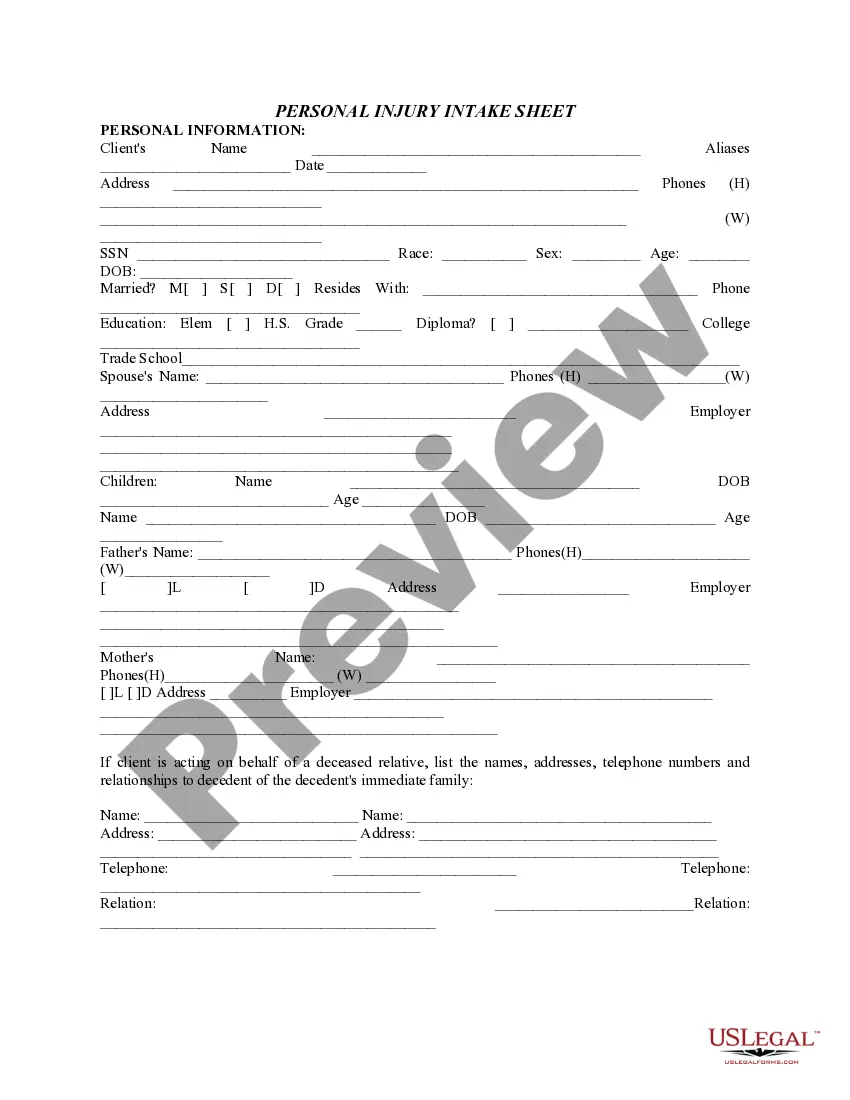

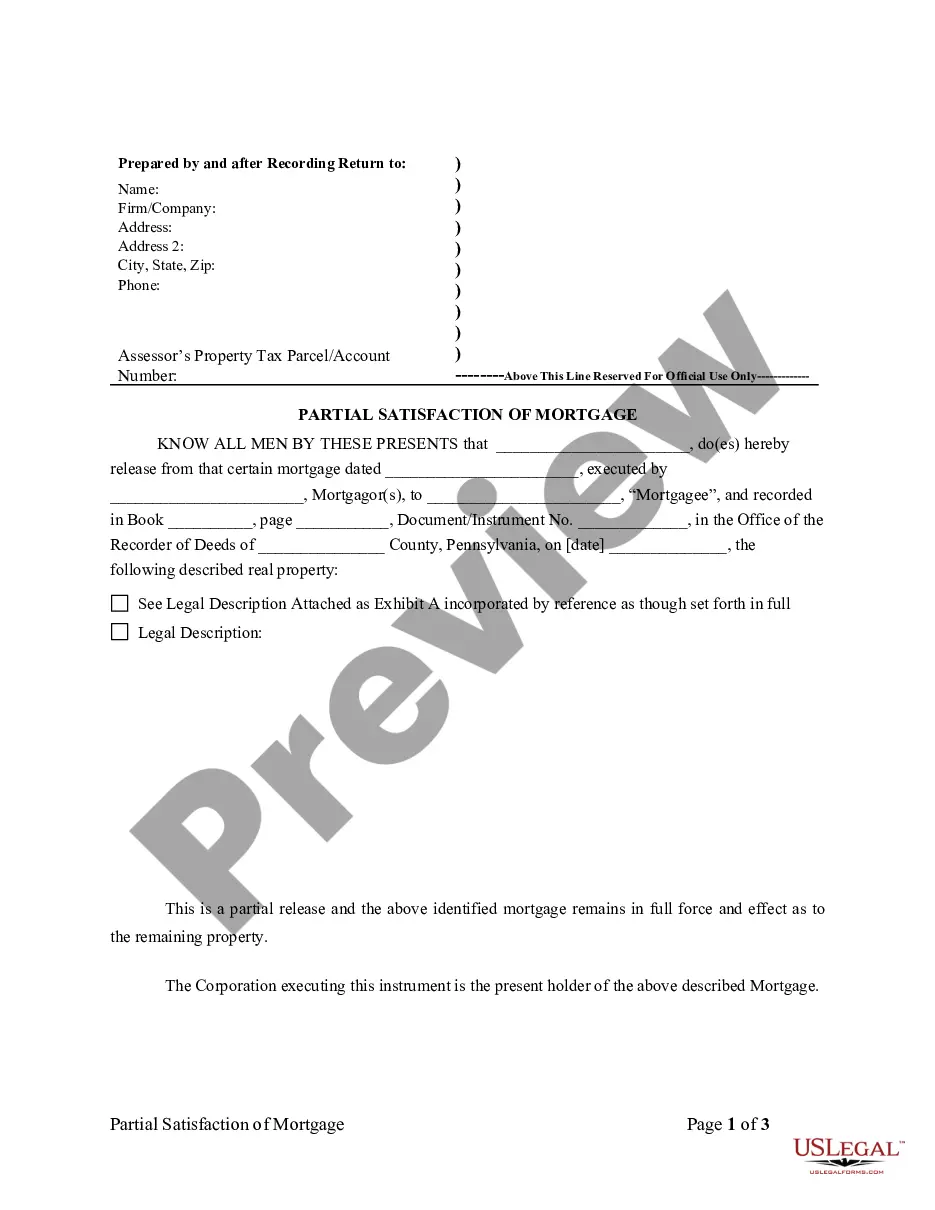

- Ensure to carefully examine the form content and its alignment with general and legal standards by previewing it or reading its description.

- Search for another official template if the one you previously opened doesn’t fit your circumstances or state statutes (the tab for that is on the upper page corner).

- Log in to your account and save the Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership in your desired format. If this is your first experience with our service, click Buy now to proceed.

- Establish an account, select your subscription plan, and pay using your credit card or PayPal account.

- Choose the format you wish to save your form in and click Download. Print the blank form or upload it to a professional PDF editor to prepare it digitally.

Form popularity

FAQ

To obtain a Certificate of Formation, you need to file the appropriate paperwork with your state's Secretary of State or equivalent office. In Delaware, this process can be completed online, ensuring a smooth experience. Also, if you're converting a business type, like a statutory trust to a limited liability partnership, our platform, USLegalForms, can guide you through creating the necessary documents, including your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

Getting a copy of your Certificate of Formation in Delaware starts with visiting the Delaware Division of Corporations' website. There, you can search for your business by name. After locating your entity, you can order a copy of the certificate online. This is especially important if you are in the process of filing your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

To obtain a copy of your Certificate of Formation in Delaware, you can request it through the Delaware Division of Corporations. They provide an easy online service for individuals and businesses. Simply enter your business name or file number, and you can access your documents quickly. Whether you require this for your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership or other purposes, this process is both straightforward and efficient.

While both documents serve to establish a business entity in Delaware, they are not exactly the same. The Certificate of Formation is used for limited liability companies (LLCs) and partnerships, while the Articles of Incorporation apply to corporations. If you're looking to convert a statutory trust to a limited liability partnership, understanding these distinctions is essential when preparing your Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

While Delaware offers many advantages for LLC formation, there are a few potential downsides. For instance, Delaware LLCs are subject to an annual franchise tax, which can be a financial consideration. Furthermore, if your business operates in another state, you may need to register as a foreign LLC there, which involves additional fees and paperwork. It’s wise to weigh these factors against the benefits of utilizing a Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

Converting to an LLC in Delaware involves filing a Certificate of Conversion along with your new LLC's Certificate of Formation. Make sure to include all required information about your current entity and the new LLC. This process can be streamlined by utilizing a Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership, ensuring all legal requirements are met. Once approved, you will have a registered LLC, ready to operate.

To register a limited partnership in Delaware, you need to file a Certificate of Limited Partnership with the Delaware Division of Corporations. Ensure you include necessary details such as the name of the partnership and the registered agent's information. Once filed, you will receive a stamped copy, which serves as proof of your registration. If you're transitioning from a statutory trust, consider obtaining a Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership for a smooth process.

Section 18 607 of the Delaware Limited Liability Company Act details the cancellation of a limited liability company’s certificate of formation. This section is particularly relevant if you wish to dissolve an existing LLC before converting to a different entity type. Understanding how this section operates can be essential when obtaining the Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

Section 18 703 of the Delaware Limited Liability Company Act pertains to the conversion of entities. This section outlines the process for an entity to convert into a limited liability company or change its form. If you are looking to convert from a statutory trust to an LLP, referencing this section can provide valuable insights on required steps and documentation like the Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership.

Setting up a limited partnership in Delaware involves a few steps, starting with choosing a unique name for your partnership. You must then file a Certificate of Limited Partnership with the Delaware Secretary of State. For those converting from a statutory trust, obtaining the Delaware Certificate of Conversion From Statutory Trust To Limited Liability Partnership streamlines this process.