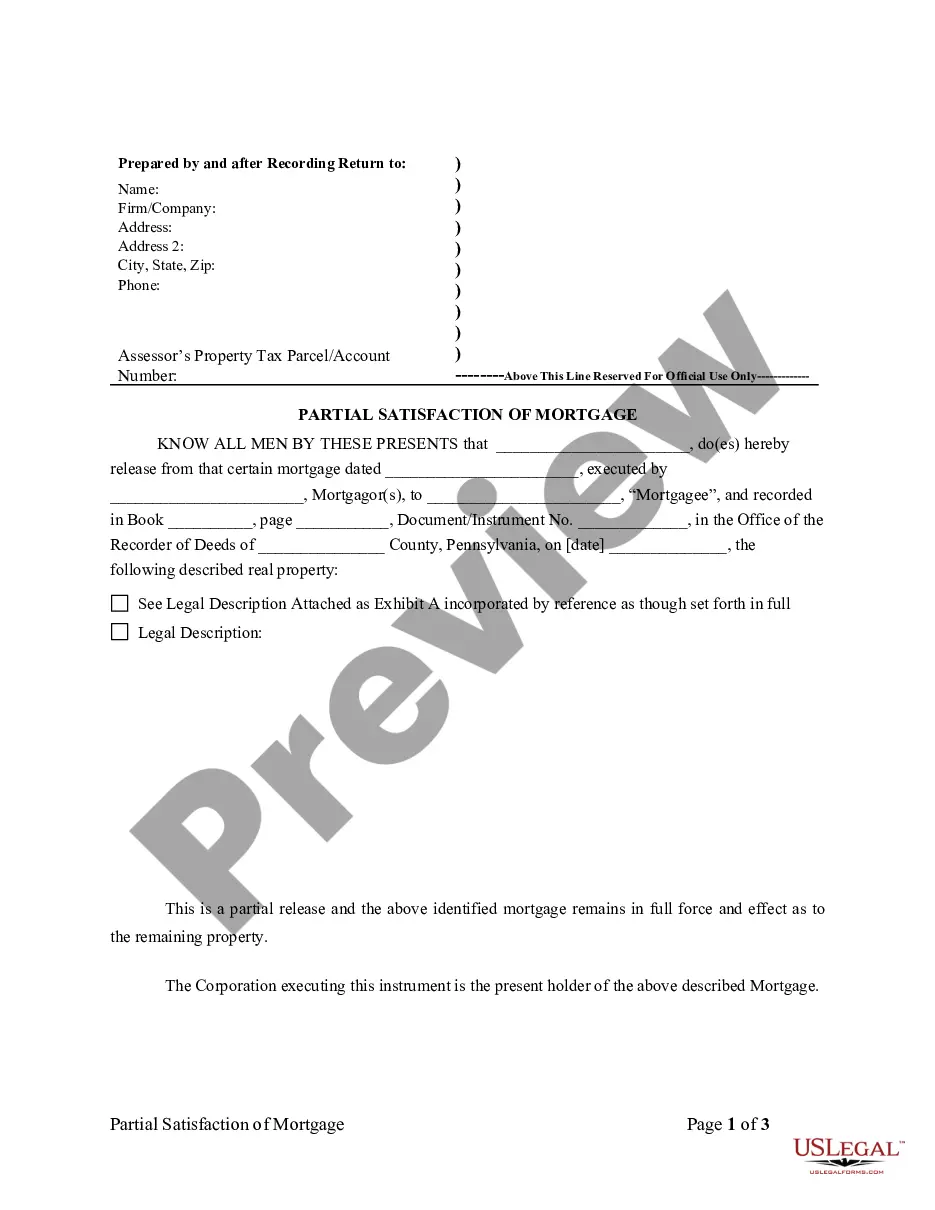

Pennsylvania Partial Release of Property From Mortgage for Corporation

Description

How to fill out Pennsylvania Partial Release Of Property From Mortgage For Corporation?

Creating papers isn't the most easy job, especially for those who almost never deal with legal papers. That's why we advise using accurate Pennsylvania Partial Release of Property From Mortgage for Corporation samples made by professional lawyers. It gives you the ability to prevent difficulties when in court or handling formal organizations. Find the samples you require on our website for high-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the template page. After getting the sample, it will be saved in the My Forms menu.

Users with no a subscription can quickly create an account. Follow this brief step-by-step help guide to get the Pennsylvania Partial Release of Property From Mortgage for Corporation:

- Make sure that the sample you found is eligible for use in the state it is required in.

- Verify the document. Utilize the Preview option or read its description (if offered).

- Buy Now if this sample is the thing you need or use the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

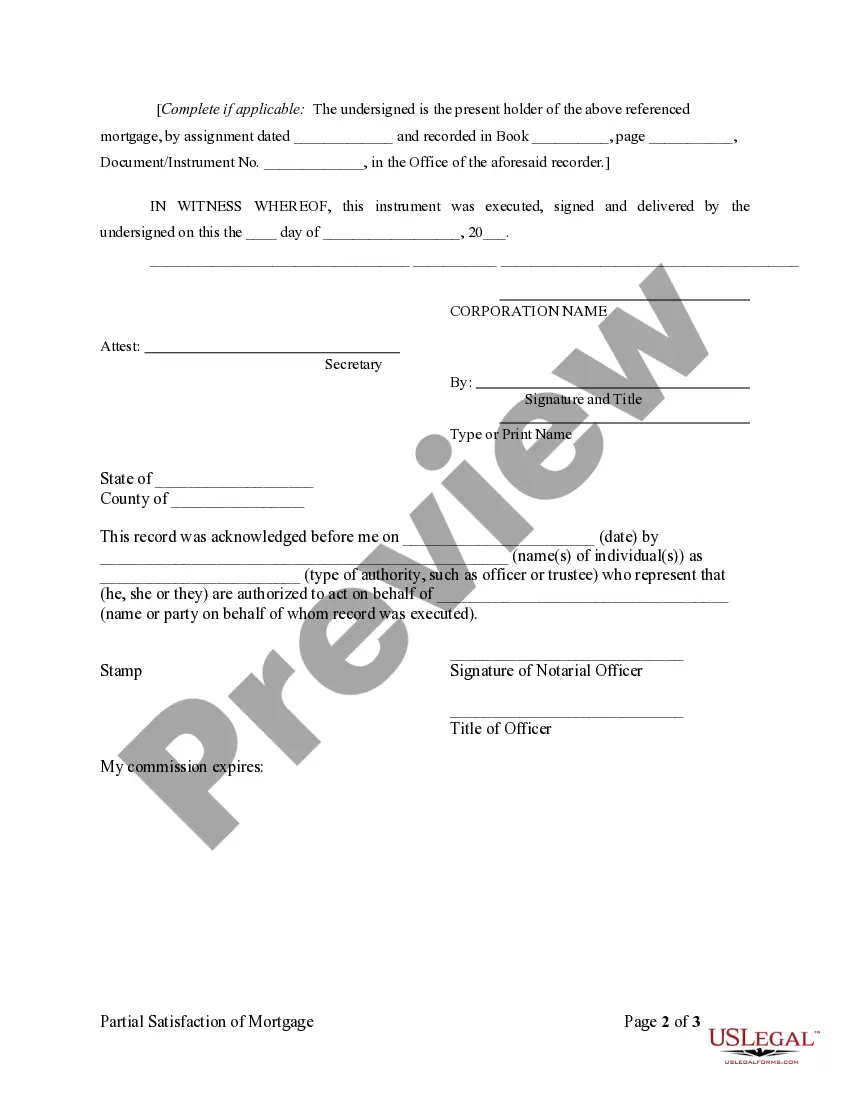

Right after doing these easy steps, it is possible to fill out the sample in an appropriate editor. Check the completed details and consider requesting an attorney to review your Pennsylvania Partial Release of Property From Mortgage for Corporation for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.He will have to wait to pay off the full loan before the property is granted back to him.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.