A Delaware Certificate of Conversion From Statutory Trust To Corporation is a document used to convert a statutory trust into a corporation in the state of Delaware. The conversion is typically done to take advantage of the legal and tax benefits of a corporate entity. There are two types of Delaware certificates of conversion from Statutory Trust to Corporation: the Standard Certificate of Conversion and the Full Certificate of Conversion. The Standard Certificate of Conversion is used to convert a statutory trust into a Delaware corporation without the need for further filings or documents. The Full Certificate of Conversion is used to convert a statutory trust into a Delaware corporation with additional filings and documents.

Delaware Certificate of Conversion From Statutory Trust To Corporation

Description

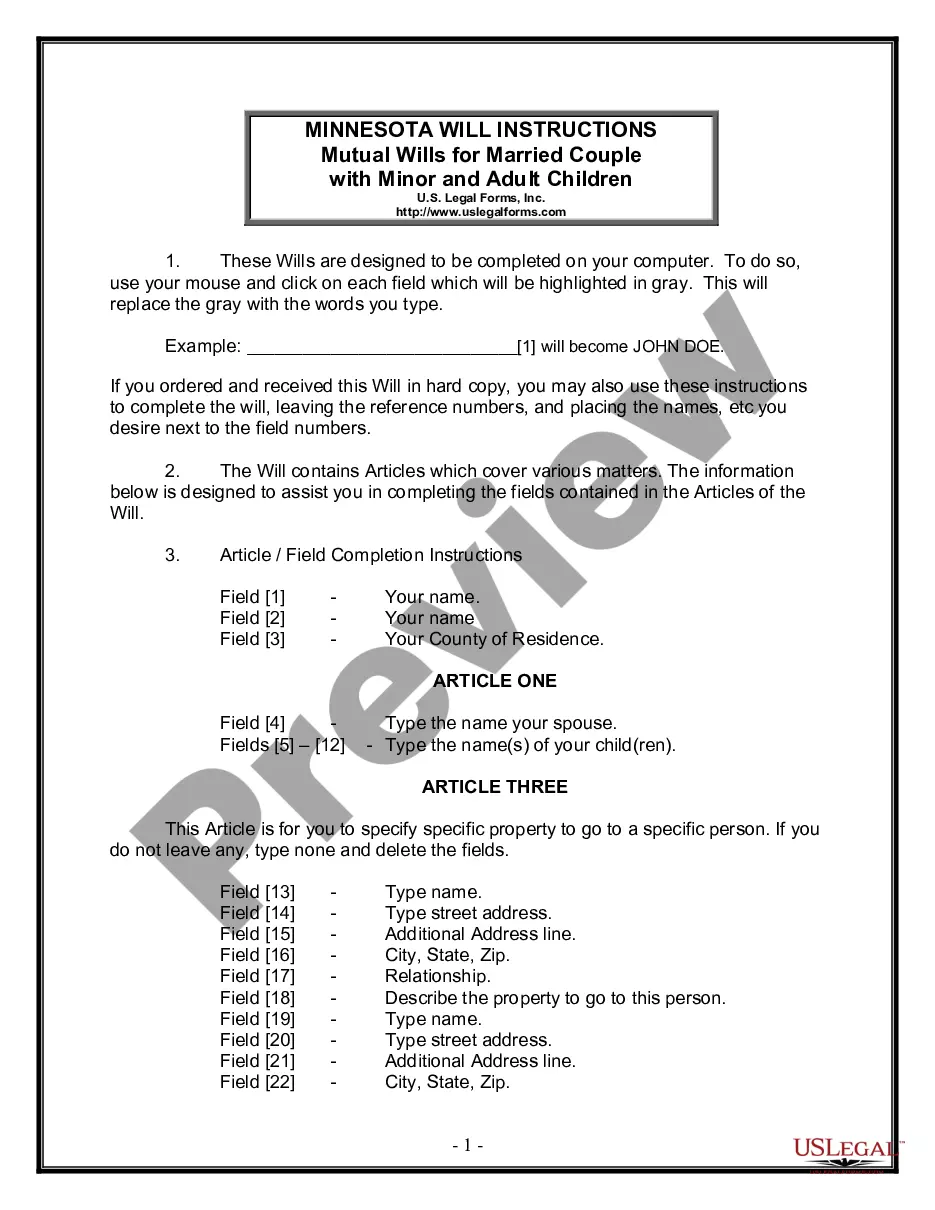

How to fill out Delaware Certificate Of Conversion From Statutory Trust To Corporation?

How much duration and assets do you typically allocate to composing official documentation.

There’s a superior alternative to obtaining such forms than employing legal experts or squandering hours searching online for a suitable template. US Legal Forms is the premier online repository that offers expertly crafted and confirmed state-specific legal documents for any objective, including the Delaware Certificate of Conversion From Statutory Trust To Corporation.

Another advantage of our service is that you can retrieve previously obtained documents that you safely store in your profile in the My documents tab. Access them at any time and re-fill your paperwork as often as required.

Conserve time and energy finishing formal paperwork with US Legal Forms, one of the most reliable online services. Join us now!

- Review the form content to guarantee it aligns with your state regulations. To do this, verify the form description or utilize the Preview option.

- If your legal template does not satisfy your requirements, find a different one using the search tab at the top of the page.

- If you already possess an account with us, Log In and retrieve the Delaware Certificate of Conversion From Statutory Trust To Corporation. Otherwise, move on to the following steps.

- Click Buy now once you identify the appropriate document. Choose the subscription plan that fits you best to access our library’s full offerings.

- Register for an account and process your subscription payment. You can complete a transaction using your credit card or via PayPal - our service is fully trustworthy for that.

- Download your Delaware Certificate of Conversion From Statutory Trust To Corporation onto your device and complete it on a printed version or electronically.

Form popularity

FAQ

In Delaware, the Certificate of Formation is used mainly for LLCs, while Articles of Incorporation refer to corporations. Both documents serve to legally create the business structure, but they cater to different entity types. If you're moving from a statutory trust, your Delaware Certificate of Conversion From Statutory Trust To Corporation will outline your transition and affirm your new corporate identity.

You can find your Delaware incorporation number through the Delaware Division of Corporations' website. Simply enter your business name in their search tool, and your details, including the incorporation number, will appear. This number is crucial, especially when applying for a Delaware Certificate of Conversion From Statutory Trust To Corporation to streamline your business transformation process.

Typically, obtaining a Delaware certificate of good standing takes a few days if you request it online. However, processing times can vary based on demand and the time of year. This document is essential for various business transactions, and if you're converting from a statutory trust, it ensures that your Delaware Certificate of Conversion From Statutory Trust To Corporation is recognized as valid.

A Certificate of Incorporation for an LLC is an official document that establishes the existence of the company in Delaware. This document provides the essential details about your business, such as its name, purpose, and the registered agent. If you're transitioning from a statutory trust, obtaining a Delaware Certificate of Conversion From Statutory Trust To Corporation will also require submitting this document to formalize your new corporate structure.

To convert a Delaware LLC to a corporation, first, file a Certificate of Conversion along with the Certificate of Incorporation with the Delaware Division of Corporations. It's essential to follow specific protocols, including fulfilling any necessary tax obligations. Using resources like US Legal Forms can streamline the process, providing the correct forms and guidance needed to secure your Delaware Certificate of Conversion From Statutory Trust To Corporation efficiently. This transition could unlock new advantages for your business.

Yes, typically, you will need a new Employer Identification Number (EIN) when converting from an LLC to a C Corporation. The reason behind this is that the IRS views the two entities as distinct for tax purposes. As you go through the process of filing the Delaware Certificate of Conversion From Statutory Trust To Corporation, ensure you apply for a new EIN to comply with tax regulations. This step is vital for maintaining proper accounting and tax records.

No, a Delaware Statutory Trust is not a corporation; it is a separate legal entity designed primarily for investment purposes. While both structures offer liability protection and benefits in governance, they serve different functions. When converting a statutory trust to a corporation, you’ll need the Delaware Certificate of Conversion From Statutory Trust To Corporation to ensure everything is legally documented. Understanding these differences can help in making informed decisions about your business structure.

Switching from an LLC to a corporation can be straightforward if you follow the correct steps. You must file the Delaware Certificate of Conversion From Statutory Trust To Corporation and complete the necessary paperwork. While some complexities can arise, particularly related to tax treatment and compliance, having proper resources or professional assistance can make the transition smoother. Ultimately, the conversion can enable greater business opportunities and flexibility.

To convert your LLC to an S Corporation, you first need to elect S Corporation status by filing IRS Form 2553. This process requires your LLC to meet specific criteria, such as having eligible shareholders and a limited number of stock classes. Additionally, you may need to file a Delaware Certificate of Conversion From Statutory Trust To Corporation to finalize the change legally. Choose a reliable platform like US Legal Forms for guidance in this process.

A Delaware Certificate of Conversion is an official document that facilitates the change of a business entity's structure. In your case, it allows a statutory trust to transition into a corporation. This document is essential for ensuring compliance with state laws during the conversion process. By obtaining this certificate, businesses can operate under their new corporate identity seamlessly.