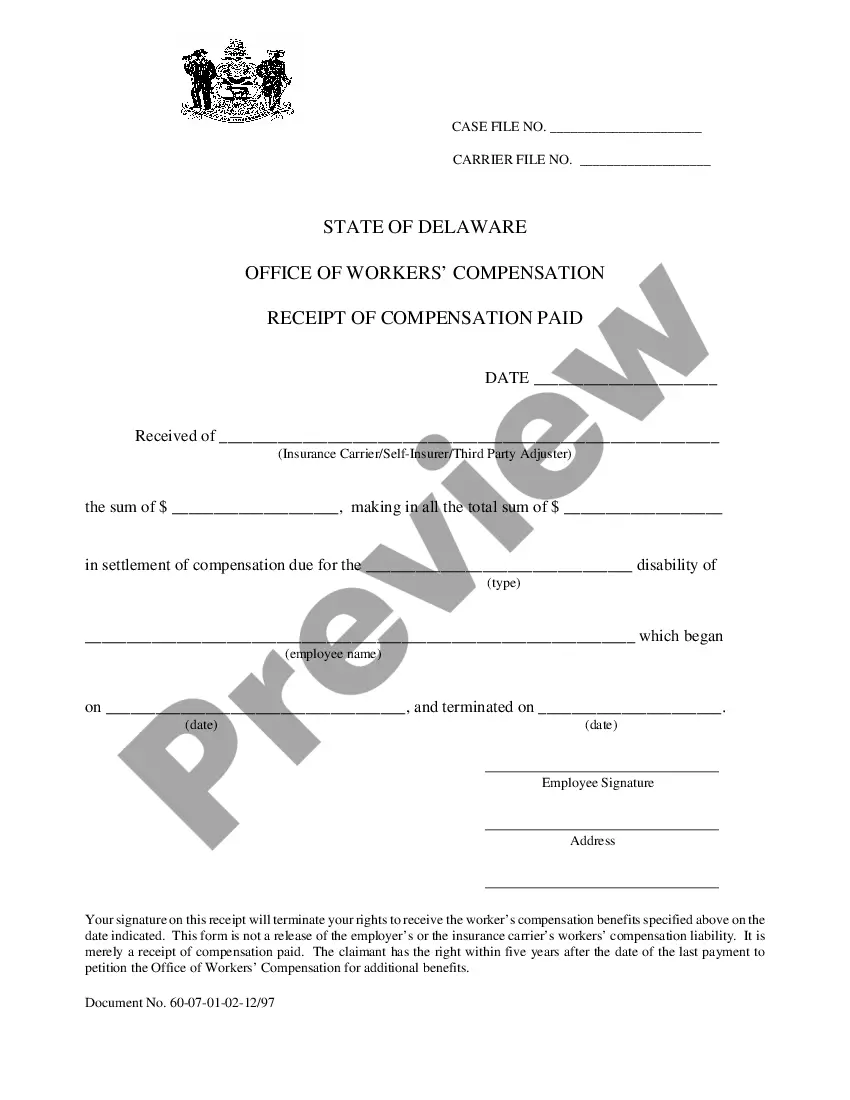

Delaware Receipt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Receipt?

The greater the quantity of documents you must assemble - the more anxious you feel.

You can discover numerous Delaware Receipt of Compensation Paid samples online, yet you're uncertain which ones to rely on.

Remove the frustration to simplify obtaining samples with US Legal Forms. Acquire professionally created documents that adhere to the state requirements.

Fill in the required information to create your account and pay for your purchase via PayPal or credit card. Choose a suitable file format and download your template. Access all files you obtain in the My documents section. Simply go there to complete the new iteration of the Delaware Receipt of Compensation Paid. Even when utilizing professionally prepared samples, it's still important to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will notice the Download option on the Delaware Receipt of Compensation Paid’s page.

- If you haven’t utilized our service before, complete the registration process by following these guidelines.

- Ensure that the Delaware Receipt of Compensation Paid is legitimate in your residing state.

- Verify your selection by reviewing the description or by using the Preview feature if available for the chosen document.

- Click Buy Now to start the registration process and select a pricing plan that fits your needs.

Form popularity

FAQ

Any business that operates in Delaware and earns revenue is required to file a Delaware return, which includes submitting a Delaware receipt form. This obligation applies to various types of entities, including corporations, partnerships, and sole proprietorships. Even if your business had a minimal income, you still need to report it. For specific guidelines and compliance tips, uslegalforms provides useful resources.

When completing your tax return, gross receipts are typically reported in the income section. You will list them under business income if you operate a company. It is essential to ensure accuracy in this section, as it directly influences your overall tax liability. Utilizing uslegalforms can help you correctly position your Delaware receipt information within your return.

Filing your gross receipts tax in Delaware involves completing the appropriate tax form, which you can obtain from the Delaware Division of Revenue website. Once you fill out your Delaware receipt form with your total gross receipts amount, submit it along with your payment before the due date. Consider using uslegalforms for an easy-to-follow guide and access to required forms to simplify your filing experience.

To enter a gross receipt, you first need to gather all your sales records for the applicable period. Next, you will input this information into the designated section of the Delaware receipt form when filing your taxes. Be sure to include all sources of income, as this total impacts your gross receipts tax calculations. If you need assistance, uslegalforms offers resources to help streamline this process.

Yes, Delaware annual reports are public documents and can be accessed by anyone. This transparency allows the public to view important information about incorporated entities. You can find these reports through the Delaware Division of Corporations. If you need detailed guidance on obtaining this information, US Legal Forms can assist in easing your search process.

To contact Delaware gross receipts tax, visit the Delaware Department of Revenue's website where you can find contact information for customer service. They provide details on how to email or call them with your inquiries. If you prefer a more guided approach, US Legal Forms offers resources that can help you understand the tax obligations related to gross receipts and provide further assistance.

Yes, you can obtain a copy of a Delaware annual report through the Delaware Division of Corporations website. Each corporation must file an annual report that includes key information about the entity. Accessing these reports is straightforward and can be done online. For more convenience and assistance, consider using US Legal Forms to navigate these requests seamlessly.

To obtain a copy of a certificate of incorporation in Delaware, you can visit the Delaware Division of Corporations website. They offer online ordering options for certified copies, which you can complete within minutes. Alternatively, you may send a written request by mail to the Division of Corporations, including the necessary details and payment for processing. Using a reliable service like US Legal Forms can help streamline this process and ensure you receive the necessary documents without hassle.

Yes, you can file your Delaware state taxes online through the Delaware Division of Revenue's website. The online process is user-friendly, allowing for quick submissions and immediate confirmation of your filing. You will receive a Delaware receipt once your submission is successful. For additional support and clarity, consider using platforms like uSlegalforms to guide you through the online filing.

Anyone earning income from Delaware sources or living in Delaware for part of the year generally must file a tax return. This includes residents as well as non-residents. To determine your specific obligations, review the Delaware Division of Revenue’s requirements carefully. Keeping your Delaware receipts handy will assist in establishing your income details during the filing process.