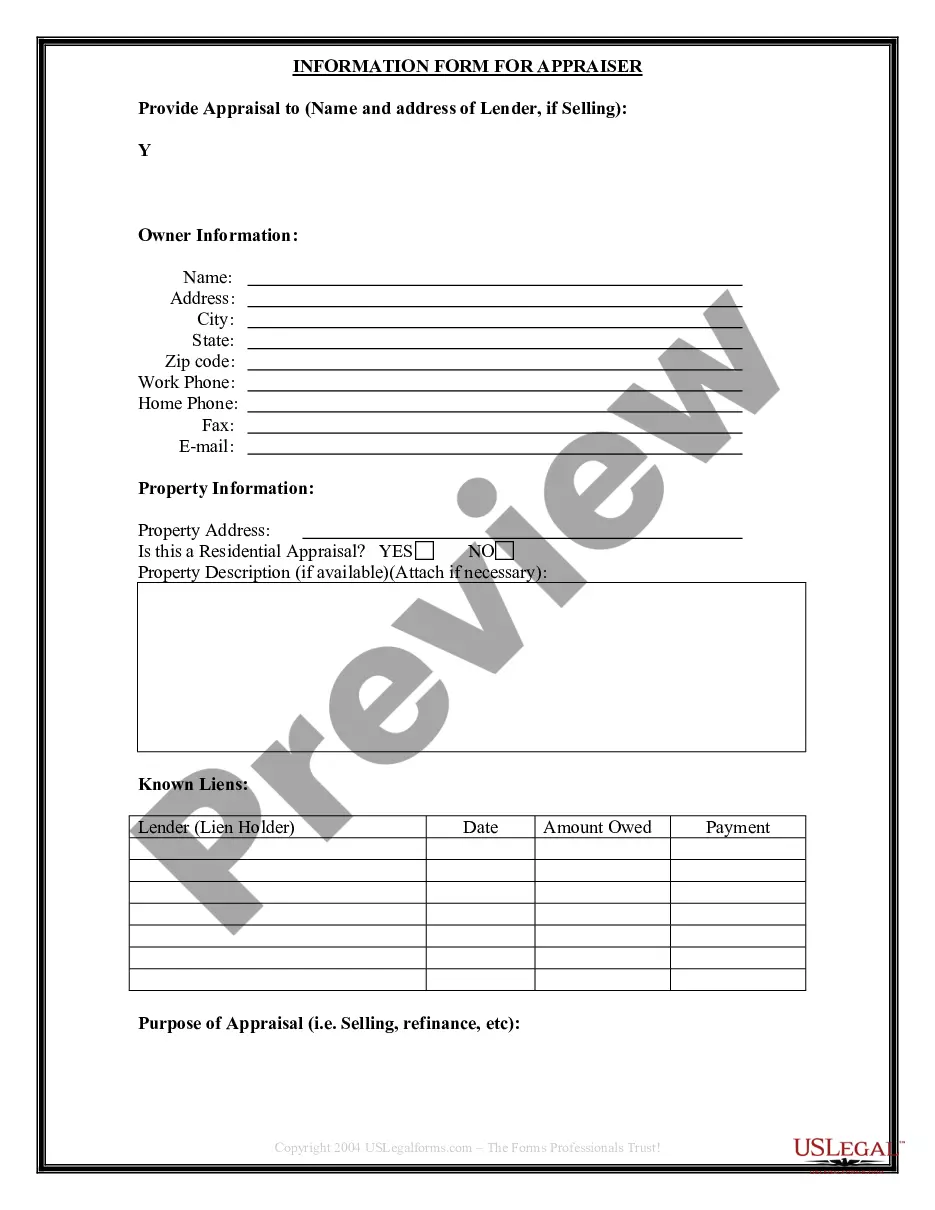

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Delaware to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Delaware Seller's Information for Appraiser provided to Buyer

Description

How to fill out Delaware Seller's Information For Appraiser Provided To Buyer?

Among numerous paid and complimentary templates available online, you cannot guarantee their dependability.

For instance, who developed them or whether they possess the necessary skills to address your requirements.

Stay composed and utilize US Legal Forms!

Examine the template by reviewing the information using the Preview function. Click Buy Now to commence the ordering process or find another template using the Search field situated in the header. Select a pricing plan and create an account. Remit payment for the subscription with your credit/debit card or PayPal. Download the form in the required file format. After signing up and purchasing your subscription, you can use your Delaware Seller's Information for Appraiser provided to Buyer as frequently as needed or for the duration that it remains valid in your state. Modify it within your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Delaware Seller's Information for Appraiser provided to Buyer samples crafted by experienced attorneys.

- Avoid the costly and time-intensive task of searching for a lawyer and subsequently paying them to draft a document that you can access yourself.

- If you have a membership, Log In to your account and locate the Download button next to the file you’re looking for.

- You will also have access to all your previously downloaded documents in the My documents section.

- If you are visiting our website for the first time, adhere to the steps below to obtain your Delaware Seller's Information for Appraiser provided to Buyer swiftly.

- Ensure that the document you find is applicable in your state.

Form popularity

FAQ

Adjustments Based on Closing Cost Credits So how does the appraisal handle the closing cost credit on the final valuation? The simple answer is it varies. The purpose of the appraisal is to provide the lender with the current value of a property as accurately as possible.

Typically, the buyer pays for a home appraisal. The buyer can pay up front at the time of the appraisal or the appraiser's fee can be included in closing costs. Yet while the buyer usually pays for the appraisal, he or she doesn't order the appraisal.

Home sellers aren't entitled to copies of the appraisals mortgage lenders conduct on behalf of their borrowers. If a home seller wants a copy of an appraisal, she should consider asking for a copy from the buyer.However, a copy may come in handy if the appraisal comes in low and price negotiations must ensue.

A: An appraisal is generally considered a professional opinion of the market value of a property, not a fact. Although it's both legally and ethically necessary to disclose a material fact, the same requirement doesn't apply to an opinion.

Seller concessions are closing costs the seller agrees to pay. They can make a home more affordable for the buyer, and they can help the seller close the deal. Work with your real estate agent to decide whether you have a good opportunity to ask the seller for concessions.

Know How it Works: Remember that appraisers do not make adjustments if there are concessions in your listing they are appraising. They are only making adjustments to the comps if needed. Your seller can offer substantial credits back to the buyer for your listing, and no adjustment will be given because of that.

What happens if the appraisal comes in above the purchase price of the home? You're in a good situation if this happens. It simply means that you've agreed to pay the seller less than the home's market value. Your mortgage amount does not change because the selling price will not increase to meet the appraisal value.

Yes, the appraiser will actually visit the house during the home appraisal process. There is no specific rule that says buyers cannot attend, but the process is typically handled by the appraiser alone. You would have to contact him to see if you can be present when he visits the house.

Usually, but not always, the amount is added to the sale price and rolled into the loan. Since concessions raise the sale price and thus the loan amount, the home must appraise for the new amount. It can't appraise for lower because the lender can't loan over the appraisal amount.