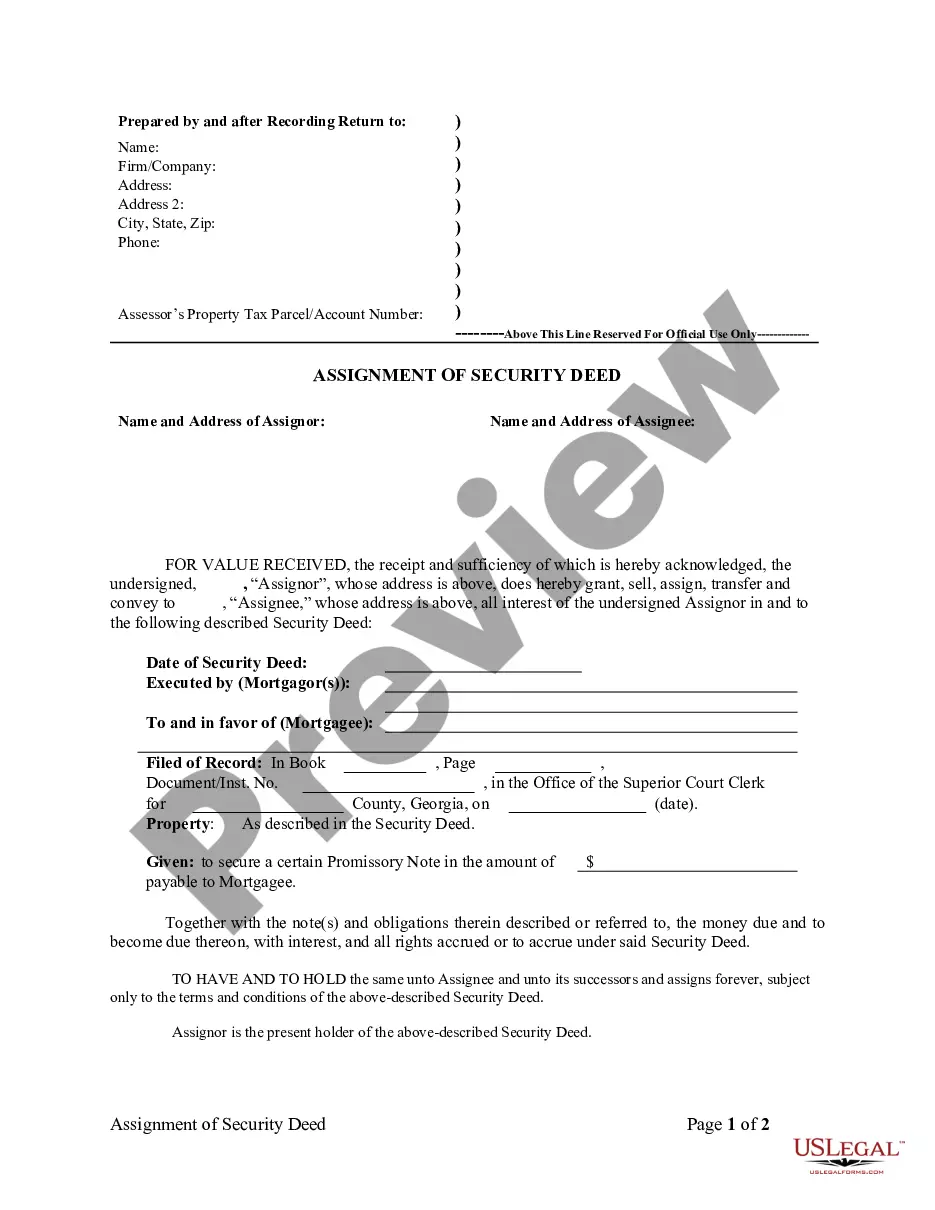

This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

District of Columbia Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

Discovering the right legal papers design might be a have a problem. Of course, there are plenty of themes available on the net, but how will you obtain the legal kind you require? Make use of the US Legal Forms web site. The support provides a large number of themes, including the District of Columbia Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries, that you can use for enterprise and personal needs. All the kinds are inspected by experts and fulfill state and federal specifications.

Should you be already listed, log in for your bank account and then click the Obtain key to obtain the District of Columbia Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. Utilize your bank account to look from the legal kinds you may have purchased formerly. Go to the My Forms tab of your bank account and acquire yet another backup of the papers you require.

Should you be a whole new customer of US Legal Forms, here are simple recommendations so that you can stick to:

- Initially, be sure you have selected the correct kind to your metropolis/county. You can look over the form making use of the Preview key and browse the form outline to make certain this is basically the best for you.

- In case the kind will not fulfill your needs, use the Seach area to discover the appropriate kind.

- Once you are certain the form would work, click on the Buy now key to obtain the kind.

- Opt for the pricing prepare you would like and type in the required information. Make your bank account and purchase an order with your PayPal bank account or Visa or Mastercard.

- Select the submit file format and obtain the legal papers design for your device.

- Comprehensive, change and print and sign the obtained District of Columbia Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

US Legal Forms is the biggest catalogue of legal kinds where you will find different papers themes. Make use of the service to obtain skillfully-created documents that stick to express specifications.

Form popularity

FAQ

Hear this out loud PauseSpecify the percentage or amount of the assets or benefits that each beneficiary will receive. If there are any specific conditions or instructions for the distribution of the assets, clearly state them in the letter. Sign and date the letter at the bottom. Keep a copy of the letter for your records.

Hear this out loud PauseWhether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

Hear this out loud PauseA trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets.

The fiduciary duties of trustees refer to the duties owed when managing a trust by a trustee to the beneficiary. Like other fiduciary relationships, trustees have fiduciary duties of care, loyalty, and good faith. As a result, the trustee must manage the trust in a reasonable manner and avoid self-dealing.

You cannot control the trustee The power to control (or remove) the trustee is set out in the trust deed and is usually exercised by persons acting as the appointor and/or guardian of the trust. In some cases, the consent of the primary beneficiaries of the trust is required for some of the decisions of the trustee.

Hear this out loud PauseThe grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.