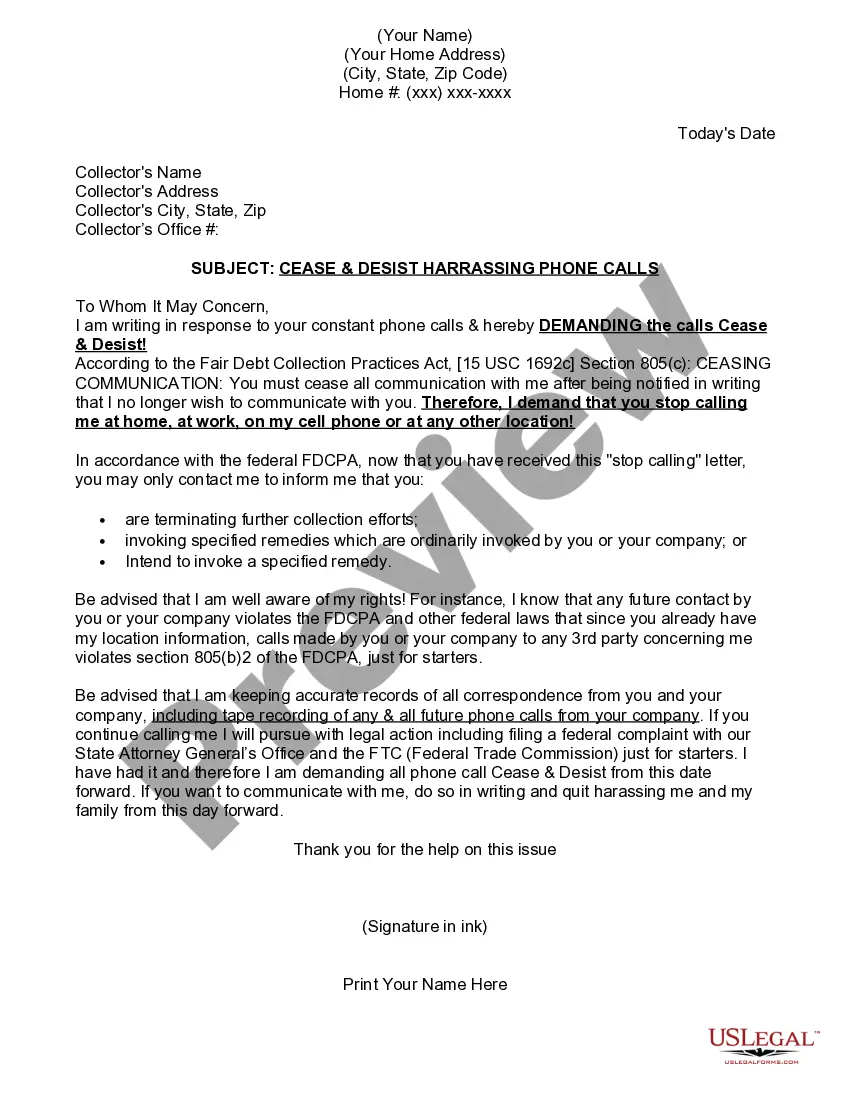

District of Columbia Cease and Desist for Debt Collectors

Description

How to fill out Cease And Desist For Debt Collectors?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the District of Columbia Cease and Desist for Debt Collectors in moments.

If you already have a membership, Log In and retrieve the District of Columbia Cease and Desist for Debt Collectors from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

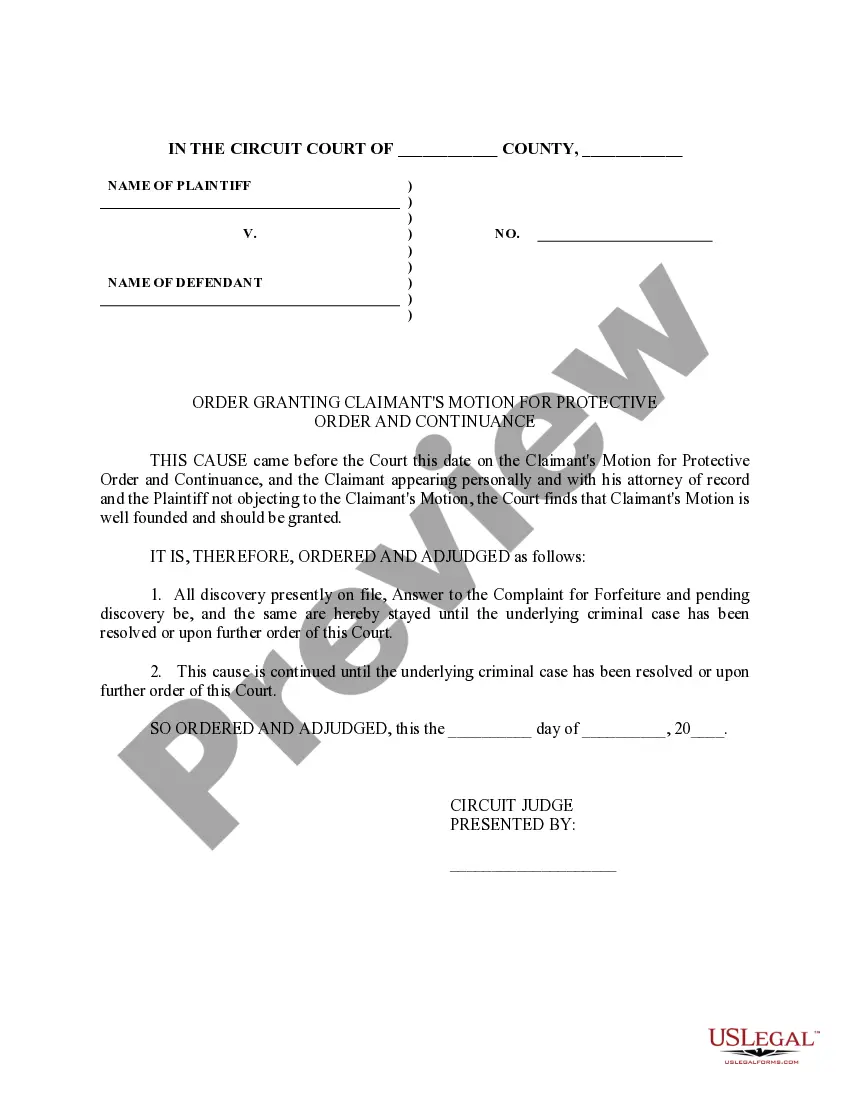

Choose the format and download the form onto your device. Make edits. Fill out, modify, print, and sign the downloaded District of Columbia Cease and Desist for Debt Collectors. Each template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the District of Columbia Cease and Desist for Debt Collectors with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form's content.

- Check the form details to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To write a cease and desist letter, start by clearly stating your intention to stop all communication from the debt collector. Include your personal information, details about the debt, and any relevant documentation. Be direct and concise in your request. You can use resources like US Legal Forms to find templates for a District of Columbia Cease and Desist for Debt Collectors, making the process easier.

Cease and desist letters can be effective in stopping debt collectors from contacting you. They serve as a formal notice that you do not wish to communicate further and can lead to a halt in collection efforts. However, effectiveness may vary based on the collector and the situation. Utilizing a District of Columbia Cease and Desist for Debt Collectors can ensure you follow the proper legal channels.

When sending a cease and desist letter, you should provide any relevant documents that support your claim, such as payment records or communication logs. This proof demonstrates your position and can help prevent further collection attempts. A clear and concise letter is crucial for ensuring your rights are respected. You can leverage a District of Columbia Cease and Desist for Debt Collectors to formalize your request.

The 777 rule refers to a guideline where a debtor can dispute a debt within seven days of being contacted by a collector. This rule emphasizes your right to seek proof of the debt and halt communication until verification is provided. Understanding this rule helps you take control of your situation. For effective communication, consider a District of Columbia Cease and Desist for Debt Collectors.

A 609 letter is a request for debt validation under Section 609 of the Fair Credit Reporting Act. It allows you to ask the debt collector to prove that the debt is yours and that they have the legal right to collect it. By sending this letter, you can initiate a process to dispute any inaccuracies. Using a District of Columbia Cease and Desist for Debt Collectors can further strengthen your position.

You can indeed send a cease and desist letter to a debt collector. This letter serves as a formal notice that you do not wish to be contacted further regarding the debt. Utilizing a District of Columbia Cease and Desist for Debt Collectors can help you create a clear and legally sound document. Platforms like uslegalforms can provide you with templates that simplify this process, ensuring your rights are protected and your message is clear.

Yes, you can tell a debt collector to cease and desist from contacting you further. By doing so, you invoke your rights under the Fair Debt Collection Practices Act. A well-crafted District of Columbia Cease and Desist for Debt Collectors can help formalize your request and provide a record of your communication. This action can significantly reduce the stress associated with persistent collection efforts.

In Washington, DC, the statute of limitations for most debt collection cases is three years. This means that debt collectors cannot legally pursue repayment of a debt that is older than this timeframe. Understanding this limitation is crucial when considering your options, such as sending a District of Columbia Cease and Desist for Debt Collectors. Knowing the timeline can help you decide how to best protect your financial rights.

The 777 rule for debt collectors refers to a strategy that suggests you should not engage with any debt collector over the phone, especially for seven days after receiving a collection notice. During this time, you can prepare your response, including a District of Columbia Cease and Desist for Debt Collectors. This allows you to collect your thoughts and assertively respond without feeling pressured. You can use this strategy to maintain control over the situation and ensure that your rights are respected.