District of Columbia Reprint Sales License Agreement

Description

How to fill out Reprint Sales License Agreement?

US Legal Forms - among the greatest libraries of lawful forms in the States - provides a variety of lawful papers themes it is possible to obtain or printing. Making use of the site, you will get 1000s of forms for organization and person purposes, sorted by groups, states, or search phrases.You can find the latest models of forms much like the District of Columbia Reprint Sales License Agreement in seconds.

If you have a subscription, log in and obtain District of Columbia Reprint Sales License Agreement from your US Legal Forms catalogue. The Down load key will appear on each kind you perspective. You gain access to all formerly acquired forms from the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, allow me to share straightforward recommendations to obtain began:

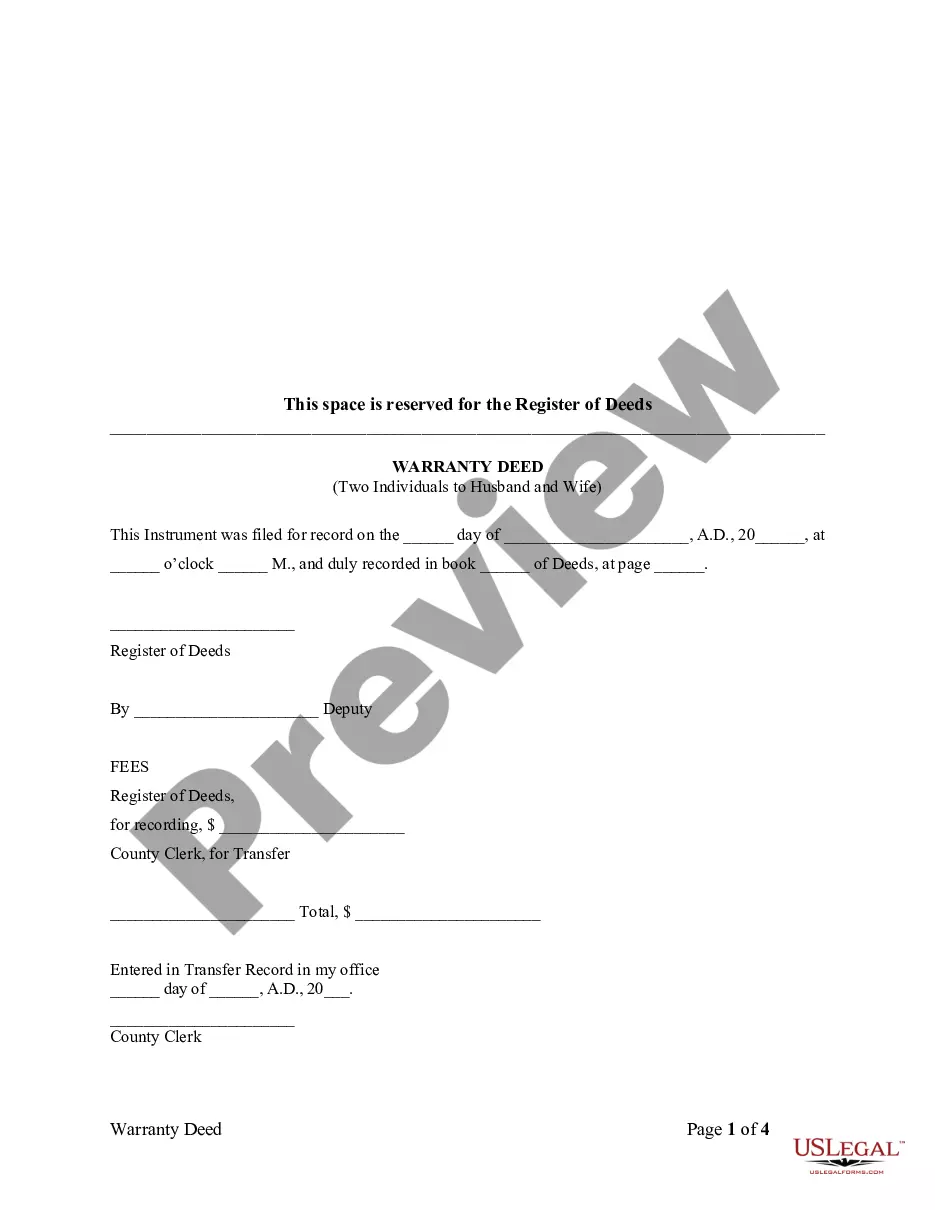

- Be sure to have picked the proper kind to your area/state. Go through the Preview key to review the form`s articles. Read the kind information to ensure that you have chosen the right kind.

- In the event the kind does not fit your requirements, take advantage of the Research area near the top of the display screen to obtain the the one that does.

- In case you are pleased with the form, affirm your selection by simply clicking the Purchase now key. Then, choose the pricing strategy you favor and offer your qualifications to register for the account.

- Process the financial transaction. Make use of your bank card or PayPal account to finish the financial transaction.

- Choose the formatting and obtain the form on your own system.

- Make modifications. Fill up, revise and printing and indicator the acquired District of Columbia Reprint Sales License Agreement.

Each and every design you added to your account does not have an expiry date which is the one you have for a long time. So, if you want to obtain or printing an additional backup, just check out the My Forms area and click on on the kind you want.

Get access to the District of Columbia Reprint Sales License Agreement with US Legal Forms, one of the most substantial catalogue of lawful papers themes. Use 1000s of expert and status-particular themes that meet your small business or person demands and requirements.

Form popularity

FAQ

If you were issued a Basic Business License online, you may log into your existing via My DC Business Center account to download a duplicate at any time free of charge. If you think you are due a refund due to an excess, duplicate or erroneous payment, you may submit a request for a refund.

To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR's Customer Service Administration at (202) 727-4TAX (4829).

Tax Registration with the OTR (FR-500) In order to register your LLC with the OTR, you need to file an FR-500. The FR-500 can only be filed online. Get started: Go to the MyTax homepage and click ?Register a New Business: Form FR-500? (it's in the middle of the page).

If you are a corporation, partnership or limited liability company (domestic or foreign), you must be registered and in good standing with the Corporations Division. You must also have a Registered Agent.

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

Tax Registration with the OTR (FR-500) In order to register your LLC with the OTR, you need to file an FR-500. The FR-500 can only be filed online. Get started: Go to the MyTax homepage and click ?Register a New Business: Form FR-500? (it's in the middle of the page).

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

All Basic Business License (BBL) and associated public license information can be verified via SCOUT. Also, a BBL can be verified by calling the Business Licensing Division at (202) 442-4311.