District of Columbia Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

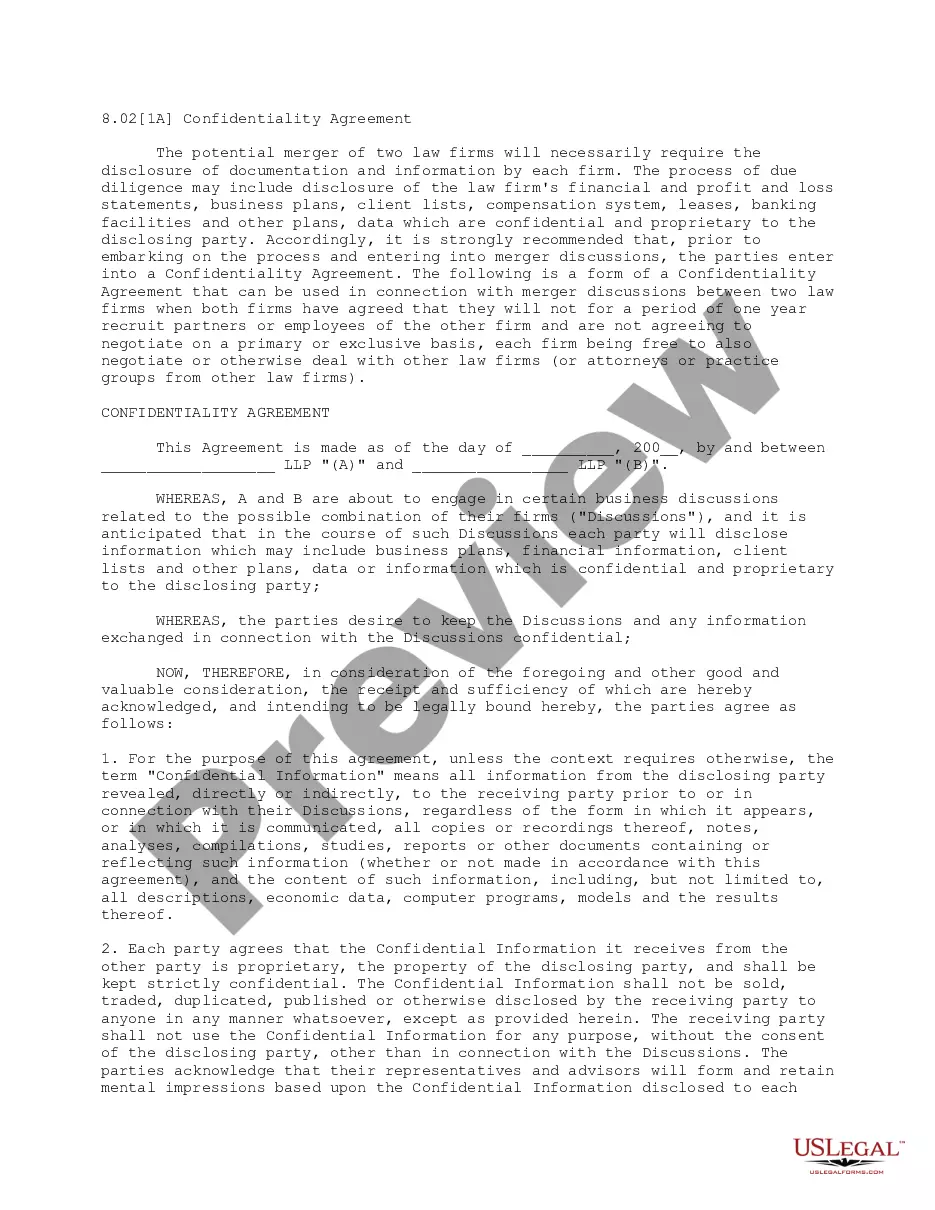

Selecting the correct legal document format can be challenging. Naturally, there are numerous online templates accessible on the web, but how can you find the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the District of Columbia Agreement for Sales of Data Processing Equipment, which you can use for business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the District of Columbia Agreement for Sales of Data Processing Equipment. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you require.

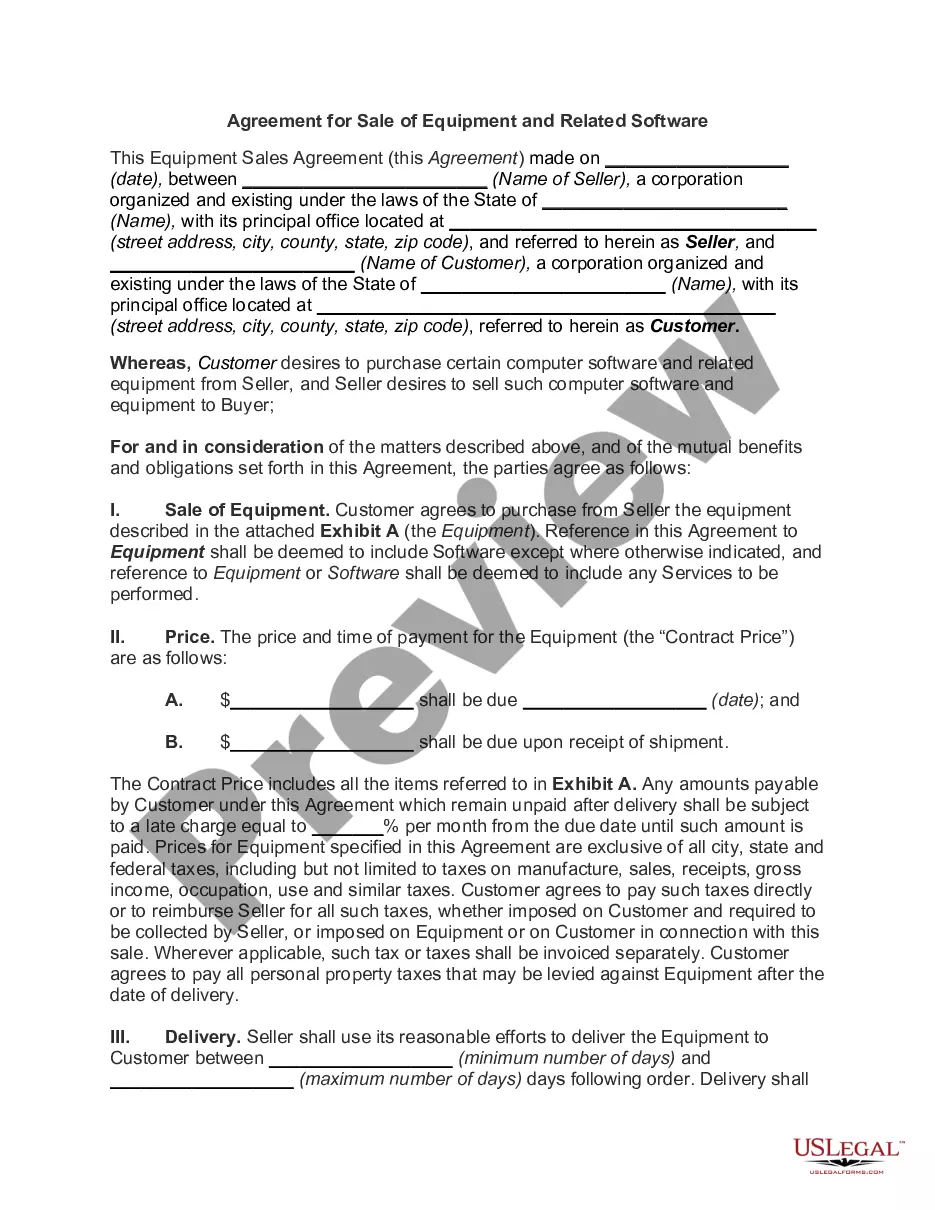

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/county. You can preview the form using the Preview button and review the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to locate the right form. Once you are certain that the form is appropriate, click on the Order now button to acquire the form. Select your desired pricing plan and enter the required information. Create your account and place an order using your PayPal account or credit card. Choose the file format and download the legal document format for your system. Complete, modify, print, and sign the acquired District of Columbia Agreement for Sales of Data Processing Equipment.

Take advantage of this resource to simplify your legal documentation process and ensure you have the right forms for your needs.

- US Legal Forms is the largest collection of legal forms available to view various document templates.

- Utilize the service to obtain professionally crafted documents that meet state requirements.

- Explore a vast array of templates for different legal needs.

- Ensure compliance with federal and state laws through expert-reviewed forms.

- Access your documents anytime through a user-friendly account interface.

- Easily manage and retrieve forms you have previously downloaded.

Form popularity

FAQ

In the District of Columbia, sales tax applies to a range of items, including tangible personal property, certain digital goods, and specific services. Notably, data processing equipment is included in this taxable category. Knowing these details can help businesses prepare a well-informed District of Columbia Agreement for Sales of Data Processing Equipment, ensuring compliance and clear financial expectations.

In the District of Columbia, software is generally considered taxable when it is sold as a standalone product. However, certain types of software, such as custom programming or software as a service (SaaS), may have different tax implications. It is crucial to clarify these details when preparing a District of Columbia Agreement for Sales of Data Processing Equipment to avoid unexpected tax liabilities.

When drafting a contract between a data controller and a data processing vendor, several key elements should be included. These elements include data protection obligations, security measures, liability clauses, and terms regarding data handling and processing. A well-structured District of Columbia Agreement for Sales of Data Processing Equipment will ensure both parties understand their responsibilities and protect their interests.

You can obtain printed tax forms from the Office of Tax and Revenue or local libraries across the District of Columbia. Additionally, various businesses offer printed materials for tax filings, including those related to the Agreement for Sales of Data Processing Equipment. If you prefer digital formats, uslegalforms provides easy access to all necessary tax document templates. This ensures that you have everything you need in one place.

DC form D-40 is the individual income tax return used in the District of Columbia. It's crucial for residents when filing their taxes, especially if they have income from the sales of data processing equipment. By understanding this form, you can better navigate your obligations under the District of Columbia Agreement for Sales of Data Processing Equipment. Being informed will save you time and ensure compliance.

You can access DC sales tax forms on the Office of Tax and Revenue's website. They provide all necessary documents including forms for sales tax reporting. If you are dealing with the District of Columbia Agreement for Sales of Data Processing Equipment, ensure you have the relevant sales tax information at hand. This will help you comply with local regulations while making your processing equipment purchases.

Yes, if your business sells taxable goods or services in the District of Columbia, you will be required to collect sales and use tax from your customers. This requirement applies under the District of Columbia Agreement for Sales of Data Processing Equipment, which outlines the obligations for businesses. It's essential to understand how these tax rules affect your operations. With tools from USLegalForms, you can streamline your tax collection process and ensure compliance.

Data processing requirements often include maintaining appropriate software and hardware to handle data efficiently while ensuring compliance with relevant regulations. Under the District of Columbia Agreement for Sales of Data Processing Equipment, businesses must adhere to specific guidelines that govern data security and privacy. Using the proper forms and keeping up with legal requirements can protect your business. Platforms like USLegalForms offer a simple way to manage these obligations and help you stay organized.

The District of Columbia offers sales tax exemptions for certain items, including groceries, prescription medications, and some medical equipment. However, data processing equipment may not qualify for these exemptions. Understanding which items qualify can help your business stay compliant under the District of Columbia Agreement for Sales of Data Processing Equipment. Consulting resources like USLegalForms can provide clarity on sales tax exemptions relevant to your situation.

In the District of Columbia, businesses typically need to file sales tax returns either monthly or quarterly, depending on their total taxable sales. If your sales exceed a specific threshold, you will likely file on a monthly basis. Timely filing is crucial to comply with the District of Columbia Agreement for Sales of Data Processing Equipment. Using platforms like USLegalForms can simplify your filing process, ensuring you meet all deadlines effectively.