District of Columbia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

Choosing the right legitimate record web template can be a struggle. Naturally, there are plenty of layouts available on the net, but how do you get the legitimate develop you will need? Utilize the US Legal Forms web site. The service delivers a large number of layouts, such as the District of Columbia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc., which can be used for business and private requirements. All of the varieties are checked out by professionals and meet up with federal and state demands.

When you are already signed up, log in to your bank account and then click the Obtain key to find the District of Columbia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.. Make use of bank account to search with the legitimate varieties you possess acquired previously. Visit the My Forms tab of the bank account and acquire an additional backup from the record you will need.

When you are a fresh customer of US Legal Forms, listed here are easy guidelines that you can comply with:

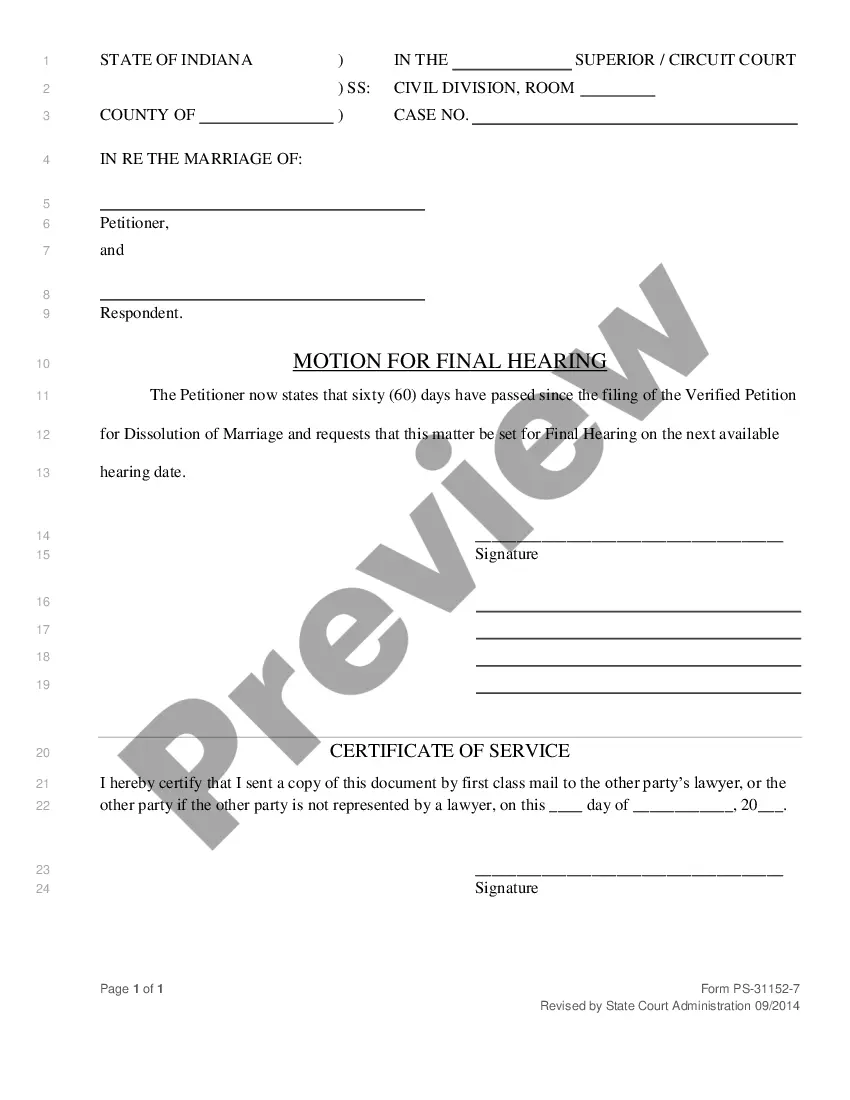

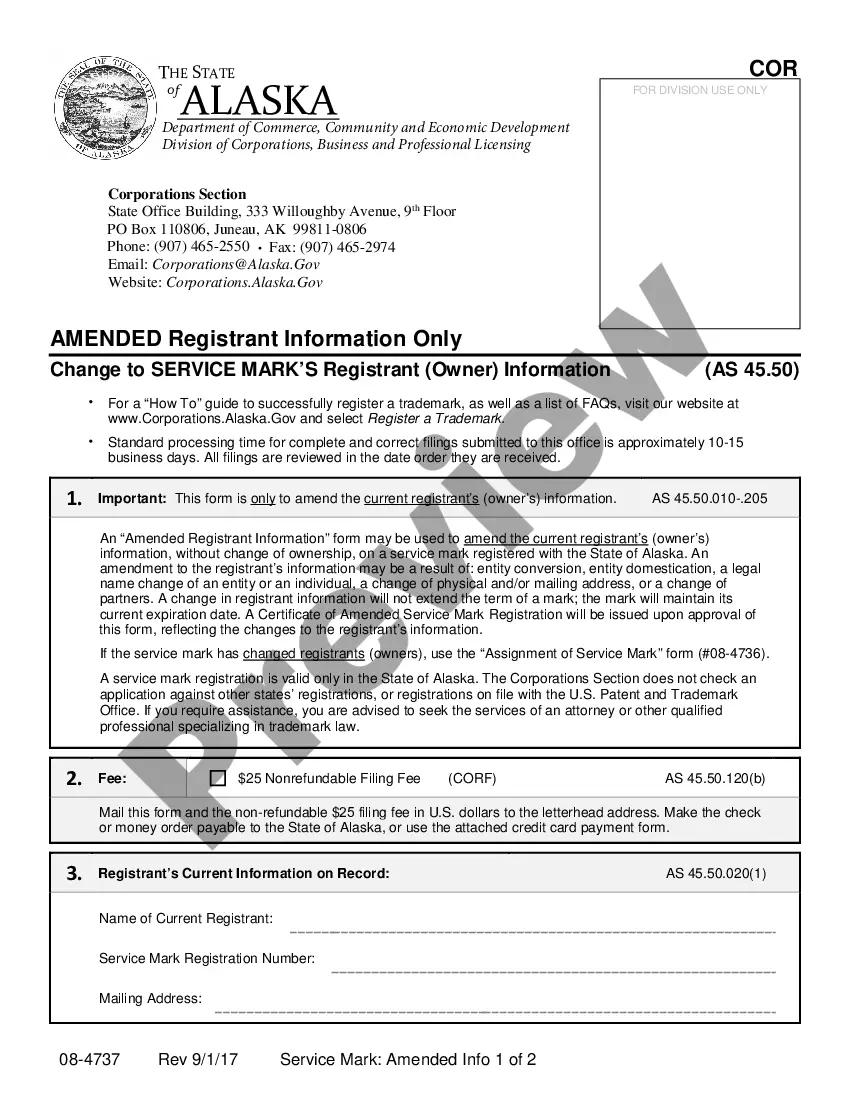

- Very first, make certain you have selected the correct develop for the metropolis/area. You can look through the shape utilizing the Review key and study the shape description to guarantee this is the best for you.

- In the event the develop is not going to meet up with your expectations, take advantage of the Seach area to discover the proper develop.

- When you are positive that the shape would work, select the Get now key to find the develop.

- Choose the rates plan you would like and type in the necessary information. Design your bank account and purchase the order utilizing your PayPal bank account or bank card.

- Choose the file structure and acquire the legitimate record web template to your product.

- Total, modify and printing and signal the attained District of Columbia Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc..

US Legal Forms is definitely the largest local library of legitimate varieties that you can discover numerous record layouts. Utilize the company to acquire expertly-manufactured documents that comply with express demands.